- On Friday, Ethereum's market experienced an initial dip, reflecting the ongoing volatility pervasive across the cryptocurrency landscape.

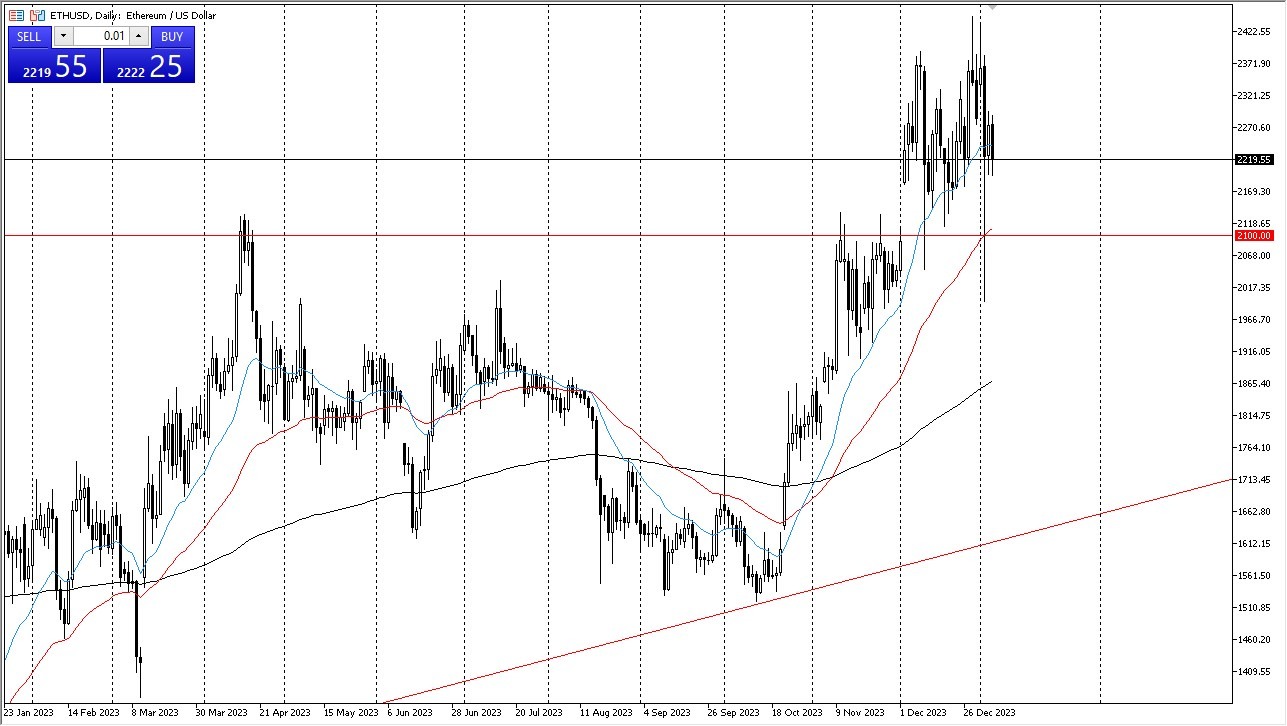

- Despite this turbulence, the 20-Day Exponential Moving Average has played a pivotal role in providing the necessary support to reverse the pullback, at least so far.. Notably, the $2100 price level stands out as a critical focal point for market participants.

- This level holds significance not only due to its historical role as a resistance barrier but also because it aligns with the 50-Day EMA, thereby reinforcing its importance within the market's collective memory.

Examining the candlestick pattern, it bears resemblance to a hammer, indicating a recurring phenomenon where a substantial number of buyers surface whenever prices experience a downturn. Immediate resistance levels are discernible around the $2400 mark, followed by the psychologically significant milestone of $2500, which is anticipated to attract significant attention.

Pay close attention to the movements in Bitcoin

The movements in the Bitcoin market warrant close attention, as Bitcoin often sets the tone for the broader cryptocurrency landscape, Ethereum included. It appears that traders are still placing their bets on the possibility of a Bitcoin Exchange-Traded Fund, with the expectation that Bitcoin's performance will influence the trajectory of the entire crypto market. Ethereum enjoys a unique advantage as it serves as a foundational element for numerous smaller crypto projects. Consequently, Ethereum stands to gain significantly as long as the broader cryptocurrency sector maintains its vitality, given its high utility within this ecosystem.

Top Forex Brokers

In summary, Ethereum's market continues to be characterized by noise and fluctuations. However, there remains a resilient pool of buyers, ready to seize opportunities presented by lower prices. Shorting Ethereum does not appear to be a prudent strategy in the near term. Nevertheless, it is essential to remain vigilant, particularly in the event that Ethereum's price falls below the $1900 level, as such a development may necessitate a reevaluation of what to do with crypto in general as we will continue to see a lot of noisy movement. I think this year is going to be difficult to hang onto, but it’s also worth noting that the momentum is most certainly to the outside and that’s probably the most important thing when it comes to crypto as it is momentum driven market.

Ready to trade our ETH/USD forecast? We’ve made a list of the best Forex crypto brokers worth trading with.