- Looking at the gold market, we have seen choppy performance on Friday, which aligns with the typical behavior expected on the last trading day of the year.

- It is not surprising that market participants exercise caution and refrain from making substantial investments during this period as there is no rush.

- Consequently, it is prudent to adopt a longer-term perspective when assessing the market.

Top Forex Brokers

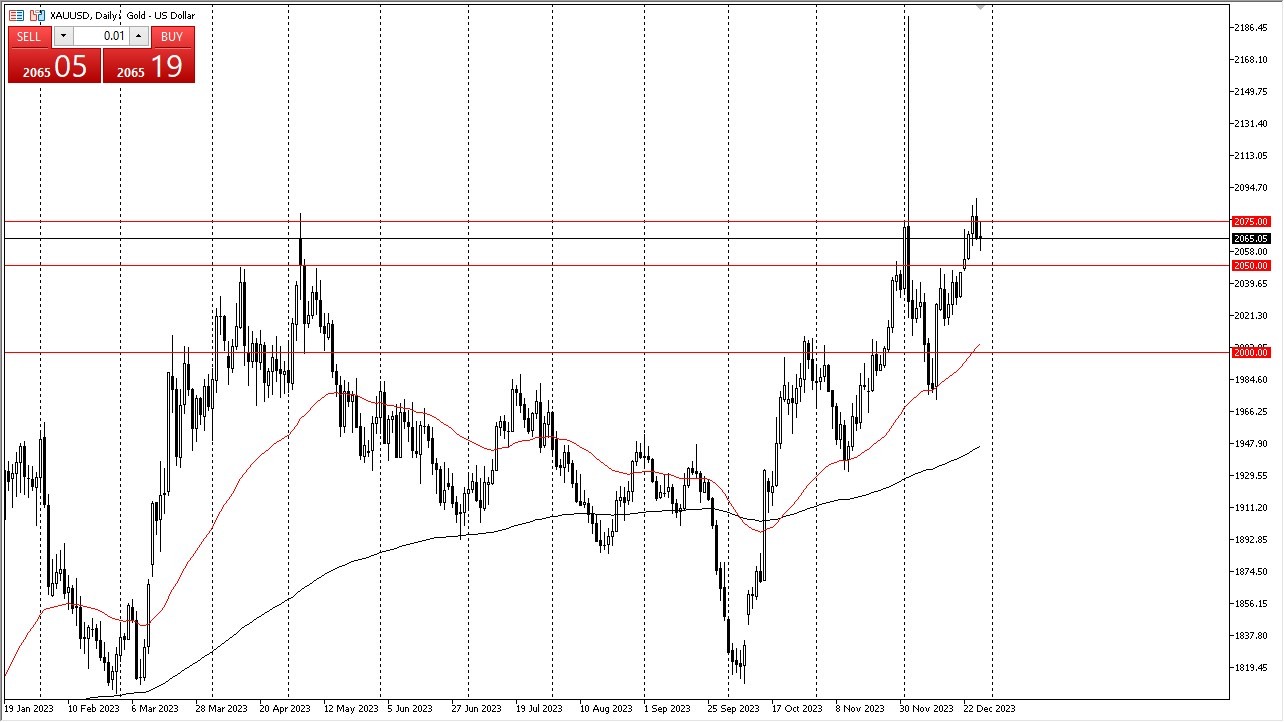

Over an extended period, it becomes evident that buyers have maintained control. As a result, any forthcoming pullbacks are likely to be viewed as potential opportunities to acquire value. The $2,050 level is one that many traders may consider a short-term support zone.

However, I believe that the true support level resides at $2,000. This level aligns closely with the 50-day Exponential Moving Average, a widely monitored indicator. Moreover, the psychological significance of the $2,000 price point cannot be underestimated, as it tends to draw considerable attention. As long as the market remains above this level, it is likely to exhibit strength.

Falling Rates in America

The declining interest rates in the United States are expected to provide ongoing support to the gold market. Nonetheless, the initial week of January may witness some unusual market dynamics as traders gradually return to their routines. A notable event to anticipate is the release of jobs numbers in the second week of January, which is likely to coincide with the return of substantial liquidity to the market. Nevertheless, it is essential to recognize that the negative correlation between gold and US interest rates will continue to dictate the market's trajectory.

If US rates experience a decline, the market may seek to challenge the substantial wick observed on the candlestick from December 4th. While this movement may not unfold rapidly, it is a development that I anticipate occurring for this year.

In the end, Friday's performance in the gold market exhibited choppy behavior, reflecting the cautious approach typically associated with the last trading day of the year. The dominance of buyers over an extended period suggests that pullbacks are viewed as potential value opportunities. While the $2,050 level may serve as short-term support, the true support level is seen at $2,000, reinforced by the presence of the 50-day EMA. Declining US interest rates are expected to bolster the gold market, and the return of liquidity in January, coupled with the ongoing negative correlation with interest rates, will shape the market's future movements. The challenge of the December 4th candlestick wick is a development that is anticipated to unfold over the year.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with.