- The gold market experienced a decline in its performance during the recent trading session, a consequence of the return of full liquidity to the marketplace.

- However, it is crucial to note that this dip should not be seen as a significant departure from the overall upward trend that has characterized the gold market.

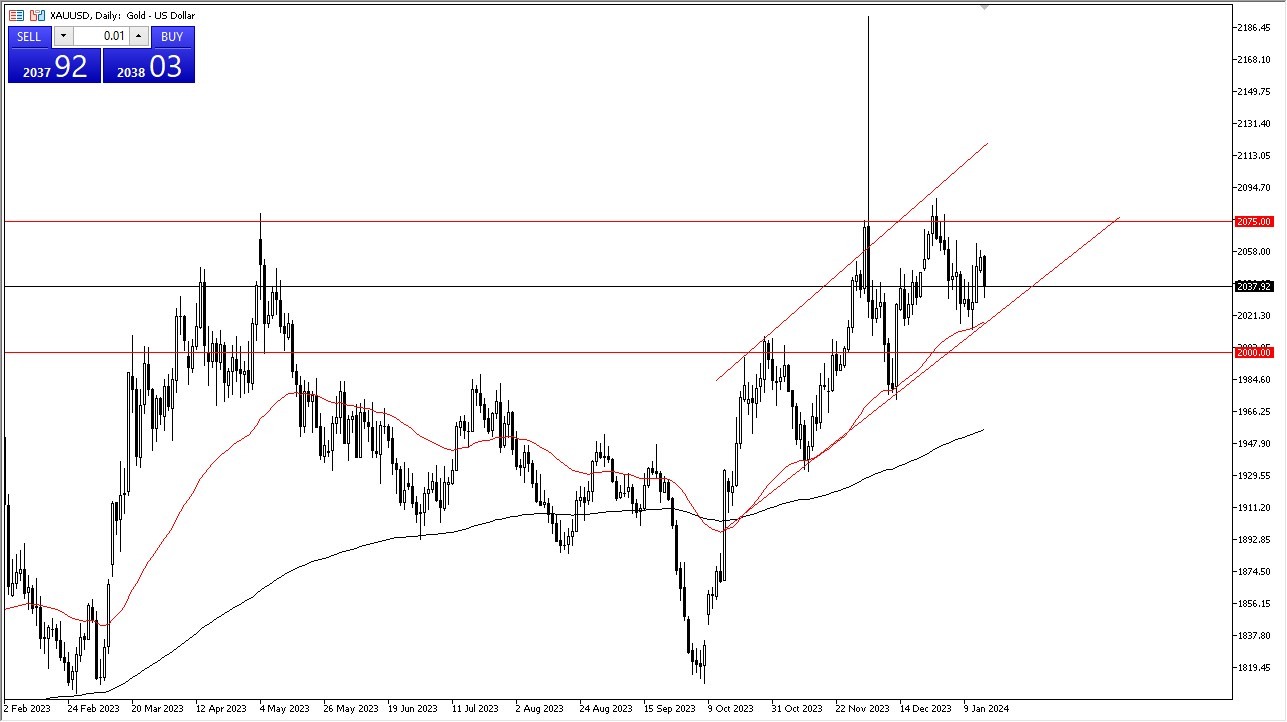

Analyzing the recent trading data, it is evident that the gold market witnessed a notable decrease in value on Tuesday. This decline is part of a recurring pattern, suggesting that the market remains within the confines of its established trend. Observing this pattern, investors should be on the lookout for a potential buying opportunity as the market retraces towards the 50-day Exponential Moving Average and the uptrend line.

Gold remains a valuable asset with several factors that could contribute to its potential for growth. One such factor is the possibility of declining interest rates, which typically drive investors towards precious metals like gold. Additionally, the current global geopolitical landscape is marked by uncertainty and instability, factors that traditionally boost demand for gold as a safe-haven asset. Consequently, it is reasonable to assume that many investors are considering including gold in their portfolios, at least to some degree.

Resistance Above?

Top Forex Brokers

A significant resistance level for gold is positioned at $2,075, presenting a formidable barrier to any attempts at an upside breakout. However, once this level is breached, it is likely that the market will witness a surge in Fear of Missing Out (FOMO) trading activity. Overall, the prevailing scenario suggests that value-oriented investors will continue to show interest in gold. In the event of a breakdown below the 50-day EMA and the uptrend line, the $2,000 level below would serve as a critical support level. Any further decline would prompt concerns about the potential failure of gold. Nonetheless, it is important to emphasize that the market remains firmly within an upward channel.

Considering the current global economic landscape, it appears increasingly likely that central banks worldwide will implement looser monetary policies in the near future. Such policies tend to favor the performance of gold price, making it a more attractive investment option. However, in light of the ongoing geopolitical turbulence and volatility in the bond market, a cautious approach is advisable when entering the gold market.

To mitigate risks associated with market uncertainties, a prudent strategy would be to scale into a gold position gradually, rather than making an all-in investment. This approach allows investors to maintain resilience and hold onto their positions, even in the face of fluctuating market conditions. In conclusion, while caution is warranted due to geopolitical and bond market complexities, gold remains an asset likely to continue attracting attention over the long term, making a measured and strategic entry into the market a wise choice.

Ready to trade our Gold forecast? We’ve shortlisted the most trusted Gold brokers in the industry for you.