- The gold market has experienced significant fluctuations, primarily influenced by the release of the Consumer Price Index (CPI) figures on Thursday.

- These fluctuations were expected, given the relevance of CPI data in the current economic climate.

Analyzing the gold market, it's evident that gold prices have been subject to considerable volatility during Thursday's trading session, which is unsurprising considering the release of the CPI numbers. The CPI data essentially aligned with initial expectations, possibly slightly higher than anticipated. However, it seems that some on Wall Street were hoping for more pronounced CPI figures. The bond market, reacting to these developments, has also been displaying its own fluctuations, indirectly affecting the gold market.

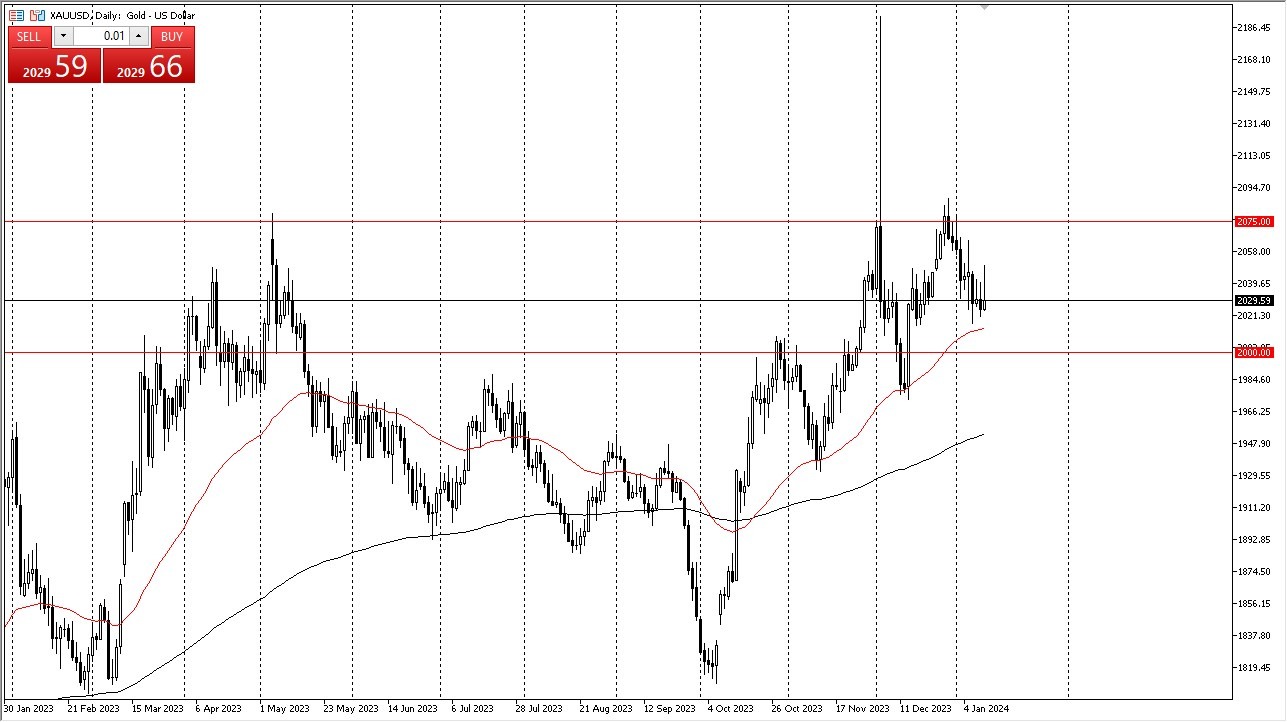

Consequently, it is reasonable to expect continued noise and uncertainty in the gold market. In essence, these developments have not brought about any significant changes in the long-term perspective of the market. Gold has been consolidating within a range delimited by the $2,000 and $2,075 levels.

Look to Long-Term Charts

Given this consolidation, it might be worthwhile to examine longer-term charts to gauge the potential for further consolidation before a substantial movement occurs. Such consolidation should not be considered out of the ordinary, as the market previously experienced a robust uptrend and is now in the process of determining its next course of action.

In light of these factors, adopting a buy-on-the-dip strategy seems prudent. A breakdown below the $2,000 level could be viewed as a negative development. However, the overall bullish sentiment remains intact, and the market continues to consolidate while searching for catalysts to trigger a more pronounced move.

Top Forex Brokers

For investors and traders, closely monitoring the bond markets and interest rates is crucial, as gold exhibits sensitivity to these factors. Caution is advised in navigating this environment, but there is an expectation that buyers will re-enter the market, provided the price remains above the $2,000 level.

Ultimately, the gold market has witnessed significant fluctuations, primarily influenced by the release of CPI data. The market remains in a state of consolidation, bounded by the $2,000 and $2,075 levels. Investors are encouraged to adopt a buy-on-the-dip approach, while closely monitoring the bond markets and interest rates, which significantly impact gold prices. Despite the current noise and uncertainty, the overall bullish sentiment prevails, and the market awaits the catalysts that will propel it in a definitive direction.

Potential signal: I am willing to buy gold at current levels. I would have a stop loss at 2013, with a target at the 2065 level.

Ready to trade our daily Forex signals? Here’s a list of some of the top 10 forex brokers in the world to check out.