- Natural gas markets have been exhibiting noticeable volatility recently, and the prevailing sentiment seems to be centered on identifying a potential bottom in this market.

- This being said, I think this is a market that will continue to be volatile to say the least.

- This is typical of natural gas markets in general.

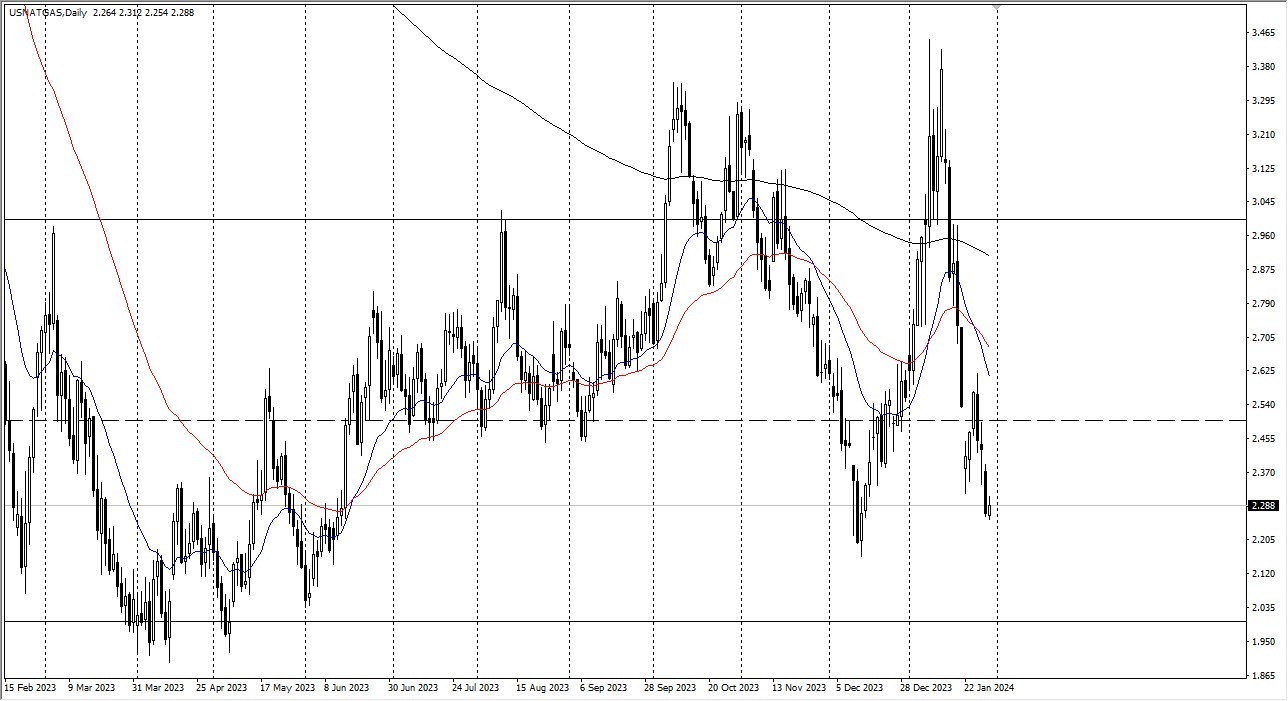

In the early hours of Tuesday's trading session, natural gas prices experienced a modest rally. However, it remains evident that traders determine where the market's bottom may reside. The question lingers: could it be at the $2 level, or perhaps closer to the $2.20 mark?

The likely scenario is a range of support levels emerging, with $2.50 potentially serving as a pivotal point or a fair value level for the market. Breaking above this threshold could open the door to a possible ascent toward the $3 level. It's important to note that the market's historical data suggests a trading range between the two-dollar and three-dollar levels.

With the winter season drawing to a close, market participants will continue to closely monitor weather reports as they hold a significant influence over natural gas prices. While there is substantial demand for natural gas, the market is burdened by an abundant supply. The relatively mild winter weather has failed to drive prices higher. Consequently, futures traders are already factoring in March prices, leaving limited catalysts to drive prices upward, barring unforeseen disruptions.

Top Forex Brokers

Furthermore, concerns persist regarding potential disruptions in natural gas supply, particularly in the Middle East, where conflicts and geopolitical tensions can impact the market. Additionally, recent actions by the Biden administration have introduced uncertainties, particularly concerning liquefied natural gas (LNG) exports from the United States.

Ultimately, natural gas markets exhibit volatility as traders navigate the quest for a bottom. While the market's direction remains uncertain, a range of support levels may be forming, with $2.50 seen as a possible pivotal point. Nevertheless, the winter's conclusion and weather reports will continue to play a crucial role in market dynamics. Supply concerns stemming from geopolitical issues and policy changes also loom on the horizon, adding to the complexity of this market. As a result, market participants must remain vigilant and adapt to evolving conditions in the natural gas sector.

Ready to trade FX Natural Gas? Here are the best commodity trading platforms to choose from.