Top Forex Brokers

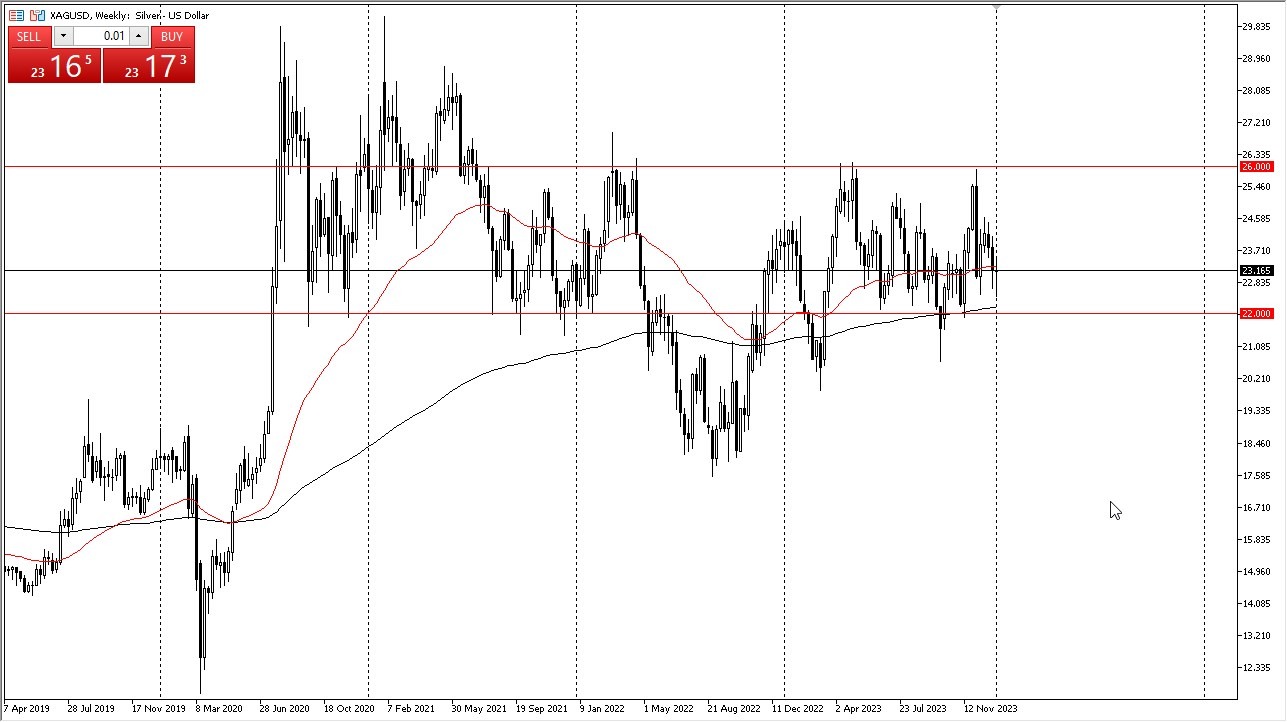

Dow Jones 30

Although Monday is Martin Luther King Junior Day in the United States, anticipate that we will continue to see buyers on dips in the Dow Jones 30, as well as many other US indices. With this being the case, the market looks as if it has plenty of support near the 37,050 level, assuming we even drop to that region. The 37,800 level above is a significant amount of resistance, and if we do break above there, then it’s likely that we will continue to see a move toward the 39,000 level.

USD/MXN

The US dollar try to rally against the Mexican peso during the course of the week, but it looks like the sellers have reemerged. Underneath, the 16.62 level will continue to offer support, and a breakdown below that level has a US dollar reeling against its southern neighbor. On the other hand, if we were to turn around and take out the 17.33 level to the upside, is very likely that the US dollar could go looking toward the 50-week EMA over the longer term.

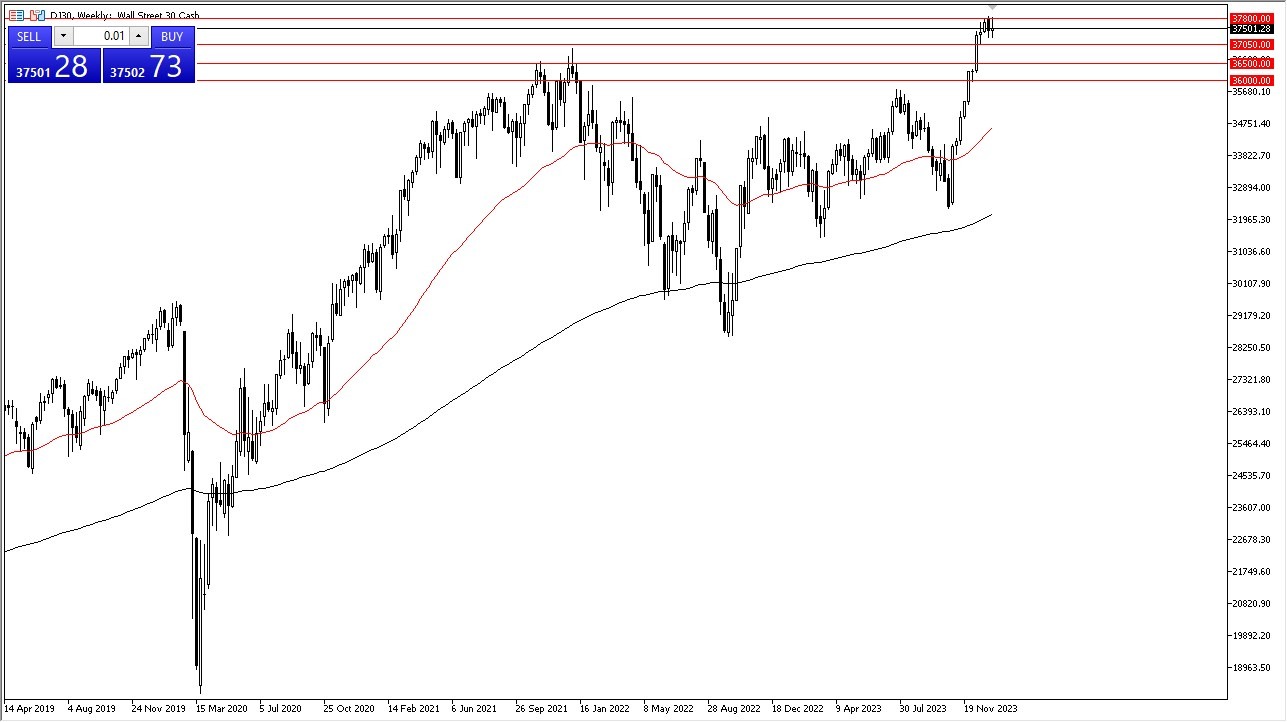

DAX

The German DAX has been all over the place during the week but did find enough support at the €16,500 level to look as if it is ready to go higher over the longer term. In the meantime, though, I think we are very likely to see a lot of consolidation, which makes sense considering just how bullish the market has been over the last several months. After all, the ECB has to think about a German recession, and while it’s bad for the economy, the reality is that liquidity will probably be pumped back into the market sooner or later.

NASDAQ 100

The NASDAQ 100 had a very bullish week, as it looks like we are threatening to break out above recent highs. That being said, there is the worry about the Martin Luther King Jr. Day holiday on Monday but given enough time I do think that there will be plenty of people to jump into the market and pushing this stock index even higher. Quite frankly, this is a market that I think continues to see more of a “buy on the dips” attitude, with the 16,300 level underneath offering massive support. That being said, remember that the NASDAQ is driven by just a handful of stocks, and therefore you need to pay attention to all of the usual suspects.

EUR/USD

The euro has been very choppy in the midst of a noisy trading week, as we continue to see the 1.10 level offer significant resistance. If we do break above that level, then it opens up a move to the 1.1150 level. On the other hand, if we turn around and break down below the previous week, it could send this market down to the 1.0750 level. In general, the euro is continuing to move on the idea that the ECB may keep monetary policy tighter than the Federal Reserve, but with the German economy slipping into a recession, that may change soon.

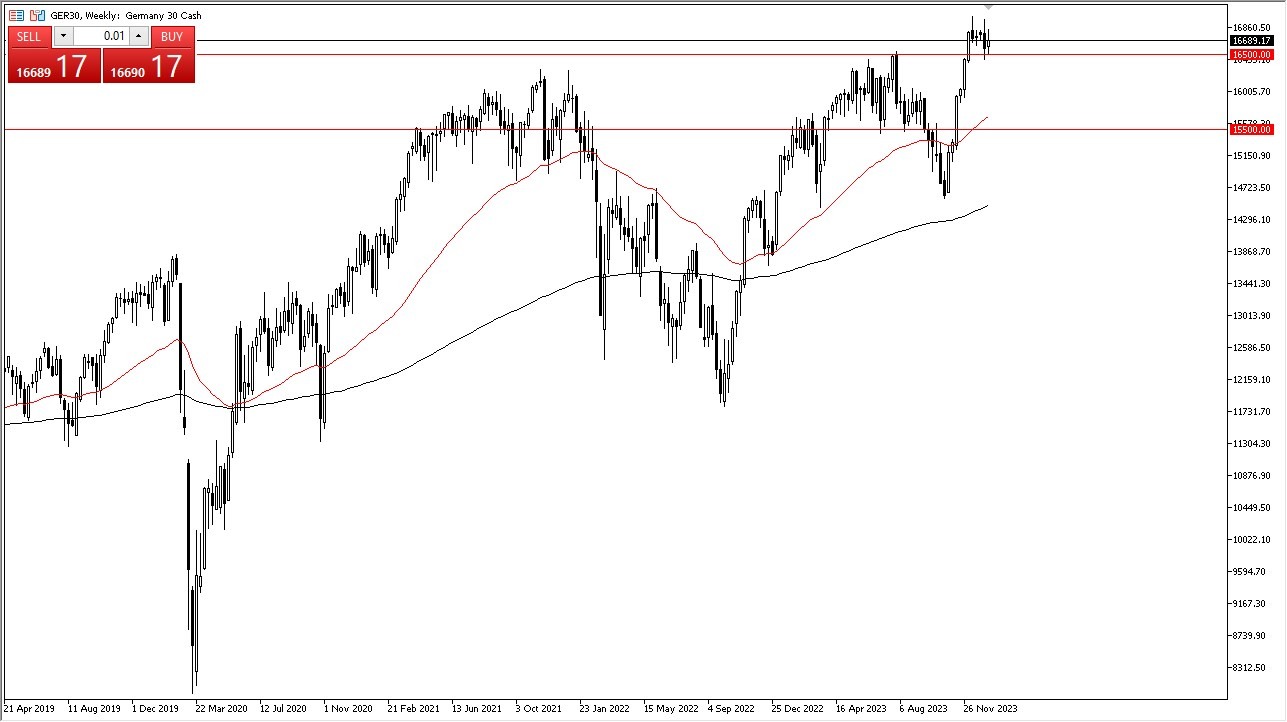

Gold

Gold markets were very noisy during the week, initially falling rather drastically, before turning around to show signs of life. Gold of course is going to continue to be very sensitive to interest rates in the United States, as well as other major economies. If interest rates continue to drop, then it’s likely that we will continue to see the gold markets be one of the major beneficiaries as a result. The $2075 level above is a massive resistance barrier that needs to be overcome. If we can break above that level, then it’s likely that gold will continue a longer-term “buy-and-hold” type of situation.

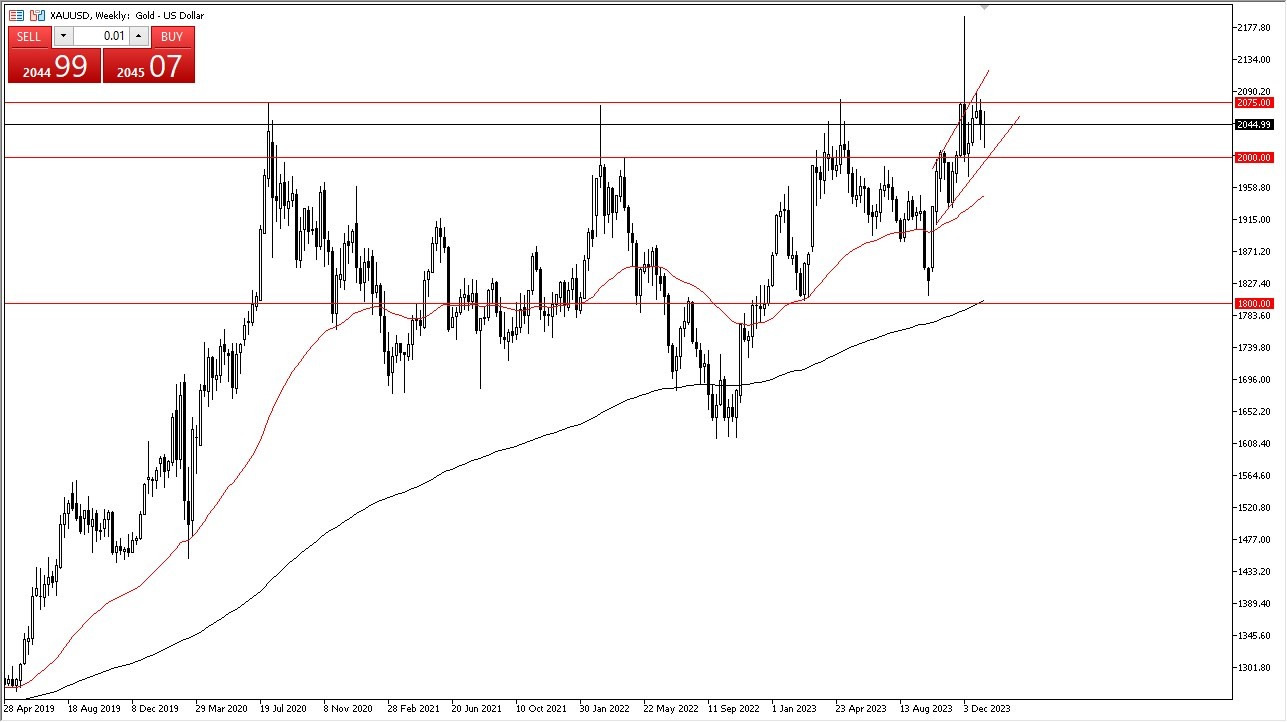

Silver

Silver has been very choppy during the course of the week as well, just like the gold market. The 200-Week EMA is sitting just above the $22 level, an area that is major support for the longer term. The $22 level is like a hard floor in the market, so if we break down below there it would obviously be a very negative turn of events. On the other hand, if we break above the top of the candlestick for the week, then it’s likely that we could go looking to the $24.50 level ball, which could lead for a move all the way to the $26 level, which I see as the top of the overall trading range at the moment.

Ready to trade our Forex weekly analysis? We’ve shortlisted the best Forex trading brokers in the industry for you.