Top Forex Brokers

AUD/USD

The Australian dollar has plummeted during the course of the week, but there is plenty of support underneath to keep this market afloat. Ultimately, I think we are in the middle of a larger consolidation area between the 0.65 level on the bottom and the 0.69 level above. Because of that, the market is going to continue to try to search for some type of momentum, but right now we are just killing time.

BTC/USD

Bitcoin has been all over the place during the week as we continue to see the $40,000 level underneath offer significant support. The $40,000 level is an area that continues to be important, and therefore I think it’s a short-term floor in the market. I suspect that the next week or two is going to be about waiting around to see whether or not the Bitcoin ETF market will kick off. If it does, there could be a “sell on the event” type of situation, but I do think the buyers would come in to pick up a bit of a dip.

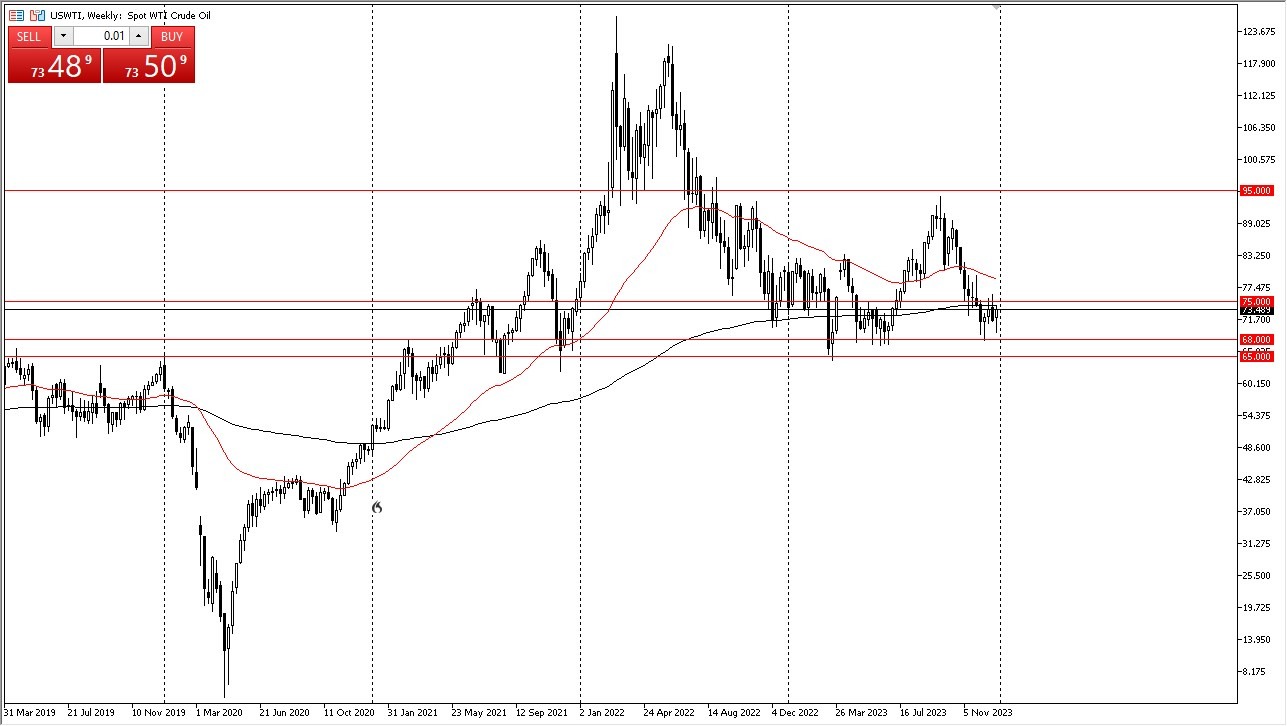

WTI Crew Oil

The West Texas Intermediate Crude Oil market initially fell during the week but continues to find buyers underneath. I think ultimately the $68 level is a hard floor in this market, and the 200-Week EMA just above continues to offer a little bit of resistance. The $75 level above is a significant resistant barrier, and I think if we break above there, then it’s likely that we could continue to go higher, perhaps reaching the 50-Week EMA, which is close to the $80 region.

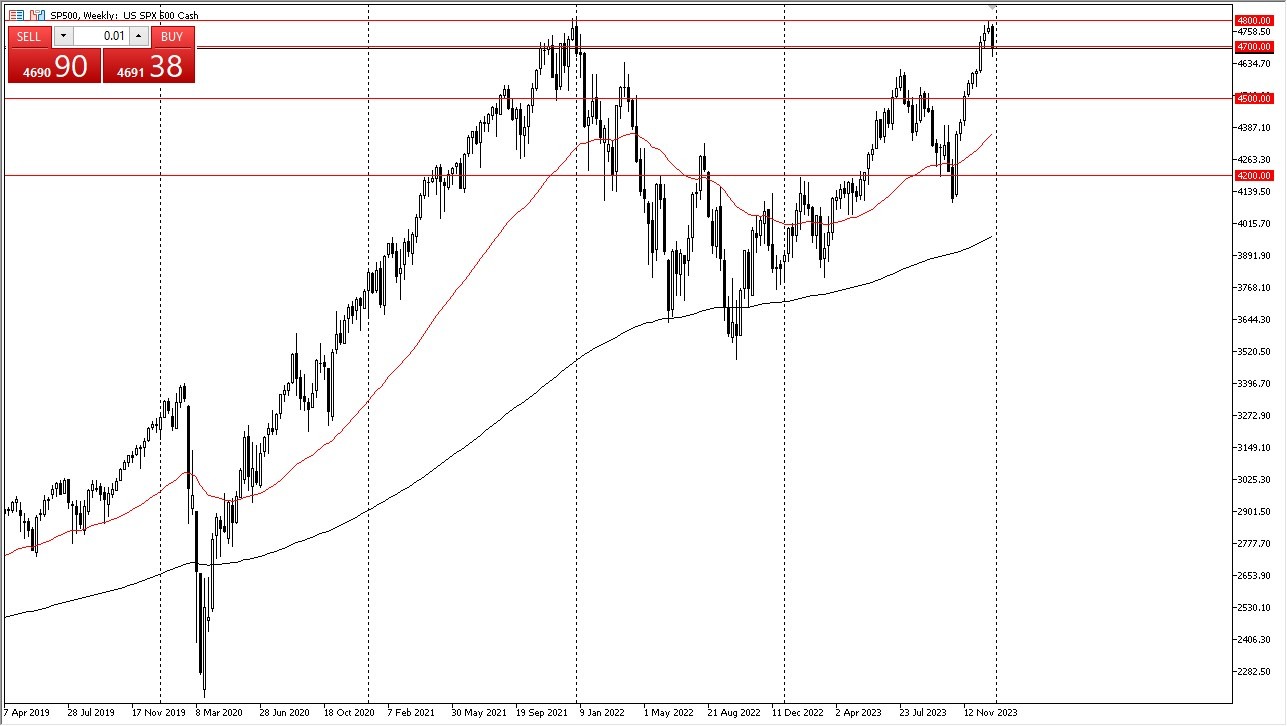

S&P 500

The S&P 500 has broken down significantly during the course of the week, reaching down to the 4700 level. The 4700 level is an area that is important, but I do think that we could break down below there going forward. All things being equal, this is a scenario where I think that the further we go, the more likely we are to see buyers jump into the market. That being said, we got through the first jobs number of the year, and it looks like we are at least trying to hang onto support. Buying the dips continues to be the way to play this market going forward.

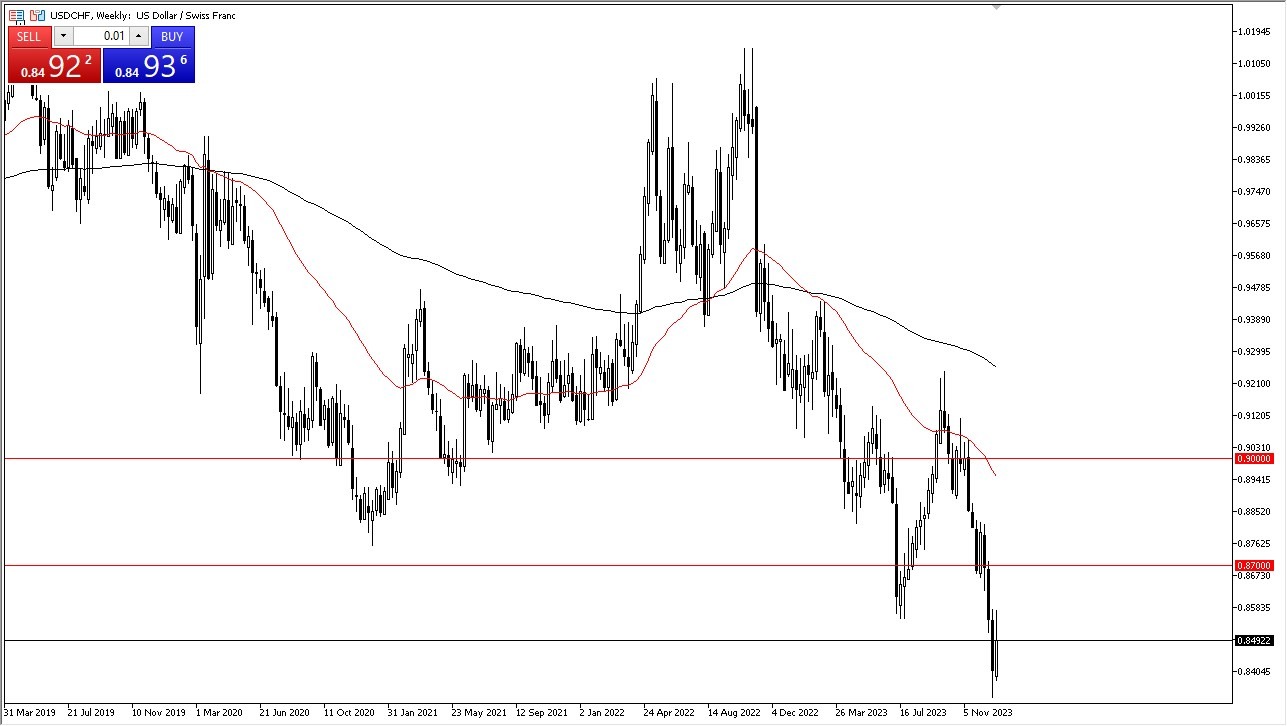

USD/CHF

The US dollar has spent most of the week rallying against the Swiss franc, but the Friday session was a bit disappointing for greenback choose one. All things being equal, the market is likely to continue to see an attempt to rally, but the 0.87 level above is going to be a significant barrier. The market is in the midst of trying to form some type a bottom, but it’s obvious to me that it’s more of a process than anything else. If we were to break down below the 0.84 level would be an opportunity to send that greenback down to the 0.82 level.

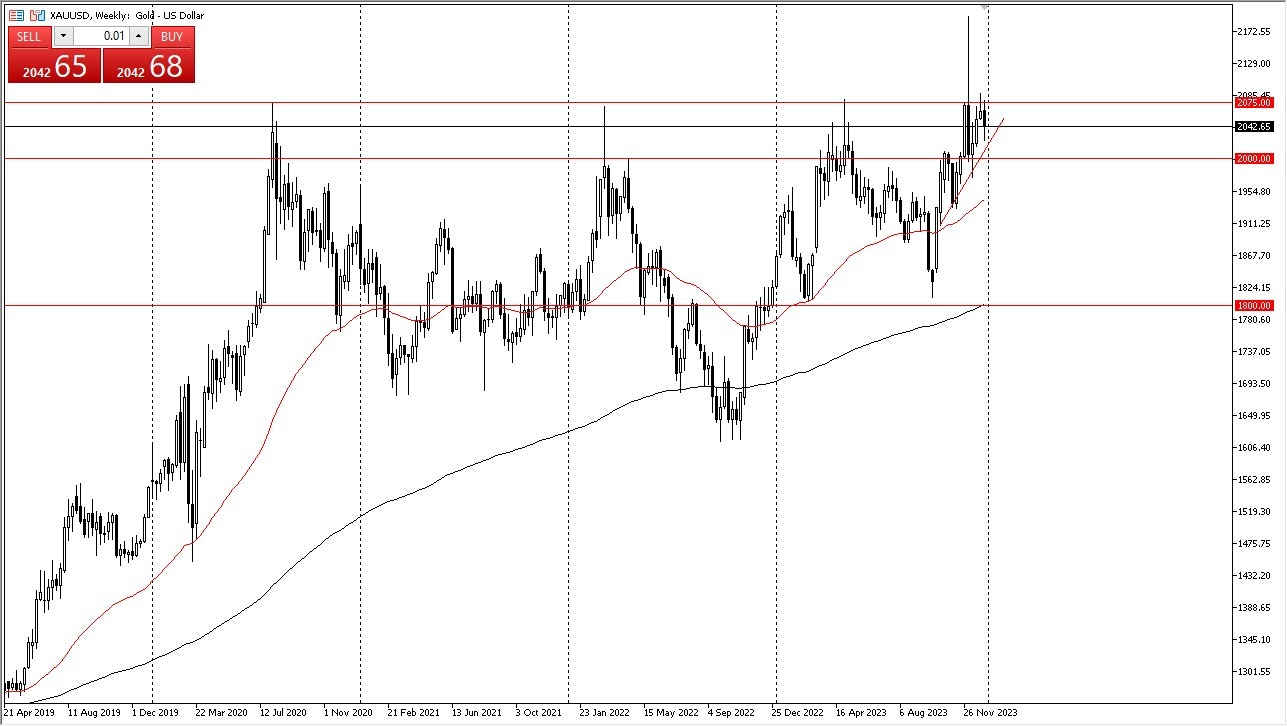

Gold

Gold markets fell significantly during the course of the week but found buyers near the uptrend line. I think this is a market that continues to see a lot of noisy behavior, and therefore think you get a situation where you will continue to get plenty of opportunities to turn the market around and start buying. I believe that the $2000 level is a “floor in the market”, therefore we need to see the market stay above there in order to remain bullish. If we were to break above the $2075 level, I think the gold market will start to rise even higher.

GBP/USD

The British pound has fallen significantly during the week, only to turn around and show signs of life. The 1.2750 level above continues to be a major barrier, and if we can break above there on a weekly close, then I believe that the British pound could go looking to the 1.30 level. Underneath, the 1.25 level offer support, and I do think that is something that you will need to keep an eye on. We can see this market go back and forth in general, and therefore it looks as if we have a sideways to slightly higher bias.

DAX

The DAX has been all over the place during the course of the week, as we have broken higher, only to turn around and show signs of negativity. All things being equal, this is a market that looks as if it is trying to grind away to the side in order to work off some of that excess froth. A pullback at this point in time could send the DAX down to the 16,000 level, where we would turn around and find buyers. If we give up 16,000, then it’s likely we will go down to the 15,500 level next which is where we see the 50-Week EMA.