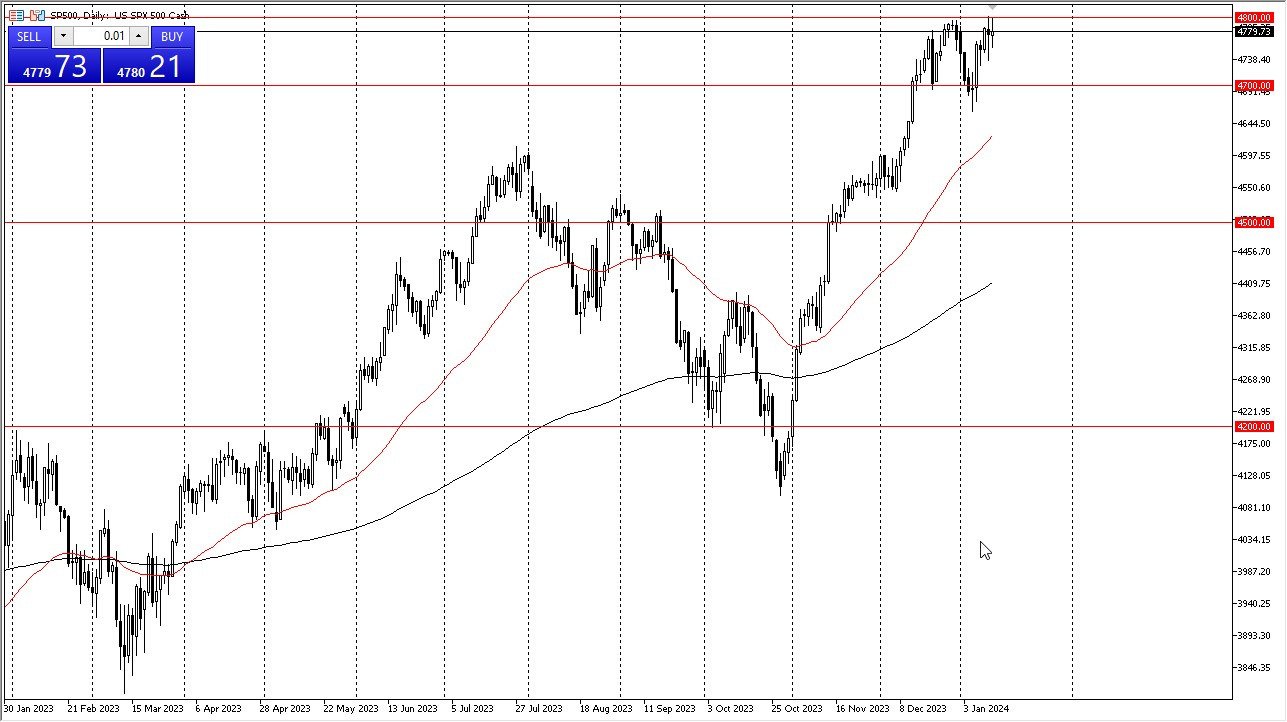

- The S&P 500 index has experienced a period of fluctuation following the release of the Producers Price Index (PPI) figures in the United States, but throughout the Friday trading session, the S&P 500 displayed a back-and-forth pattern, with the 4800 level proving to be a significant resistance point.

- Presently, it appears that this level is imposing a notable amount of selling pressure, making it challenging to surpass the 4800 mark without a compelling catalyst.

- The PPI numbers, which came in lower than expected on Friday, triggered speculations of further monetary easing by the Federal Reserve.

- However, the previous day's release of the Consumer Price Index (CPI) showing slightly higher figures has left the market in a state of uncertainty.

The $4,800 level is currently presenting itself as a formidable barrier that may not be easily breached. There is a possibility of a minor pullback in the market as a result. This will more likely than not be the case for most traders at this point – a game of value hunting.

Momentum

For momentum traders, the 4700 level below could serve as a potential support zone. It is conceivable that the market may continue to hover within this general range. Nevertheless, should a daily close manage to break above the 4800 level, attention will shift to the 4900 level, followed by the 5000 level in the coming weeks or even months. Having said that, it is worth noting that Wall Street is closely monitoring the Federal Reserve's potential multiple interest rate cuts in 2024, which seems to be the dominant narrative guiding market sentiment.

Top Forex Brokers

In this scenario, the strategy remains focused on identifying opportunities during price dips, as has been the trend for some time. Shorting the market does not appear advisable, at least not under current circumstances. Maintaining a bullish yet cautious stance is recommended. An essential aspect of prudent trading is to keep position sizes reasonable, especially until a significant breakout occurs. While a breakout is anticipated in due course, it is advisable to avoid tying up a substantial portion of trading capital in any single position.

In the end, the S&P 500's recent performance has been characterized by uncertainty following the PPI data release. Traders should exercise caution, remain vigilant for potential opportunities during price declines, and avoid overcommitting their trading capital until a substantial market breakout is observed.

Ready to trade our S&P 500 daily forecast? Here are the best CFD brokers to choose from.