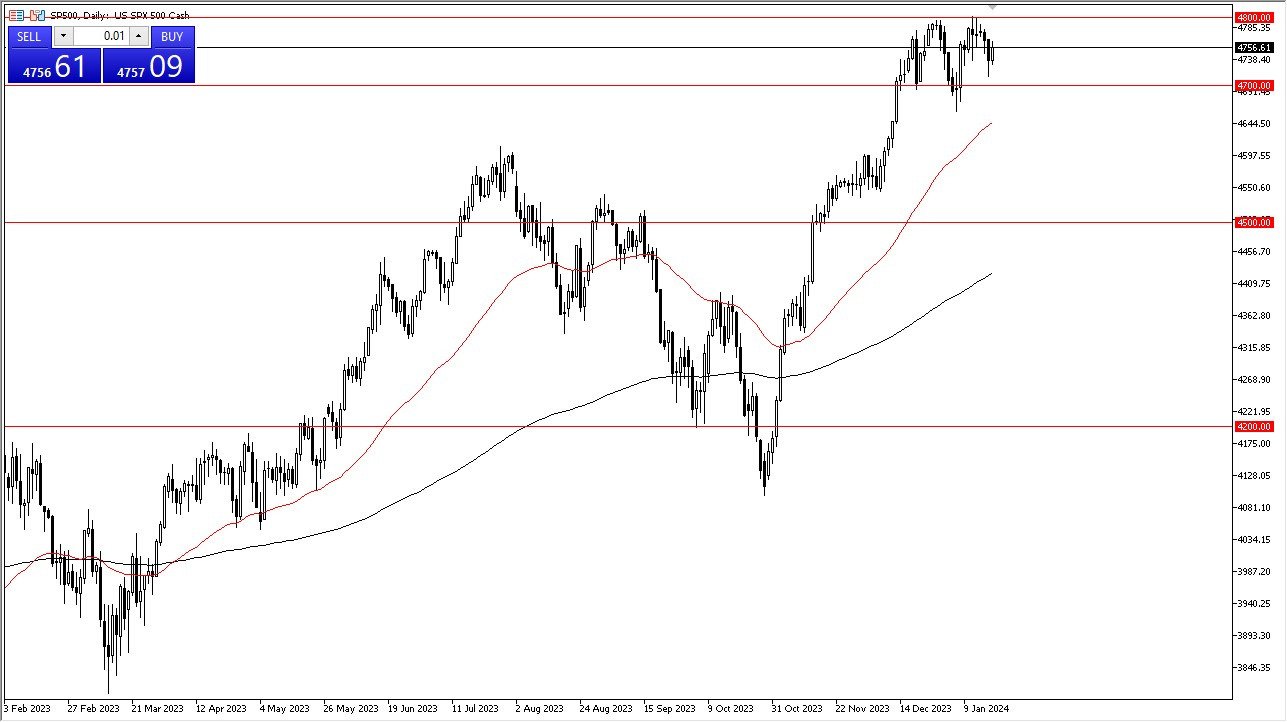

- Taking a look at the S&P 500, the market has been bullish during the early hours on Thursday and as you can see, we are roughly in the middle of the overall consolidation area between $4700 on the bottom and $4800 on the top.

- This is a market that had shot straight up in the air previously, so some significant consolidation is probably necessary.

2024….and the Fed

As we start to dig into 2024, there are a lot of traders out there now focusing on whether or not the Federal Reserve will cut rates aggressively this year. There's an interesting dichotomy at the moment though because if they get too aggressive, then people start to worry about the overall economy in general and that of course is bad for stocks. However, if they do it in a gradual manner, it makes money cheap, and Wall Street starts to buy assets.

Since the great financial crisis of 2008, Wall Street has fueled itself on cheap money and cheap money only. I don't think this will change anytime soon, and therefore, you have to look at it through the prism of what the bond market is doing. Typically, if we get lower yields, Wall Street celebrates, and they start buying. If we were to break down below the 4,700 level, the next support level is the 50-day EMA, followed by $4,500 which I would love to see the market reach down towards so I could buy it, but right now I just don't see that happening. If we break $4,800 then the $4,900 level is targeted next followed rather quickly by the $5,000 level would be my guess. In general, I don't have any interest in shorting this market and I think that's probably going to continue to be the way you have to look at it.

Potential signal

When it comes to the S&P 500 index, I believe that this remains a “buy on the dips” situation. The 4700 level is like a hard floor in the market, so every time we dropped 20 points or so, I am a buyer of a small position, only looking to cash out when I gained 40 points. The closer we get to the 4700 level, the bigger the size could be going forward.

Ready to trade our daily Forex signals? Here’s a list of some of the best CFD trading brokers to check out.