- Silver displayed an early rally in the first trading session of the year, followed by a partial retracement of the gains.

- This evolving market situation presents an intriguing dynamic as it adjusts to new liquidity conditions.

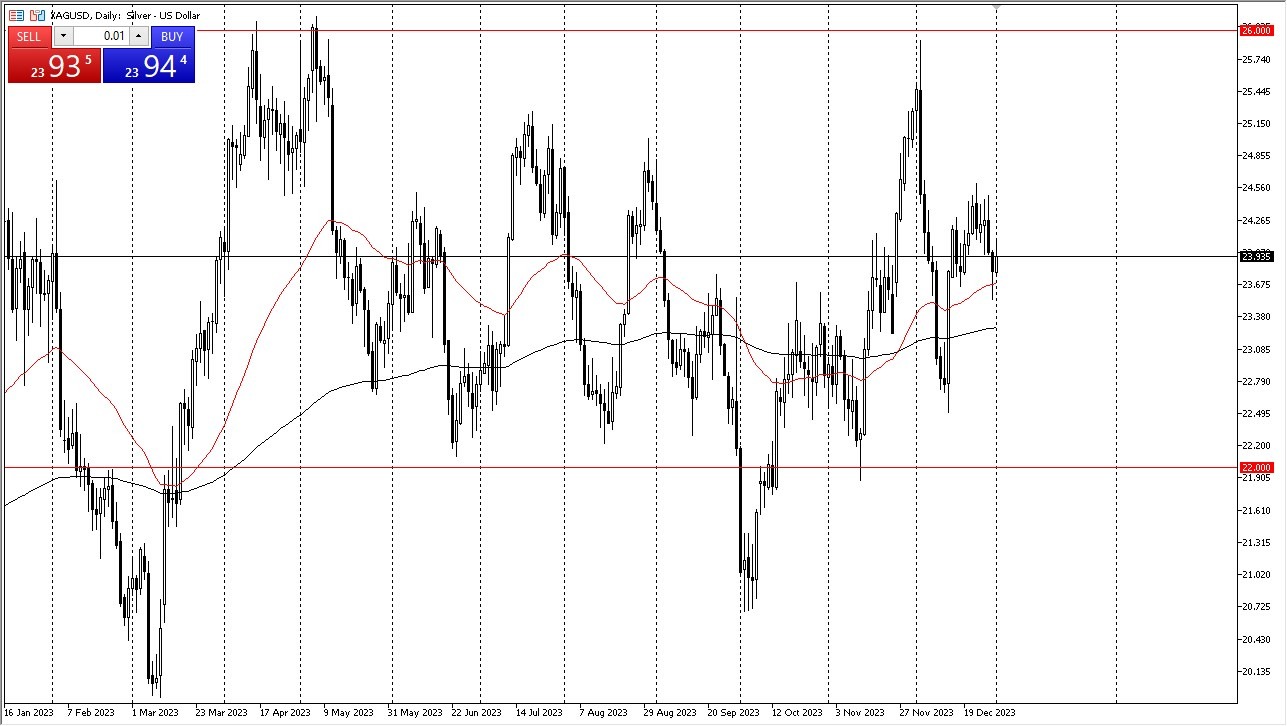

- In the broader context, it appears that we find ourselves closer to the midpoint of the overall trading range.

Taking a longer-term perspective into account, the 50-day EMA lies just below the current levels and is likely to serve as a reliable support point. Further down the line, around the $23.25 mark, corresponding to the location of the 200-day EMA, we can anticipate substantial support. Nevertheless, it's worth noting the presence of market noise slightly above current levels, contributing to a somewhat challenging trading environment until the release of the upcoming jobs report on Friday.

Top Forex Brokers

Monitoring the bond market and the behavior of interest rates, particularly the 10-year yield, remains pivotal for silver's performance. A decline in interest rates could work in favor of silver. Conversely, a strong jobs report might boost silver's prospects by implying a resurgence in industrial demand.

Presently, silver finds itself in a situation of relative equilibrium, positioned between the lower extreme around $22 and the upper extreme near $26, essentially resting in the middle ground.

A Pullback Remains a Possibility

Given the current circumstances, adopting a cautious approach is advisable. Market choppiness is expected to persist, warranting careful consideration. While there is a predisposition towards an upside bias, one should remain mindful of the potential for a pullback. Silver's perception as a riskier investment could surface in the event of an abrupt risk-off scenario. Nevertheless, at this juncture, silver seems to be navigating the waters with a focus on maintaining stability.

At the end of the day, the silver market has experienced an early-year rally and subsequent retracement, signifying an evolving landscape as it adapts to changing liquidity conditions. Positioned within the midrange of its broader trading spectrum, silver appears to be awaiting key developments, such as the upcoming jobs report. Caution is advised in this context, given the anticipated ongoing market volatility. While an inclination toward an upside trajectory exists, a pullback remains a possibility. Silver's role as a potential riskier asset may become apparent in specific market scenarios. Nonetheless, this market is poised to offer favorable opportunities when approaching its range boundaries.

Ready to trade our Forex daily forecast? We’ve shortlisted the top forex brokers in the industry for you.