- Silver saw a resurgence in its value during Friday's trading session, marking a recovery from a recent market pullback.

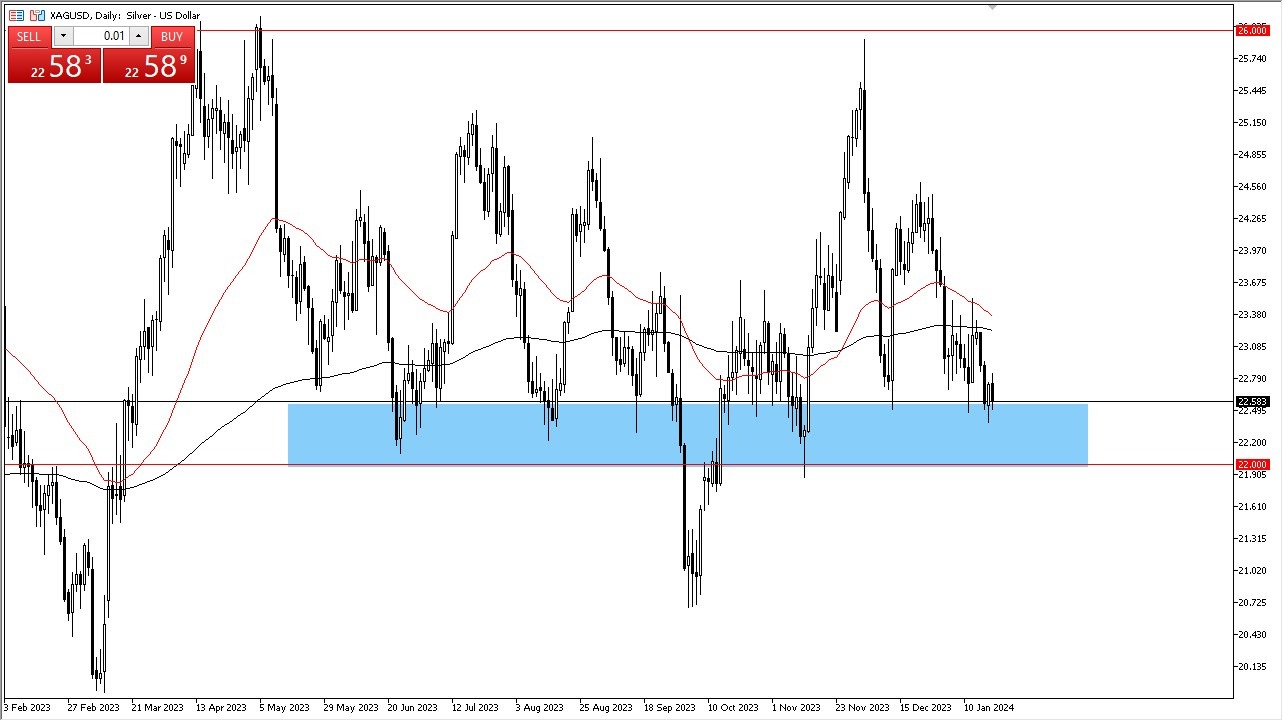

The initial pullback experienced by silver was minor, but it quickly reversed course, indicating renewed strength. Currently, it appears that the market is finding support around the $22.50 level, a support level that extends down to $22. Given the recent upward momentum in the last few sessions, it seems plausible that silver may aim for the 200-day Exponential Moving Average (EMA) situated around $23.20. Any price movement beyond this point could potentially lead to a more substantial uptick, possibly reaching as high as $24.50.

Taking a broader perspective on silver's long-term chart, it becomes evident that $26 acts as a significant resistance level, while $22 serves as a formidable support level. Given the proximity to this robust support, it is reasonable to expect continued interest from value-seeking investors. It's important to note that silver's performance is closely tied to the 10-year yield in the United States; an increase in yields tends to make precious metals less appealing.

Top Forex Brokers

Silver is Also an Industrial Metal

Additionally, silver serves as an industrial metal, particularly in the context of green technologies and other industries where its properties are highly valued. Interestingly, platinum is also showing strength after a period of lower prices, and silver and platinum often exhibit similar price movements. This correlation further suggests that silver may have the potential to rise in the near term.

At the very least, it is anticipated that silver will make an attempt to reach the 200-day EMA, and possibly even the 50-day EMA in the short term. However, it's essential to exercise caution when trading silver, as it is known for its high volatility. Traders should maintain reasonable position sizes to mitigate the risk of significant price fluctuations that could result in swift losses.

Ultimately, silver is displaying signs of recovery after a brief pullback, finding support around $22.50 with potential upside toward the 200-day EMA. The $26 resistance level and strong support at $22 frame the broader price range. Factors such as the 10-year yield and industrial demand influence silver's performance, making it a market to watch closely. Nonetheless, traders should remain vigilant due to silver's inherent volatility and carefully manage their positions to navigate potential price swings.

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.