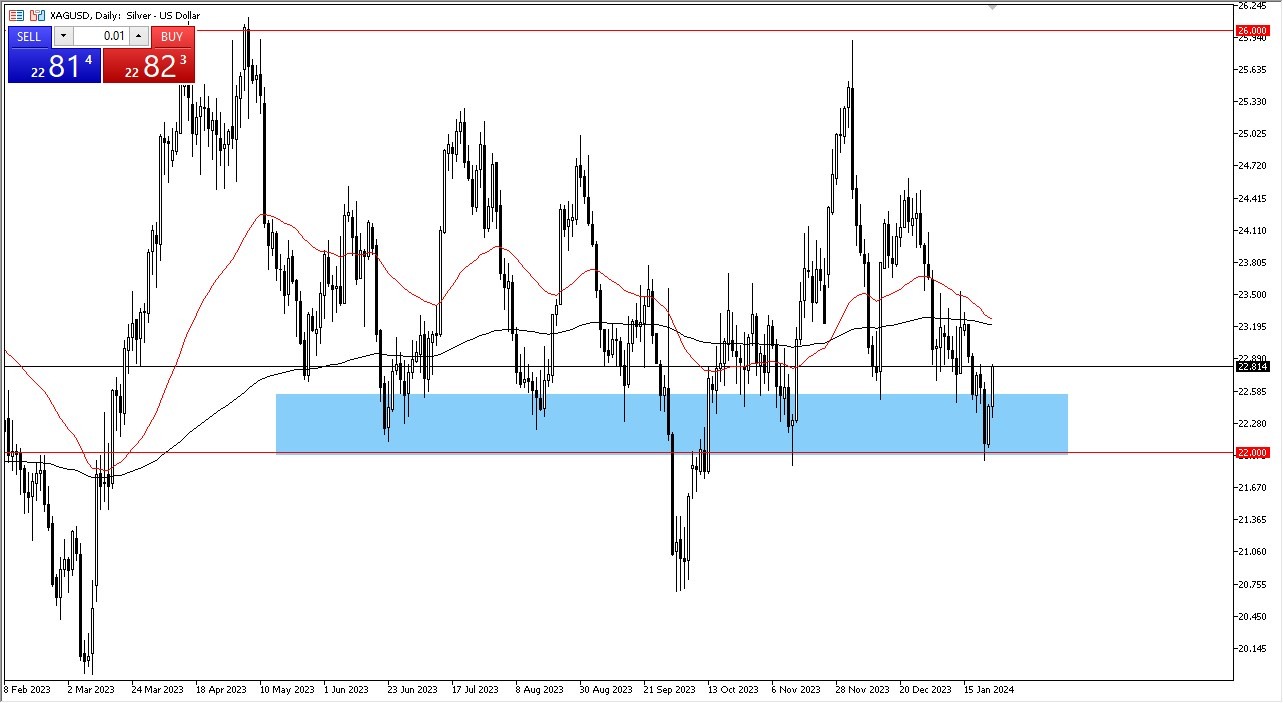

- During Wednesday's session, silver exhibited a substantial rally, reinforcing the $22 mark as a strong support level.

- Given the current market behavior, there is an increasing expectation that silver prices will continue to ascend. The immediate target for silver is the 200-day Exponential Moving Average, which lies near the $23.20 mark.

- Following this, the market faces structural resistance around the $23.50 level.

- Should there be any resistance at this point, it is likely to be viewed by many as an opportunity to buy.

A critical point to watch is whether silver can surpass the $23.50 barrier. Overcoming this level could pave the way for a potential move towards the $24.50 mark. A breach of the $24.50 level may open the door to an advance towards the $26 level, which corresponds to the peak of a longer-term consolidation phase that is anticipated to dominate the market this year. This will continue to be a situation where breaking above that could open up the floodgates, but reality suggests that it will be almost impossible to make that happen anytime soon.

On the Downside

On the downside, a reversal and break below the $22 level could lead to a decline towards the $21 mark. However, such a scenario is becoming increasingly improbable. The current market environment suggests that participants are likely to continue purchasing dips. Nonetheless, it is essential to monitor interest rates closely due to their inverse relationship with silver prices. Additionally, the negative correlation between the US dollar and silver is another crucial factor to consider.

Top Forex Brokers

The short-term outlook for silver appears positive. However, whether this translates into a viable long-term buy-and-hold strategy remains to be seen. Another important aspect to consider is the economic and industrial demand for silver. As an industrial metal, fluctuations in demand can significantly impact silver prices. This will continue to make silver behave quite a bit differently than many other commodities, including gold.

Given silver's volatility, traders and investors must exercise caution. Position sizing should be managed prudently to mitigate the potential risks associated with the metal's price fluctuations. An overly aggressive stance in the silver market could lead to substantial portfolio impacts if not carefully managed. Overall, while the current trends in the silver market offer opportunities, they demand paying close attention to your position sizing as you can get hurt by silver in general. After all, it does tend to move quite volatilely.

Ready to trade our daily Forex forecast? Here’s a list of some of the best online forex trading platforms to check out.