- The silver market experienced a notable uptick in early Monday trading, although it remains in a state of flux, seeking a clear direction.

- To chart a decisive course, a strong, unambiguous candlestick pattern is required.

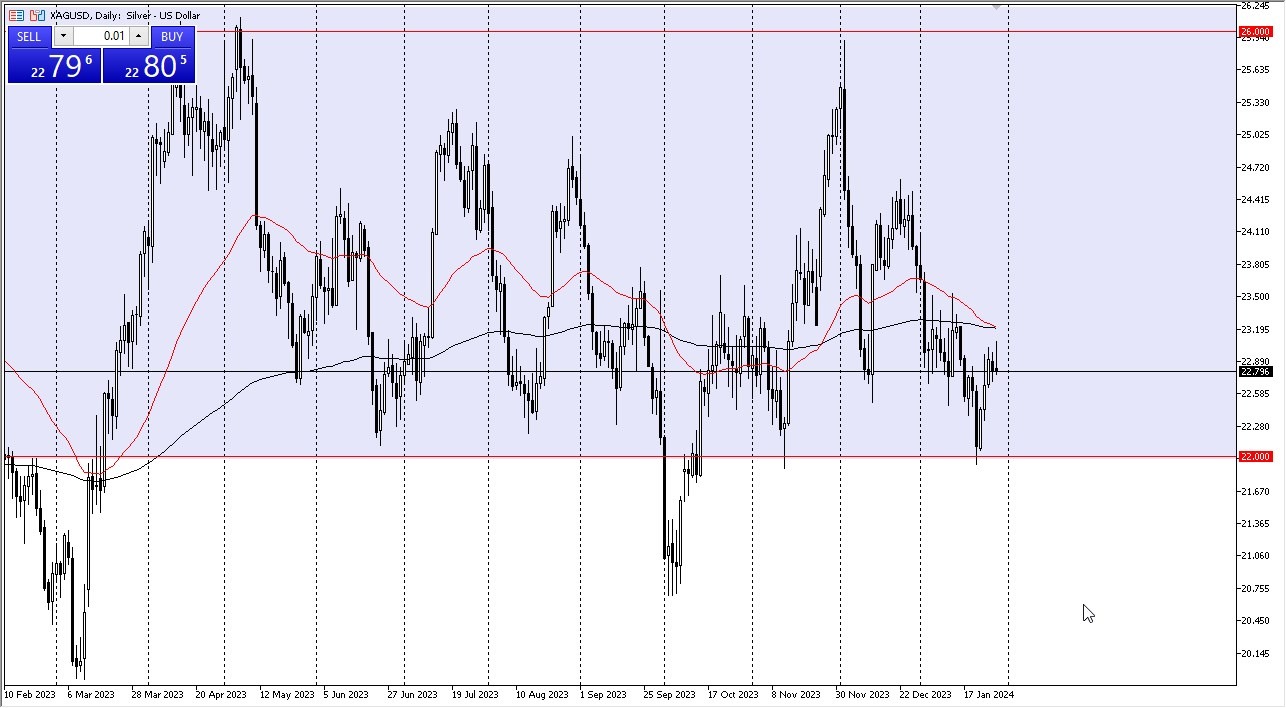

Silver prices made a significant upward move during Monday's trading session as market participants returned from the weekend. It is worth noting that the $23 price level holds particular significance as a round number, drawing attention from many traders. Currently, the market appears poised to test the $23.50 level. Short-term price retracements are likely to present opportunities for buyers at this juncture. Additionally, the $22 level is viewed as a substantial support level in the market, having demonstrated its resilience over multiple years. Although the market briefly dipped below this threshold last year, it has generally served as a solid foundation. As the market continues to climb, the $24.50 level may become a significant obstacle.

Breaking Above $26? Not So Fast..

Breaking above the $26 level represents a formidable challenge, with the potential to mark a momentous development. Presently, the market seems intent on achieving equilibrium, positioning itself within the broader consolidation phase bounded by the $22 to $26 price range. Silver's performance remains sensitive to several key factors, including United States interest rates, the strength of the US dollar, and industrial demand. Investors should exercise caution, given the silver market's extraordinary volatility, which can lead to rapid losses. It is essential to maintain a reasonable position size to manage risk effectively.

Top Forex Brokers

Moreover, it is crucial to bear in mind that the upcoming Federal Open Market Committee (FOMC) meeting will exert a significant influence on interest rate markets, which, in turn, correlates with the silver market's dynamics. Prudence is advisable, but the current market sentiment leans more toward support levels than resistance.

Ultimately, silver prices have seen a recent uptick, although the market is still grappling with uncertainty. The $23 and $23.50 levels are currently in focus, with short-term pullbacks providing buying opportunities. The $22 level has proven to be a robust support over the years. Breaking above $24.50 poses a challenge and surpassing $26 would represent a significant milestone. Silver's performance is closely tied to US interest rates, the US dollar, and industrial demand. Caution is essential due to the market's volatility, especially with the FOMC meeting looming, as it could impact interest rates and, consequently, silver's trajectory.

Ready to trade our Forex daily analysis and predictions? Here are the best regulated trading brokers to choose from.