- The S&P 500 exhibited notable volatility during Thursday's trading session, prompted by the release of the Consumer Price Index (CPI) data, which registered slightly higher than Wall Street's preference.

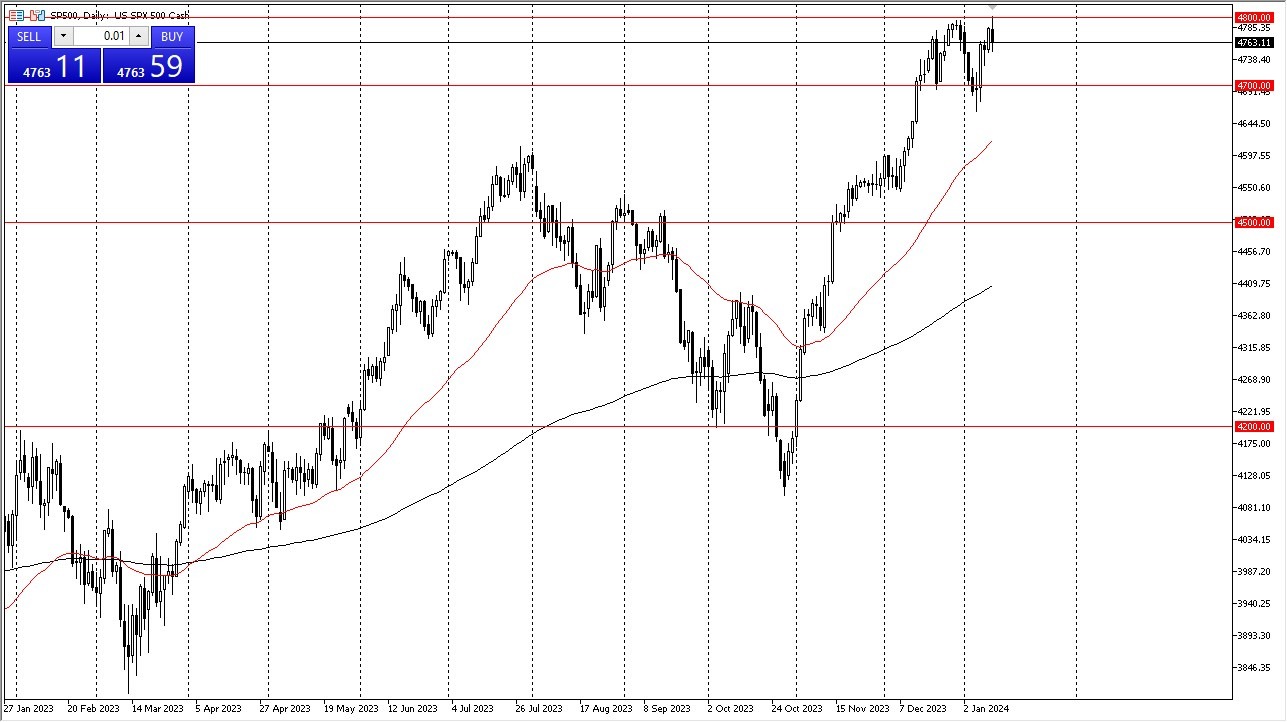

- Presently, the index faces a significant resistance barrier at the 4800 level, which was a previous high.

- This is an area where a lot of noise will be a factor.

As we look at the S&P 500's performance, it's evident that it has been struggling at the 4800 level, a zone that has historically posed formidable resistance. A break above this level would provide the market with the potential to extend its gains. However, the current landscape portrays a market grappling with indecision. Consequently, it is crucial to acknowledge the importance of the 4,700-support level. It is entirely plausible that the market may experience a period of consolidation.

The Technical

The market previously witnessed a substantial rally, and, logically, a period of correction or consolidation is necessary to offset those gains. A breach below the 50-day Exponential Moving Average could open the door to a descent towards the 4,500 level. This, as always, hinges on the prevailing sentiment surrounding interest rate expectations in the United States. Favorable signals suggesting potential rate cuts by the Federal Reserve tend to be well-received by Wall Street.

Top Forex Brokers

At present, there is a prevailing sentiment that the market may have surged beyond reasonable levels. However, a breakout above 4,800 could pave the way for an ascent towards 4,900 and eventually, the 5,000 mark, which appears to be a longer-term target. It is worth noting that a buy-on-the-dip approach has been a recurrent strategy for some time. Whether the current market candlestick formation alters this strategy remains uncertain, as this is a situation where traders are waiting for some reason to get involved.

Ultimately, the S&P 500 has experienced significant volatility in response to the CPI data, with a resistance barrier at 4,800. Support at 4,700 is crucial, and a consolidation phase may ensue. A breakdown below the 50-day EMA could lead to a descent towards 4,500. Interest rate expectations in the United States continue to influence market sentiment, and favorable signals may boost Wall Street's enthusiasm. While the market's bullish outlook remains intact over the long term, prevailing uncertainty necessitates patience in anticipation of future momentum.

Ready to trade our S&P 500 analysis? Here’s a list of some of the best CFD trading brokers to check out.