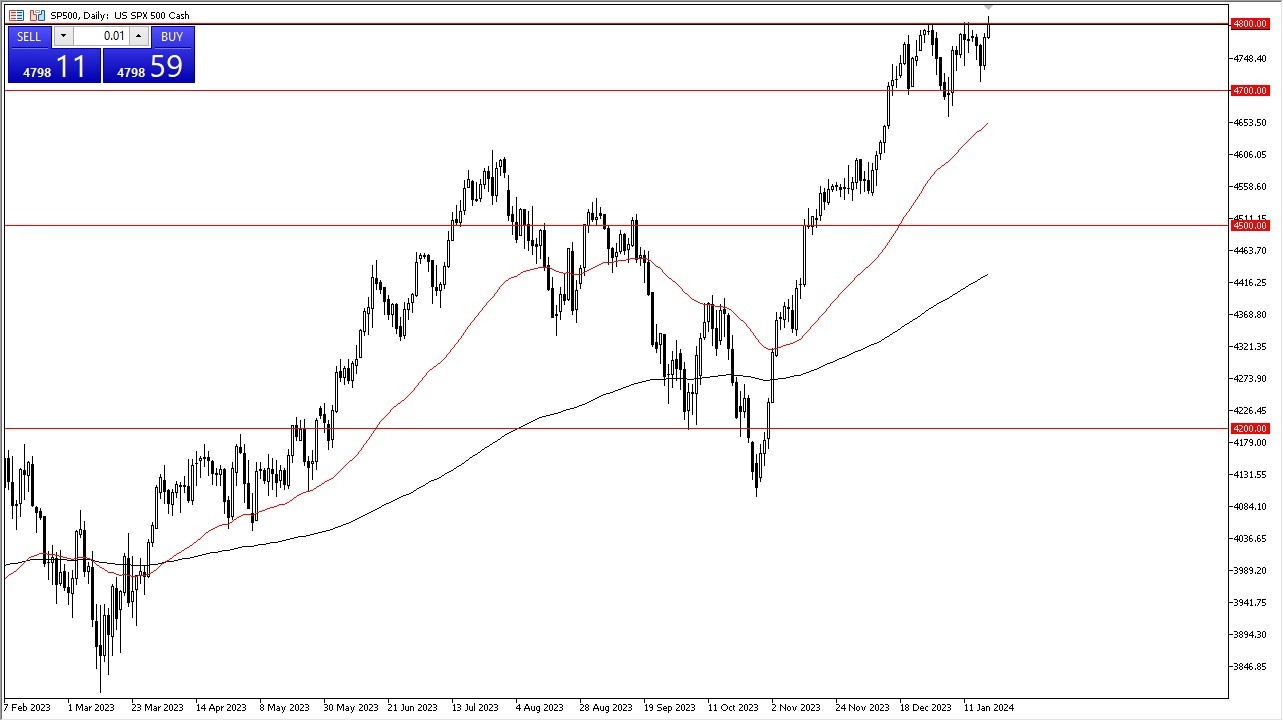

- The S&P 500 exhibited another robust rally during Friday's trading session, as it endeavors to breach the critical 4800 level.

- This number has effectively acted as a substantial resistance, akin to a ceiling limiting upward movement. However, the prevailing sentiment suggests that over time, we may witness a breakthrough on the upside.

Short-term pullbacks continue to present themselves as viable buying opportunities, emphasizing the underlying strength in the market. Notably, the 4700 level, another pivotal round number, has served as a zone of substantial buying interest over the past two months or so. In the event of a descent below this level, the 50-day Exponential Moving Average stands as a supportive factor.

In a broader context, the stock markets continue to rally, driven by the anticipation that the Federal Reserve will take action on interest rates this year, potentially lowering them and implementing a looser monetary policy. This situation has led to a curious dynamic where adverse economic news is perceived as favorable, as it provides the Federal Reserve with greater latitude to initiate rate cuts. This playbook echoes the strategies employed during the Great Financial Crisis in 2008.

Top Forex Brokers

On Wall Street, there is a palpable expectation of support from central authorities, a reflection of the prevailing market dynamics. The flow of liquidity plays a pivotal role in determining market direction. An accommodating stance by the Federal Reserve tends to propel the markets higher, while any indication of a tighter monetary policy exerts downward pressure.

Shorting Not Possible

In this scenario, there is an argument to be made that the market should have experienced a more substantial pullback. However, the current landscape still favors buying opportunities. Attempting to short the stock market in this environment is a challenging endeavor, given its strong upward momentum. The market appears to be surging and may continue to do so in the foreseeable future.

The recent weeks have been characterized by the accumulation of momentum, further solidifying the trajectory towards higher levels. Given sufficient time, it is expected that this market will persistently attract buyers, driven by the enduring "buy the dips" mentality prevalent in New York.

Ultimately, the S&P 500 showed another rally, with the 4800 level as a significant resistance point. Short-term pullbacks continue to be buying opportunities, underlining the market's resilience. The anticipation of Federal Reserve actions on interest rates is driving market sentiment, and there is a "buy the dips" mentality prevailing in the current environment, supporting the ongoing upward trajectory.

Ready to trade the Forex S&P 500? We’ve made a list of the best online CFD trading brokers worth trading with.