- There are few markets that I hate more to analyze these days than the US stock markets.

- That’s true with the S&P 500, NASDAQ 100, and just about anything that is indexed.

- This is because there is an obvious directionality to the market, but anybody who has been in the market for more than about 10 minutes understands that this type of momentum can and will eventually run out.

- As your analyst, my job is to try to sort out when that’s going to be.

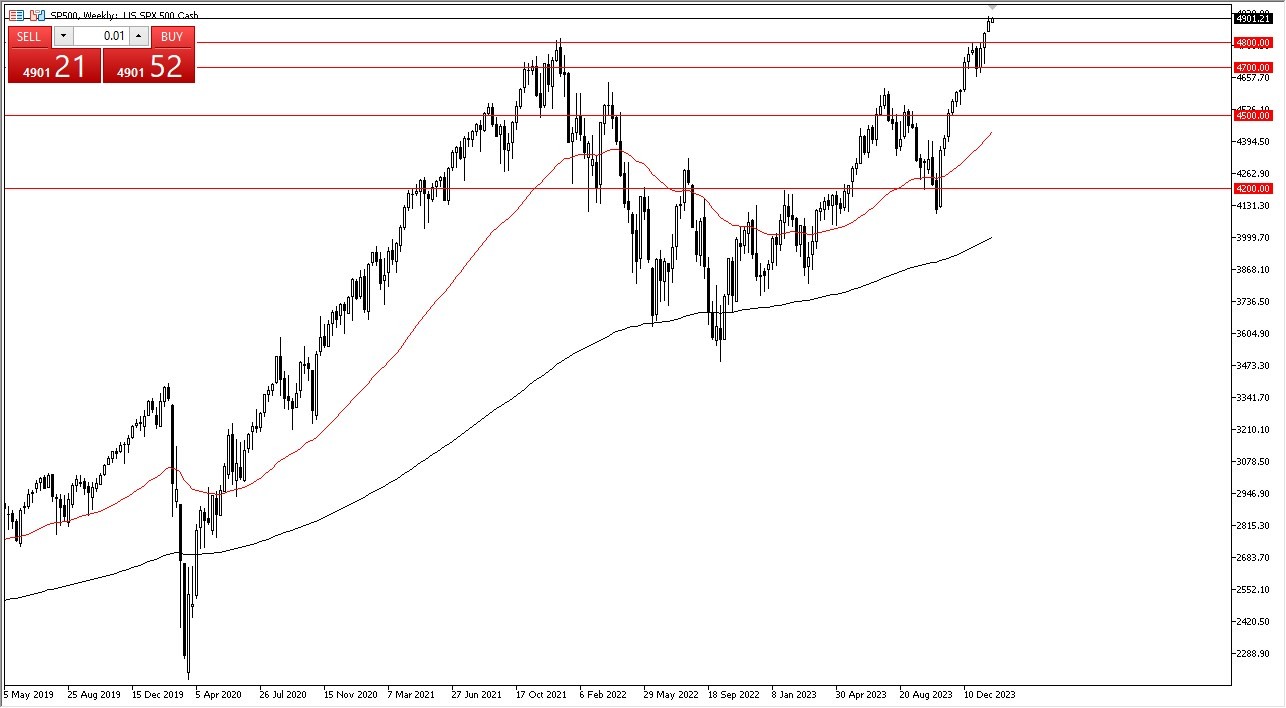

The S&P 500 has a major issue with the fact that only 7 stocks make up roughly 38% of the gain. In other words, what you are looking at is an ETF of all of the large companies that everybody is throwing money at. The S&P 500 equal-weighted index has given back most of its gains, showing just how ugly things are under the surface. However, you also have to make an argument for the fact that if you are trading the index, you just don’t care.

Federal Reserve and its Influence

Top Forex Brokers

Everything that’s going on in the stock market right now is a representation of what people believe the Federal Reserve is going to be doing. Unfortunately, the Federal Reserve doesn’t seem to know what it is going to do, and is feckless, to say the least. The latest surge higher has been based on the idea that they were going to cut rates sooner rather than later but had said just 12 days prior that they were nowhere near having conversations about that. This tells you that the central bank has lost control.

This behavior has been reinforced since the Great Financial Crisis, and there’s no reason to think that the Federal Reserve is going to do anything to upset Wall Street. Because of this, I do think we eventually go higher and it’s very likely that we try to get to the 5000 level. The 5000-level course has its psychology to deal with, but it certainly makes a nice juicy target. In the meantime, any time we pull back you have to look at it as a potential opportunity, as has been the case for what seems like a lifetime. Remember, the S&P 500 is not equally weighted, so it is not designed to fall. If it were equally weighted, the chart would look much more different. At this point, I think the 4700 level as your floor.

Ready to trade our S&P 500 monthly analysis? Here’s a list of some of the best CFD trading brokers to check out.