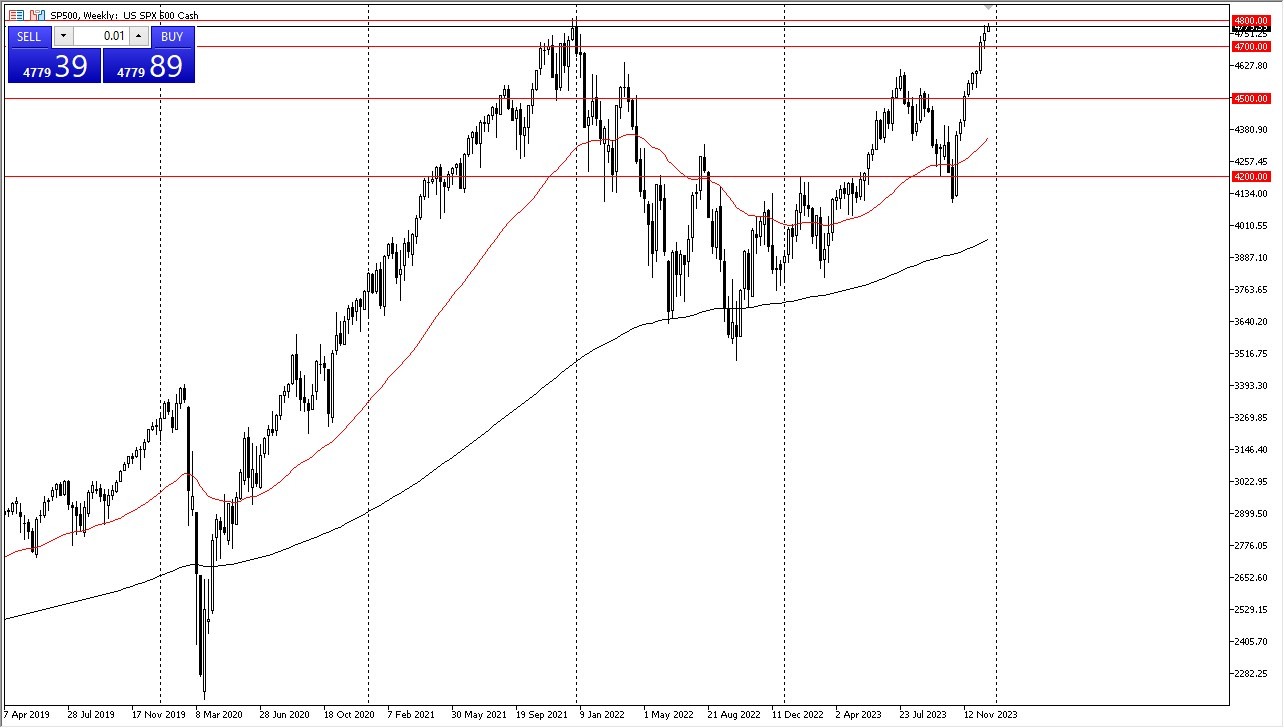

- As I look at the S&P 500 at the end of December, it’s obvious that January is set for a major showdown.

- While the market is undoubtedly a bullish one, the reality is that the insanity that is crept into the buying pressure is something that needs to be paid close attention to.

- After all, the only real question as I write this on December 27 is whether we break to a new all-time high.

- It isn’t whether you should be a buyer or seller, nor is it anything to do with economic reality, it’s whether or not we can keep up this type of momentum.

Top Forex Brokers

Eventually, Gravity Shows Up

It’s difficult for me to imagine that sometime in January we just simply take off to the outside and continue the type of euphoria that we have seen. After all, since the Halloween low, the S&P 500 has essentially gained about 16 ½%. That’s a lot for just 2 short months. Most money managers would be thrilled with that type of return for the year to put that into perspective.

Because of this, I think sometime during January we get a bit of a selloff. I don’t know if it comes before or after we break above the crucial 4800 level, but clearly, we have overdone the rally. You can see this market drop 200 points in still be in an uptrend. As a retail trader, unless you are already involved in this market you should probably wait for some type of value to present itself. What I want to see is a 10% correction, something that is quite common in the market. Unlike a money manager, you don’t have to put money to work right away at the beginning of the year, and you can simply avoid the S&P 500 in the meantime.

Do keep in mind that if you choose to simply start buying here, you are essentially playing a game of “chicken” with gravity. Eventually, it shows up in the market and pulls back. Unfortunately, I suspect that a huge number of retail traders are chasing the market up at these extraordinarily high levels. That is typically what Wall Street will do, run stock markets up like this, sell stock to the retail trader to collect profit, and then bite again once the market capitulates.

Ready to trade our S&P 500 monthly analysis? Here’s a list of some of the best CFD trading brokers to check out.