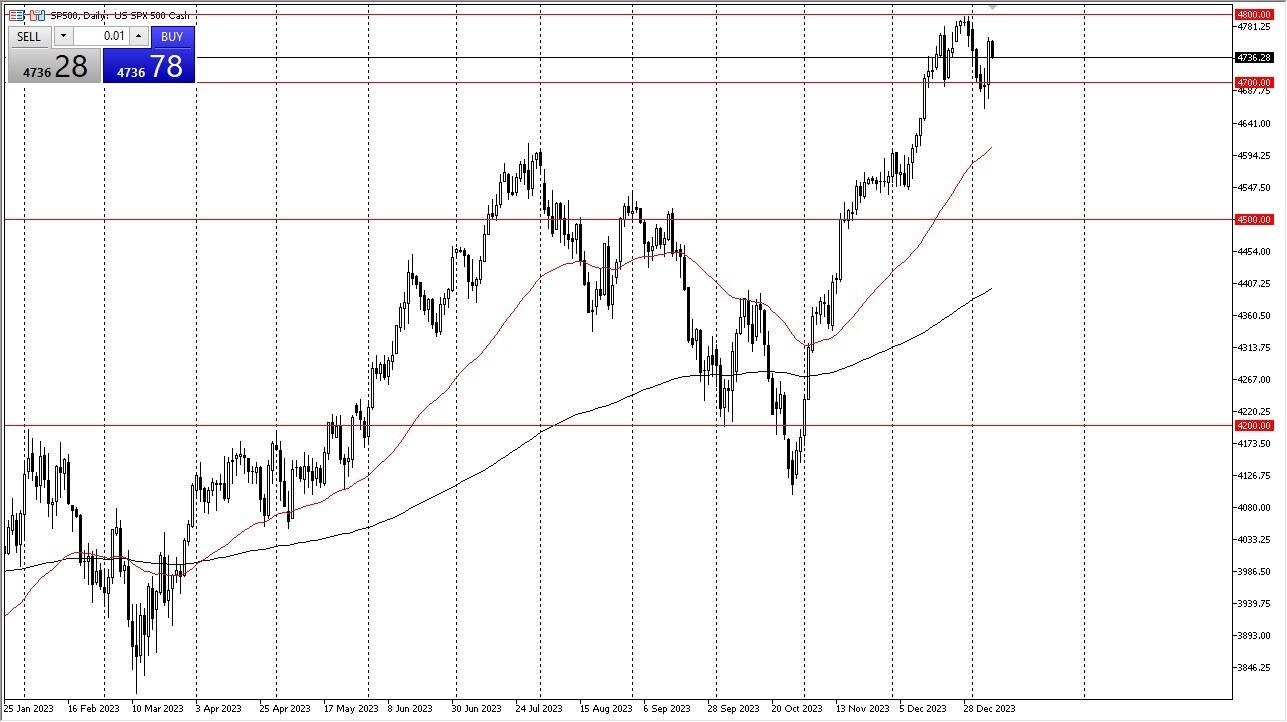

- The S&P 500 experienced a slight pullback during the early Tuesday trading session, likely in an attempt to balance out some of the excessiveness from the robust gains observed on Monday.

- Nonetheless, it appears that this could present an opportunity to buy on the dip.

- It would be somewhat surprising if the index were to fall back below the 4700 level.

Currently, it seems that there is an effort to establish a bullish flag pattern or, at the very least, form a trading range to alleviate the heightened momentum witnessed last year when the market skyrocketed without a substantial retracement. Given the absence of a significant pullback, it is reasonable to expect one sooner or later. Such a pullback, when it does occur, may provide a substantial buying opportunity, especially if interest rates in the United States decline further and the Federal Reserve decides to cut its rates.

Federal Reserve Actions and the S&P 500

In the present scenario, the focus remains on Federal Reserve actions, monetary policy, and its impact on the stock market, rather than the underlying economic conditions. This is the lens through which traders assess the likely course of monetary policy. Interestingly, bad news tends to translate into positive news for the stock market, a phenomenon observed on multiple occasions in the past. This peculiar response stems from the distortions introduced by the Federal Reserve following the financial crisis. Wall Street has grown accustomed to the availability of cheap and easily accessible funds, making it the driving force behind market movements.

Top Forex Brokers

It's crucial to bear in mind that the S&P 500 is heavily influenced by a handful of stocks, often referred to as the usual suspects. These include Tesla, Microsoft, Amazon, and others that are widely held by investors. As usual, market watchers will closely monitor the performance of these key players to gauge the direction of the index.

All in all, the longer-term outlook for the S&P 500 appears bullish, despite periodic fluctuations. The market's direction will largely hinge on the actions of the Federal Reserve, interest rates, and the behavior of the aforementioned influential stocks.

Potential Signal: There is absolutely no way I would short this market. Yes, I understand that the S&P 500 has gone straight up in the air, but I think at this point you are looking at a market that every time it dips 50 points, it’s worth picking up a small position with a 50 point stop loss and a 100 point target. I’m a buyer closer to the 4700 level, with a stop loss near 4650.

Ready to trade our free trading signals? We’ve made a list of the top 10 forex brokers in the world for you to check out.