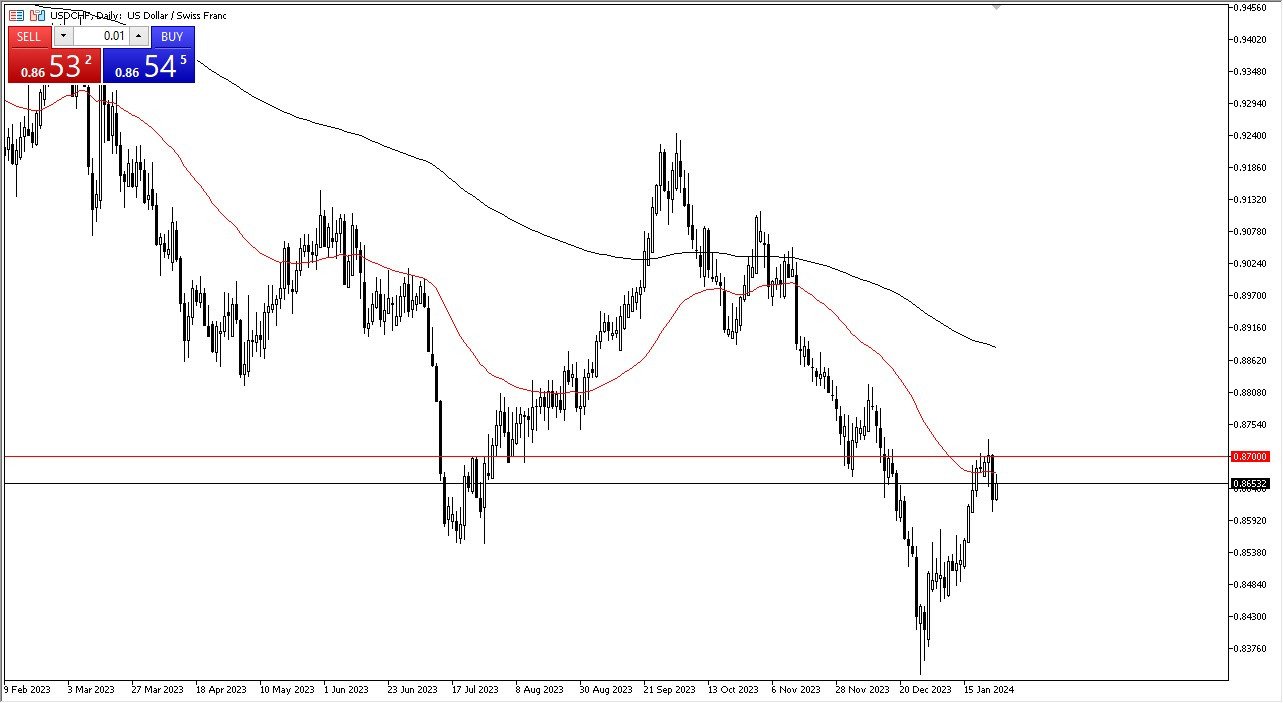

- The US dollar has rallied early on Thursday against the Swiss franc to reach the crucial 50-Day EMA indicator.

- Although there, then we have the 0.87 level that has offered a significant amount of resistance over the last 48 hours, so it’ll be interesting to see if we can break above there.

- If we can break above the neutral candlestick from the Tuesday session, then it is likely that the US dollar will continue to recover against the Swiss franc.

The Swiss National Bank

One thing is for sure, the Swiss National Bank does not care if the Swiss franc starts to depreciate, and quite frankly won’t get in the way. In fact, you can make an argument that perhaps they have been stealthily intervening in the currency markets, because they have been known to do that in the past. Whether or not that actually is the case remains to be seen but right now, it doesn’t even matter. We have bounced from a major support region on the monthly timeframe, so I think we are in the midst of trying to turn things around. The Swiss franc has been extraordinarily strong for some time and is now starting to give back some of those gains, not only against the US dollar, but against the other major currencies.

Top Forex Brokers

If we were to turn out a breakdown below the 0.86 level, then it opens up the possibility of a move down to the 0.85 level. 0.85 level is a large, round, psychologically significant figure that also offered resistance in the past, so it could very well be an area of interest. Either way, the USD/CHF pair is probably going to end up being rather choppy, but that’s nothing new for this pair as it does tend to move somewhat slowly. However, the one thing that I can say about this market is that it does tend to trend in one direction for a very long time. Because of this, if we are in the midst of turning around for a bigger move, it could be rather messy and it could take quite a few attempts.

Potential Signal

I believe this market might be in the midst of turning around for a bigger move. If we can break above the 0.8725 level, then I would be a buyer, aiming for the 0.8850 level in the short-term. The stop loss would be near the 0.8630 level.

Ready to trade our daily Forex signals? Here’s a list of some of the top 10 forex brokers in the world to

check out.