The US dollar faced a decline against the Japanese yen in response to the weaker-than-expected Producers Price Index (PPI) data during the Friday trading session. Despite this setback, there are several crucial factors to consider in the USD/JPY currency pair.

- Initially, the US dollar attempted to rally against the Japanese yen but ultimately reversed course, showing signs of negativity.

- This reversal was exacerbated by the PPI numbers, which turned out to be cooler than anticipated.

- It's important to note that this market still has substantial support levels beneath it.

Over time, there remains the possibility of a buying opportunity, primarily due to the significant interest rate differential between the two currencies. While the Bank of Japan may eventually need to normalize rates to protect their currency, they have historically been more talk than action.

This currency pair is highly sensitive to movements in the bond markets. Therefore, it is imperative to closely monitor changes in interest rates in the United States. Simultaneously, attention must be paid to any potential actions by the Bank of Japan regarding their rates. The USD/JPY market is known for its inherent volatility, a characteristic that prevails.

Top Forex Brokers

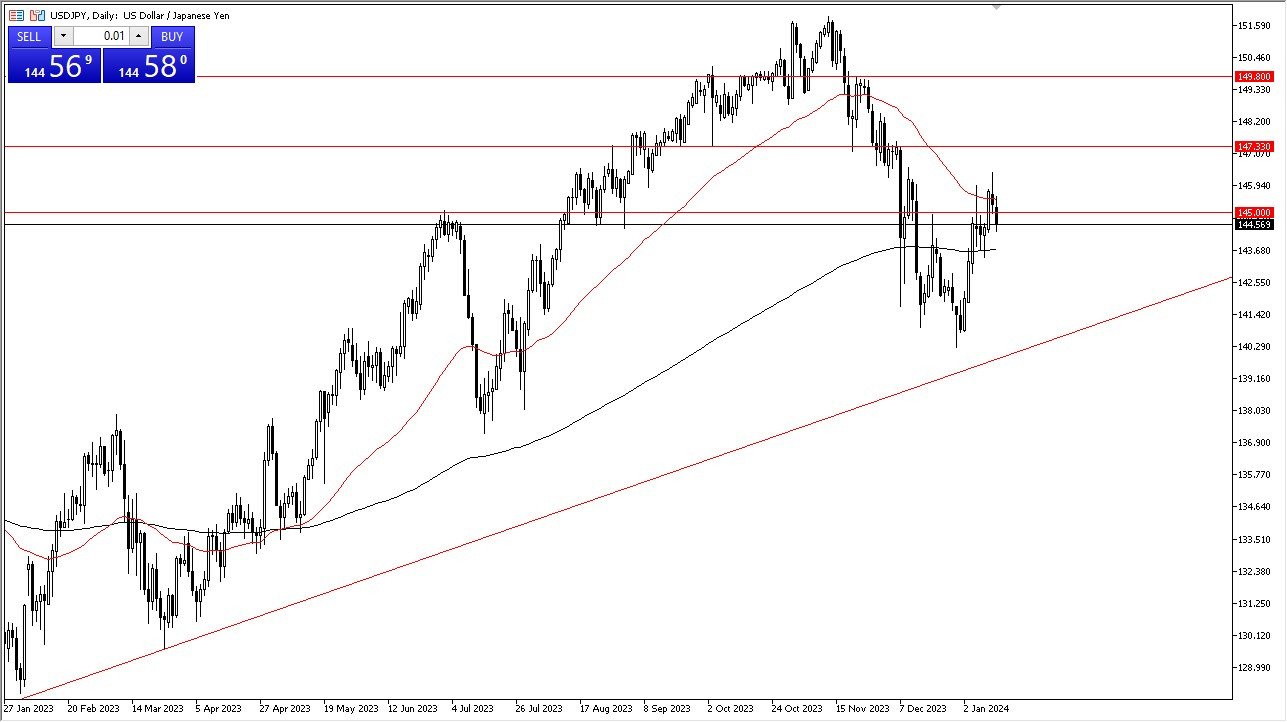

200 Day EMA Below

The 200-day Exponential Moving Average is expected to provide substantial support in this market. However, whether or not it is achieved depends on future developments. A reversal leading to the recapture of the 145 yen level on a daily close could signal renewed buying interest and an upward push. Additionally, surpassing the highest point of Friday's candlestick would be a bullish sign, potentially targeting the 147.33 yen level.

In the event of a breakdown below the 200-day EMA, the market could descend to the 142 yen level and potentially even to the 140 yen level. It is crucial to emphasize that a drop below 140 would be considered highly negative.

At the end of the day, the USD/JPY currency pair experienced a downturn in response to the weaker PPI data. However, the market retains underlying support factors, and the potential for buying opportunities remains. The dynamics of this market are influenced by interest rates in the United States and the actions of the Bank of Japan. Traders should exercise caution and closely monitor key price levels to make informed decisions in this volatile market.

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.