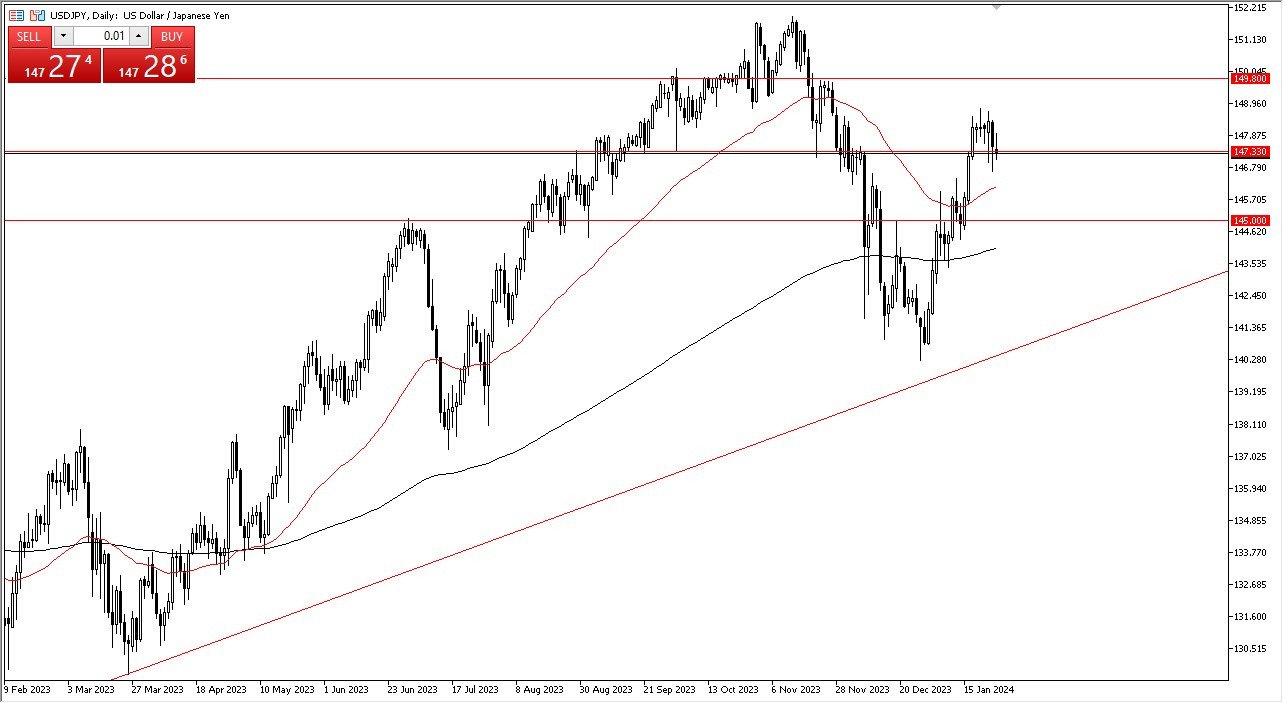

- The US dollar has gone back and forth during the trading session on Thursday as we are hanging around the crucial ¥147.33 level.

- This is an area that has been imported multiple times in the past, and therefore it’s likely that we will continue to see a lot of choppiness.

- The market has sold off in the last couple of days, only to turn back around, so it’ll be interesting to see how that plays out.

- Underneath, we also have the 50 day EMA breaking above the ¥146 level and rising.

- All things being equal, I think this is a situation where buyers will come in on the dip.

Killing Time

At this point in time, it looks like the US dollar is going to be killing time against the Japanese yen, therefore it’s likely that we are going to continue to see questions asked as to what the Federal Reserve is going to do, but perhaps more importantly, we are going to pay close attention to the Bank of Japan. The Bank of Japan has shown itself to be uninterested in trying to tighten monetary policy, which is exactly what would have to happen in order to make the Japanese yen strengthened over the longer term. All things being equal, this is a scenario where we continue to buy the dips, because although the Federal Reserve may cut rates sometime in 2024, the reality is that the interest rate differential between these 2 currencies are wide enough to drive a truck through.

Top Forex Brokers

Underneath, I see the 50-Day exponential moving average offering a bit of support, and then of course we have the crucial ¥145 level. In general, this is a scenario where there should be plenty of value hunters out there, but even if you are not willing to trade this pair, you could use the USD/JPY pair as a bit of a barometer for Japanese Yen strength or weakness, and trade other yen related pairs based on what you see in this one. For example, the AUD/JPY pair might be what you are looking to trade, but if you see the USD/JPY pair rising, you have yet another indication that the Japanese yen is going to weaken. All things being equal, I think we are trying to sort out where we are going next but right now I think we just chop back and forth in a short-term range.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.