- Speculators of the USD/CAD should brace for a rather volatile day within the currency pair.

- Not only will Gross Domestic Product numbers be coming from Canada early today, but the U.S Federal Reserve is going to release its FOMC Statement later.

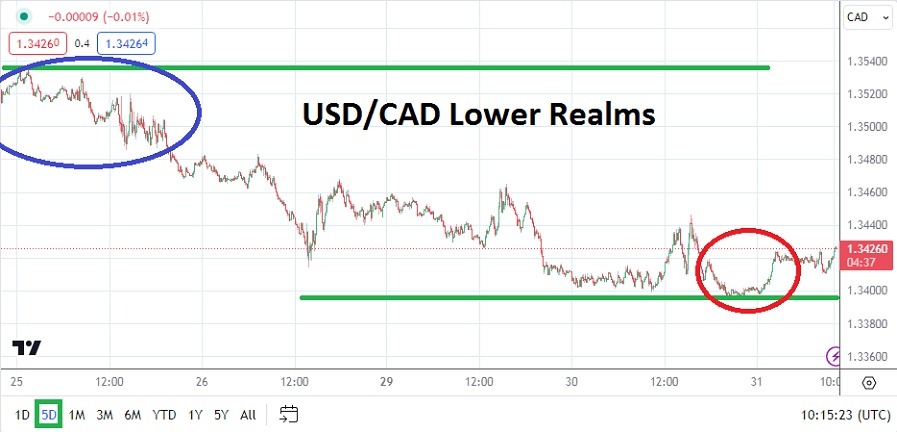

- Growth numbers from Canada are expected to be rather lackluster; the estimated 0.1% gain for today is not likely to launch a parade if it is attained. However, the past handful of days has seen the USD/CAD create a lower trend.

The current price of the USD/CAD is near 1.34300 which is close to support last tested in a sustained manner in the middle of January. The price of the USD/CAD is certainly above the lows it touched in late December near the 1.31800 vicinity, but the currency pair has been able to demonstrate downwards ability since testing a high around the 1.35435 mark on the 17th of January. Yet, trading in the USD/CAD has been choppy, because after a reversal lower from the high on the 17th, last Thursday saw another challenge upwards. The past two weeks of trading in the USD/CAD should be a warning regarding today’s potential price range.

USD/CAD Lower Momentum Holding but Likely in Question

Since coming within sight of the mid-January highs again last Thursday the downwards momentum in the USD/CAD has been noteworthy, but it might be suspicious. The USD has turned in a rather strong buying surge in January, and the USD/CAD is certainly above its late December lows. Financial institutions are going to listen to the Federal Reserve’s pronouncements later today attentively and react. But the question is after the storm of volatile trading that will be seen later today, if the price range of the USD/CAD will have taken up a new value realm?

Traders will need to be cautious as the U.S Fed’s FOMC Statement approaches today, the price range of the USD/CAD is going to grow wider and solid risk management will be needed by those who choose to participate in the currency pair. The Fed is unlikely to announce any substantial changes to its outlook today which means that volatility will create fast price velocity, but could bring the USD/CAD back to its known price range after the dust settles.

Top Forex Brokers

Standing on the Sidelines a Safer Bet for Nervous Traders

- Support near the 1.34000 should be watched today as the price range of the USD/CAD widens.

- Movement below the 1.34000 mark that is sustained may ignite speculative wagers looking for reversals higher in the short-term.

- Nervous traders may want to wait on the sidelines as the Fed announcement gets close, and wait for the central bank’s rhetoric to be digested before wagering.

Canadian Dollar Short Term Outlook:

Current Resistance: 1.34390

Current Support: 1.34220

High Target: 1.34820

Low Target: 1.33960

Ready to trade our daily Forex analysis? We’ve made a list of the best forex brokers in Canada for beginners to trade Forex worth using.