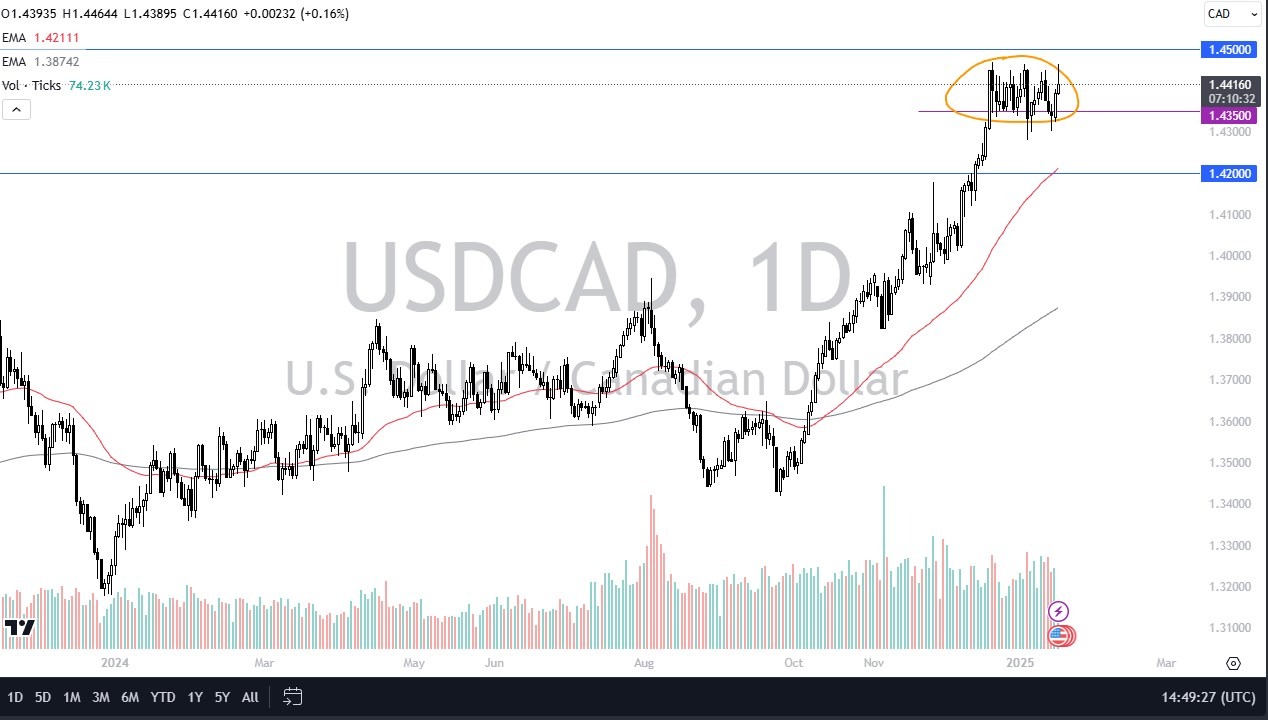

- It looks like the US dollar initially tried to rally against the Canadian dollar during the Wednesday session.

- Right around the 50-day EMA or the 200-day EMA, we have seen a lot of downward pressure.

- Furthermore, the 1.35 level above there is an area that a lot of people would be paying attention to as well as it is a large round number and an area where we have seen a lot of pressure in the past.

Keep in mind that the Canadian dollar is very highly levered to the crude oil market and the crude oil market of course is starting to show signs of life again. So, if that does end up being the case then the Canadian dollar should strengthen in general and that would include against the US dollar. In other words, if you are going to trade this market, you need to pay attention to the crude oil markets in general as they have a major influence on the Loonie itself.

Support Just Below

Top Forex Brokers

When I look at this chart, I recognize that if we can break down below the 1.34 level, it is more likely than not to send the US dollar down to the 1.32 level. It's also going to accompany quite a bit of US dollar weakness in general, I suspect. So, with that being the case, I do think it is probably only a matter of time before we could see quite a bit of momentum. In that environment, we may see a shrinking of the US dollar worldwide.

The US dollar itself looks like it's on its back right now in the early hours, and I do think that probably continues to be the case at least in the short term. After all, traders around the world expect the Federal Reserve to cut rates, and that of course works against the dollar. Rates are falling during the Wednesday session, so that's exactly what you get.

If you are a Fibonacci trader, you can perhaps take a look at the Fibonacci retracement, which right now looks like the 50% Fibonacci retracement level has held, and we are just simply falling from that. That, the fact that it was basically near the 1.35 level and a couple of major moving averages all lined up for perhaps a fall.

Ready to trade our daily Forex forecast? Here’s some of the best regulated forex brokers in Canada to check out.