- The US dollar exhibited a minor retreat against the Japanese yen as the Tuesday trading session commenced.

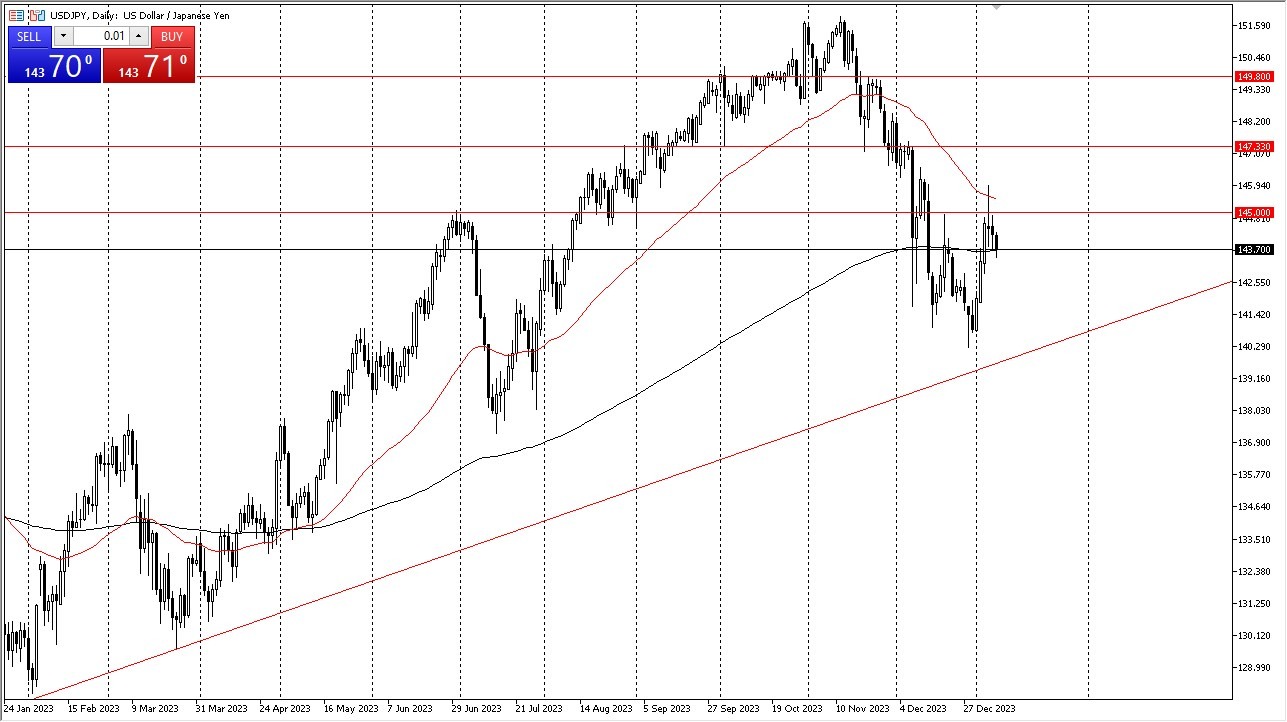

- However, it appears that the 200-day Exponential Moving Average is poised to provide a certain level of support. In this market, one can anticipate choppy conditions, making it unwise to become excessively exposed unless we witness some sustained movement.

- As it stands presently, the necessary momentum for such movement appears lacking.

Consequently, we can expect this market to continue oscillating between the 200-day EMA and the 50-day EMA positioned above it. The 145-yen level, situated midway between these averages, assumes significance as a pivotal point for the USD/JPY. It's essential to bear in mind that the trajectory of interest rates holds considerable sway over our path forward. Therefore, meticulous attention to the 10-year yield in the United States, along with a diligent observation of the correlation between these two variables, is crucial.

Bank of Japan

While the Bank of Japan has shown no inclination to tighten its monetary policy, the Federal Reserve, despite indicating potential rate cuts in 2024, will still maintain a significantly favorable interest rate differential in favor of this currency pair. Consequently, investors receive compensation for holding it, albeit at a slightly reduced rate of return on a daily basis. Over the longer term, this does add up so it’s worth paying attention to.

A potential breach above the high point of the shooting star from the Friday session could open the door to a move towards the 147.33 level. Beneath, we encounter substantial support at the 142 level, with further reinforcement at the 140 level. A breakdown below this level could trigger a significant downward movement. Nevertheless, it's worth noting that, despite the recent month's fluctuations, we technically remain within a longer-term uptrend.

Top Forex Brokers

At the end of the day, the US dollar's relationship with the Japanese yen is characterized by potential support at the 200-day EMA, amidst expectations of choppy market conditions. The 145 yen level assumes importance as a pivotal point, and attention to interest rates, particularly the 10-year yield in the US, is paramount. While the Federal Reserve hints at possible rate cuts, a positive interest rate differential persists, albeit with slightly reduced daily returns. The direction of this currency pair hinges on key support and resistance levels.

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.