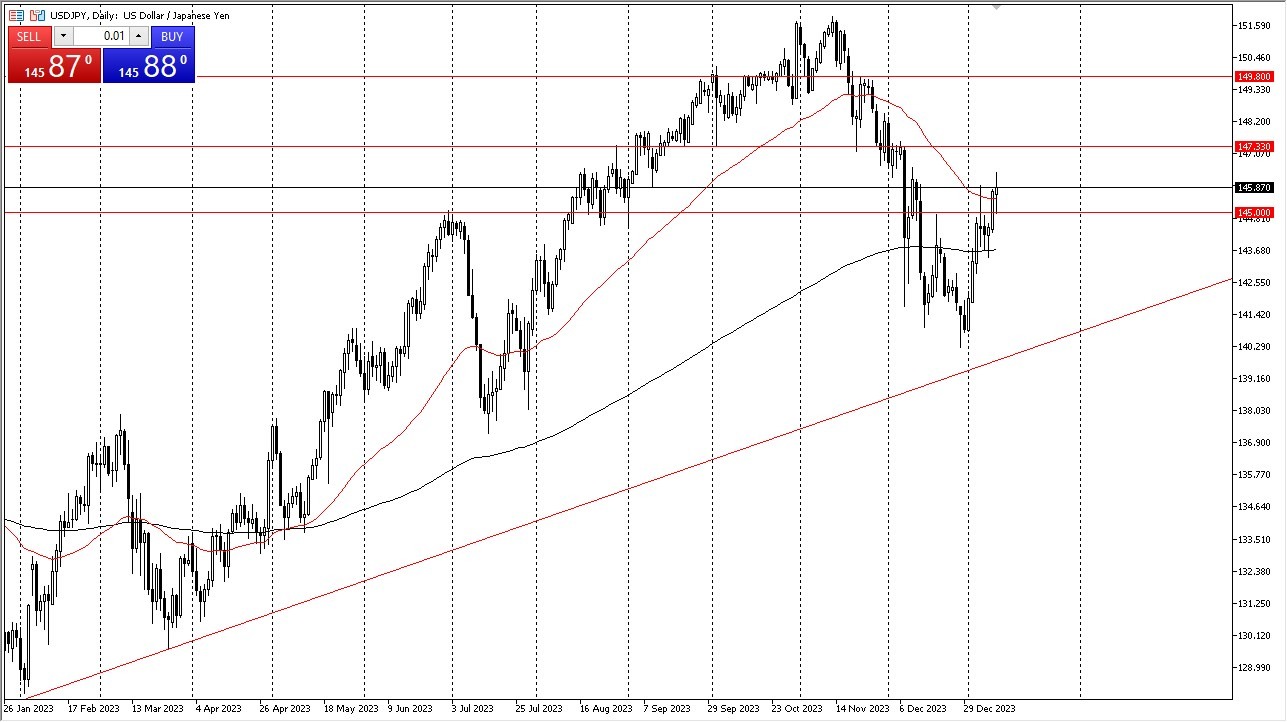

- The US dollar initially experienced a decline in its value against the Japanese yen, but it subsequently displayed signs of strength, signaling a potential continuation of the longer-term uptrend in the USD/JPY pair, there has been noticeable price volatility.

- Initially, the exchange rate retraced to the 145 yen level, where support was anticipated, and indeed, it materialized.

- The market has since exhibited renewed vigor. The next potential target appears to be the 147.33 yen level, which aligns with the prevailing interest rate dynamics favoring the US dollar.

However, it's important to recognize that this market is inherently noisy, which should not come as a surprise. Short-term pullbacks present opportunities for value-based trading strategies. The 200-day Exponential Moving Average has played a stabilizing role in the recent price action. Whether an immediate breakout will occur remains uncertain, but there are indications of a gradual recovery following a notable decline.

Moreover, it is essential to consider the context of the Bank of Japan's policy stance. The Japanese yen often experiences depreciation against most other currencies, making it susceptible to downward pressure. The Bank of Japan's reluctance to implement policy adjustments further reinforces this perception. Consequently, the yen will likely continue to be subject to depreciation relative to other currencies.

Any Downside Potential?

In terms of downside potential, if the exchange rate were to breach the 200-day EMA, one could argue for a descent towards 140 yen. However, the current market conditions do not appear to be moving in that direction. Given the prevailing dynamics, a buy-on-the-dip approach seems appropriate in trading the US dollar against the yen. This currency pair's performance remains closely tied to the interest rate differential, which remains largely in favor of the US dollar despite recent rate adjustments in the United States. The Bank of Japan's accommodative monetary policy stance is expected to exert a significant influence on the pair's future trajectory.

Top Forex Brokers

To sum up, the US dollar initially faced a decline against the Japanese yen but later exhibited signs of strength, suggesting a potential continuation of the uptrend. Short-term pullbacks offer value-based trading opportunities, with the 200-day EMA acting as a stabilizing factor. The Japanese yen remains vulnerable to depreciation due to the Bank of Japan's policy stance. While a breakdown scenario exists, current market conditions do not seem to support it. Consequently, a buy-on-the-dip strategy remains suitable, with the interest rate differential and the Bank of Japan's monetary policy stance driving the currency pair's dynamics.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.