- The US dollar experienced a significant rally against the Japanese yen in Tuesday's trading session, following the return of traders from the Martin Luther King Jr. holiday.

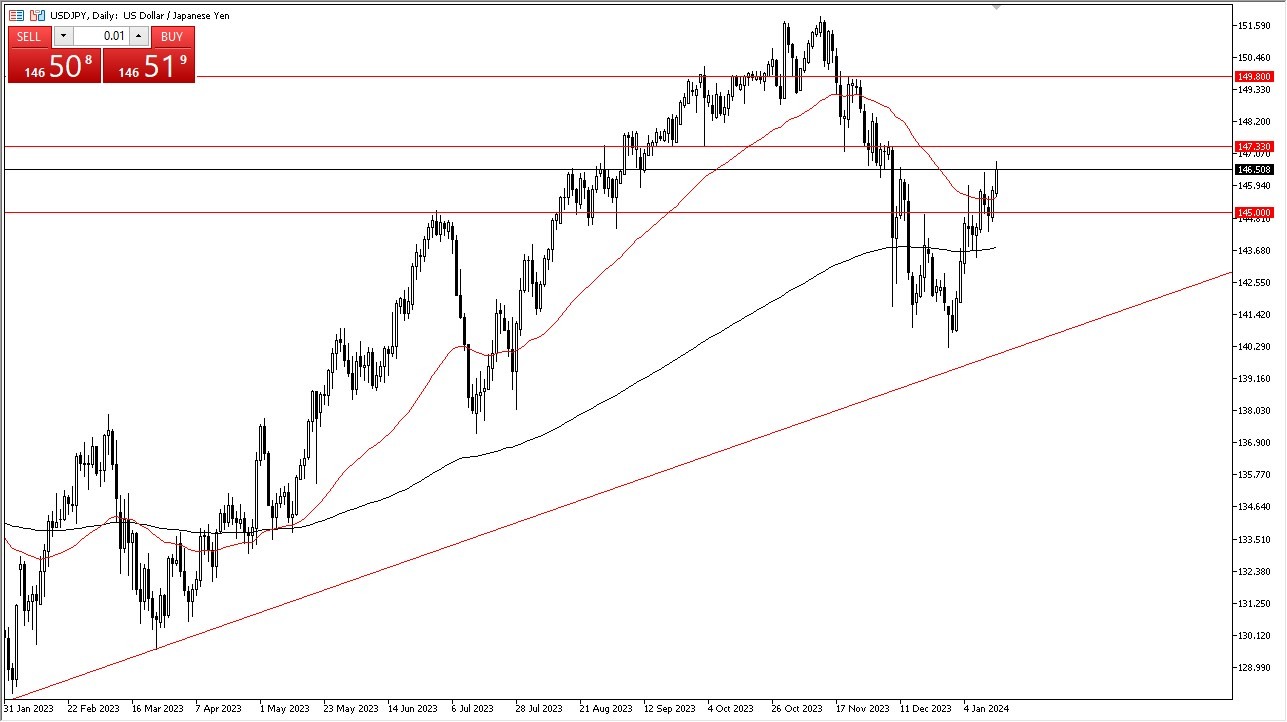

The market has been exhibiting heightened volatility as it attempts to recover from a recent sell-off. Despite this turbulence, it's worth noting that the US dollar currently stands well above both the 200-day Exponential Moving Average and the 50-day EMA. This situation has left traders contemplating their next moves. It's worth mentioning that the Empire State Manufacturing Index recently reported lower figures than anticipated, resulting in a brief sell-off. However, this is unlikely to substantially alter the course of the currency market.

The Longer-Term Outlook?

Top Forex Brokers

While the stock market may react to such news in the short term, its longer-term implications are relatively insignificant. Both the 50-day EMA and the 145 yen level underneath are expected to provide reliable support, maintaining the overall upward trajectory of the market. The market appears to be prone to sporadic reactions to the latest comments or economic announcements. However, the key driver behind this trend is the monetary policy of the Japanese central bank.

The Japanese authorities have shown no inclination to tighten their monetary policy, reinforcing the belief in the continuation of the US dollar's ascent against the yen over the long term. The projected targets are 147.33 yen and eventually 149.80 yen, although interim pullbacks may occur. This situation sets the stage for a potential "buy on the dips" scenario, where investors seize opportunities during market downturns. Despite the challenges along the way, it is likely that, given sufficient time, the market will ultimately experience further upward movement driven by a weakening Japanese yen, possibly unrelated to the US dollar's performance.

At the end of the day, the US dollar has made significant gains against the Japanese yen in Tuesday's trading session. The market's recent turbulence is primarily a response to the recovery from a previous sell-off. Notably, the US dollar price maintains a strong position above key moving averages. While short-term reactions to economic news may occur, the broader trend is influenced by the Japanese central bank's monetary policy stance. Expectations of a weaker yen in the long term support the notion that the US dollar will continue to rise, with potential opportunities to buy during dips in the market.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading accounts worth trading with.