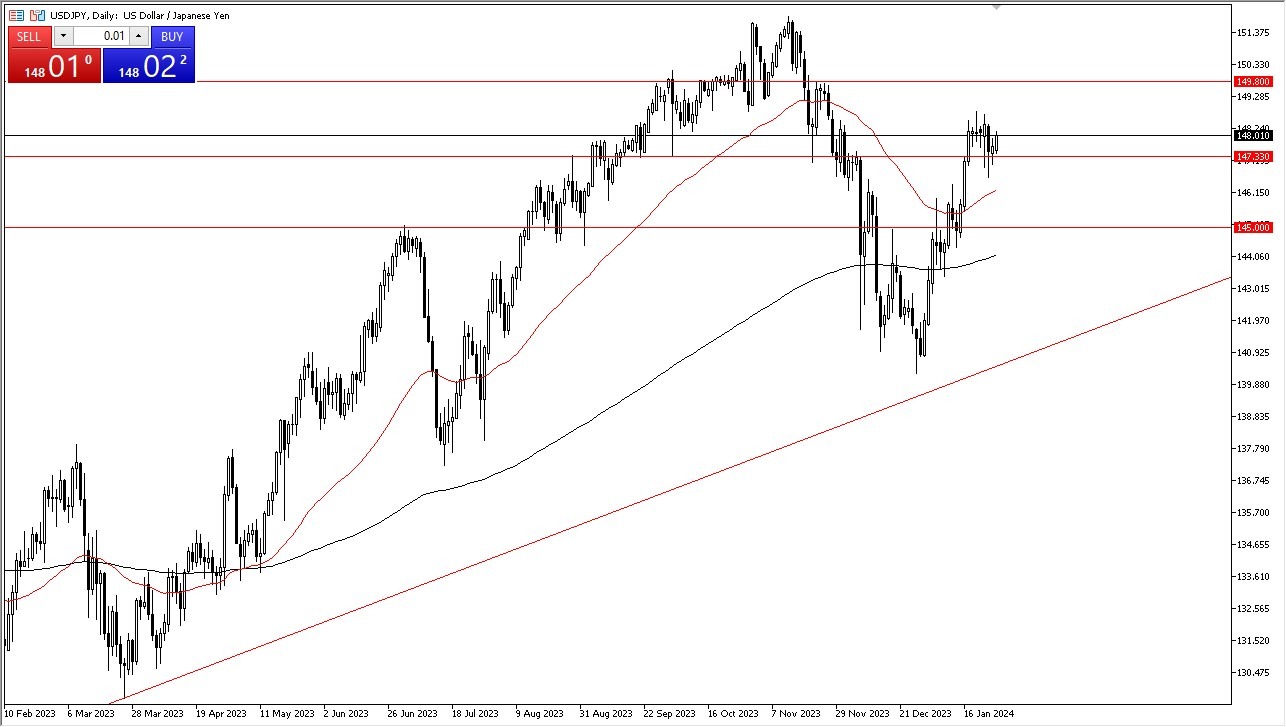

- The US dollar rallied a bit during the trading session on Friday as the ¥147.33 level continues to offer a significant amount of support.

- All things being equal, I think short-term pullbacks are nice buying opportunities as the interest rate differential between the US dollar and the Japanese yen continues to power this market higher.

- Underneath, the 50-Day EMA shows quite a bit of support just above the ¥146 level, and if we can stay above there, then it’s likely that the US dollar will continue to show a lot of momentum to the upside.

The ¥148.50 level has offered a significant amount of resistance previously, and if we were to break the barrier, it would open up a move to the ¥149.80 level. That’s an area where we have seen a lot of selling pressure previously, so it does make a nice target. A certain amount of “market memory” could come into the picture. Breaking above that opens up the possibility of a move to the ¥152 level.

Top Forex Brokers

Interest Rate Differential Continues to Be the Driver

The interest rate differential will continue to be the driver in the fact that the Bank of Japan flinched when it was given an opportunity at the interest rate decision to suggest tightening monetary policy shows just how feckless the Bank of Japan is going to be and questions now arise as to whether or not the Federal Reserve will listen monetary policy. It’s not so much that they would make cuts in 2024, but it has more to do with the fact that they may not cut as much as people thought, and they certainly won’t cut anywhere near enough to reach the level where the Japanese are right now.

Remember, you continue to get paid to hold onto this pair, so every time it dips, I suspect that there will be value hunters willing to get involved. It might be volatile at times, but at the very least I look at this as a chart that you should be paying close attention to in order to trade yen denominated markets around the world. If the yen starts to lose momentum against the US dollar again, it will certainly lose quite a bit against other more dynamic currencies such as the commodity market based currency such as the CAD/AUD/NZD/ZAR and the like.

Ready to trade our daily Forex analysis? We’ve made a list of the best online forex trading platform worth trading with.