- The US dollar has been exerting upward pressure on the Japanese yen in recent trading sessions.

- Investors are eagerly awaiting the Federal Open Market Committee (FOMC) meeting scheduled for Wednesday, as it is expected to have a significant impact on the currency market.

- The direction of the USD/JPY pair will be closely tied to the developments in the interest rate markets.

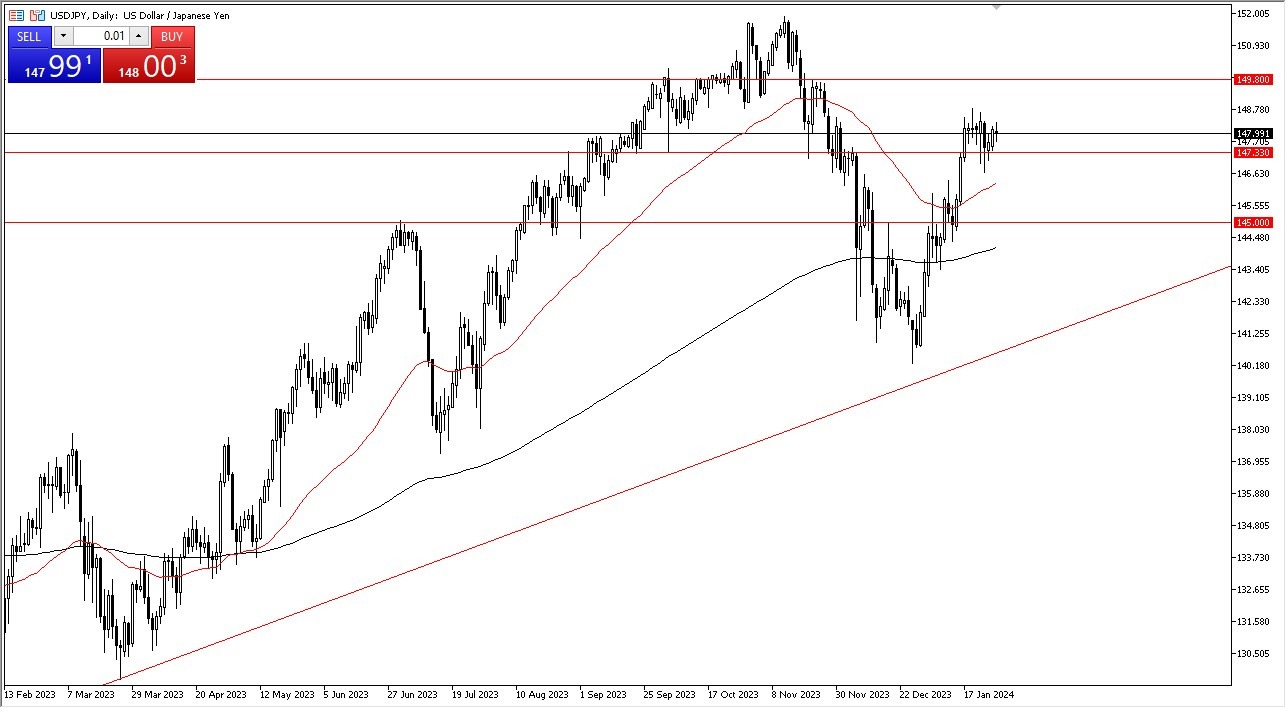

Looking at the USD/JPY chart, it becomes evident that the market has been characterized by choppy and indecisive price movements. This erratic behavior reflects the uncertainty among traders, who seem uncertain about their next moves. It is not surprising that investors are cautious, given the impending FOMC meeting. Many are adopting a wait-and-see approach, anticipating further clarity from the central bank.

One key technical indicator to monitor in this market is the 50-day Exponential Moving Average. Currently, it suggests an inclination towards higher prices. However, the real turning point for the USD/JPY pair will likely hinge on the statements made by Jerome Powell, the Chair of the Federal Reserve, during the post-meeting press conference. This will be the biggest factor this week from what I see.

Interest Rate Differential is the Driver

Top Forex Brokers

The primary driver of the USD/JPY exchange rate remains the interest rate differential between the United States and Japan. If the Federal Reserve maintains its current stance and does not take any unexpected actions, the market is poised to push towards the 149.80 yen level in the near term. However, a breach below the 50-day EMA could trigger a downward move, potentially leading the pair down to the 145 yen level, where the 200-day EMA is converging.

In general, the prevailing sentiment suggests a bullish outlook for the USD/JPY pair, barring any unforeseen surprises from the Federal Reserve during its Wednesday meeting. It appears unlikely that the Fed will opt for a rate cut at this juncture. Meanwhile, the Bank of Japan remains entrenched in its accommodative monetary policy, keeping its currency less attractive for investors.

Ultiamtely, the USD/JPY currency pair is navigating a period of uncertainty as traders await the FOMC meeting's outcome. The market is likely to continue responding to interest rate differentials between the US dollar and the Japanese yen. Unless the Federal Reserve unexpectedly alters its course, the prevailing sentiment leans towards a stronger US dollar against the yen.

Ready to trade our daily Forex forecast? Here’s a list of some of the best online forex trading platforms to check out.