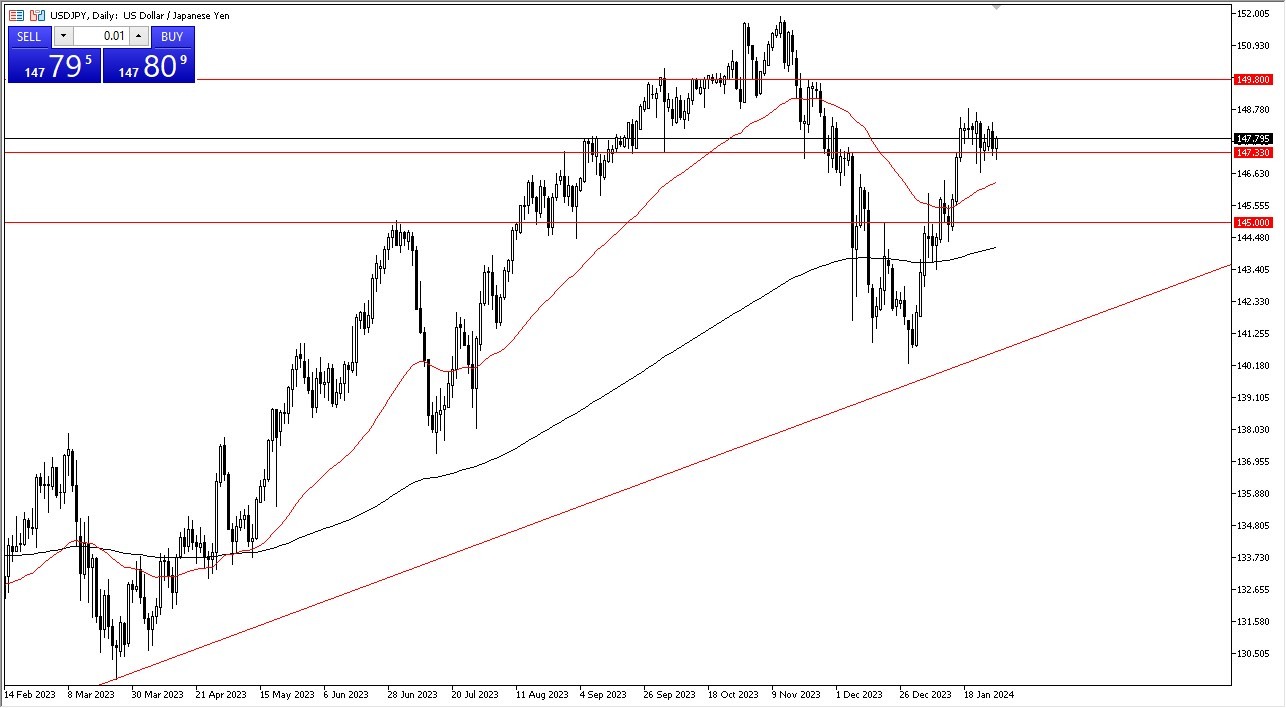

- The US dollar initially experienced a decline against the Japanese yen on Tuesday, but later rebounded from a well-established support level.

- As we approach the Federal Open Market Committee (FOMC) meeting scheduled for Wednesday, the USD/JPY pair demands close attention in the aftermath of the ensuing press conference.

During the trading session, the dollar-yen pair exhibited a minor retracement. Presently, it appears that the market is engaged in a sideways movement, working to dissipate some of the recent momentum. This indicates that the prevailing sentiment remains relatively consistent. Looking forward, it is challenging to anticipate any substantial changes within the next 24 hours. Unless Jerome Powell delivers an unexpected shock to the market, the outlook is likely to remain unaltered. Broadly speaking, the US dollar continues to hold an advantageous position over the Japanese yen.

However, the looming FOMC meeting, alongside the accompanying statement and, perhaps more notably, the ensuing press conference on Wednesday, will demand careful scrutiny. Market participants will be keen to assess the Federal Reserve's stance on potential interest rate cuts in 2024 and the degree of aggressiveness they may employ.

Beneath the current market dynamics, we find the 50-day Exponential Moving Average, which could offer substantial support. Resistance levels can be identified at 149 yen, followed by 149.80 yen. Even in the event of a breakdown below the 50-day EMA, there appears to be ample support around the 145 yen level, extending possibly down to the 200-day EMA.

Top Forex Brokers

Overall, the USD/JPY market maintains a general inclination towards an upward trajectory. This sentiment is primarily driven by the fact that the Bank of Japan shows no signs of tightening its monetary policy, consequently causing the Japanese yen to weaken. Whether one chooses to short the yen against the US dollar or other currencies is a subjective decision. However, the prevailing consensus points towards a broader trend of yen-denominated pairs moving higher. Despite anticipated volatility over the next 24 hours, the underlying sentiment suggests that even in the event of a breakdown, it would likely present a favorable buying opportunity grounded in perceived value.

In the end, the US dollar's performance against the Japanese yen is poised for close observation following its initial dip and subsequent rebound. As we approach the FOMC meeting and press conference, market dynamics may experience fluctuations, yet the broader sentiment remains favorably inclined towards the US dollar in comparison to the Japanese yen.

Ready to trade our Forex daily analysis and predictions? Here are the best regulated trading brokers to choose from.