- The US dollar made a swift ascent above the 145 yen level on Friday, fueled in part by a stronger-than-anticipated jobs report that provided some momentum to the move.

- However, it's important to maintain a realistic perspective, as expecting an uninterrupted upward trajectory may be overly optimistic.

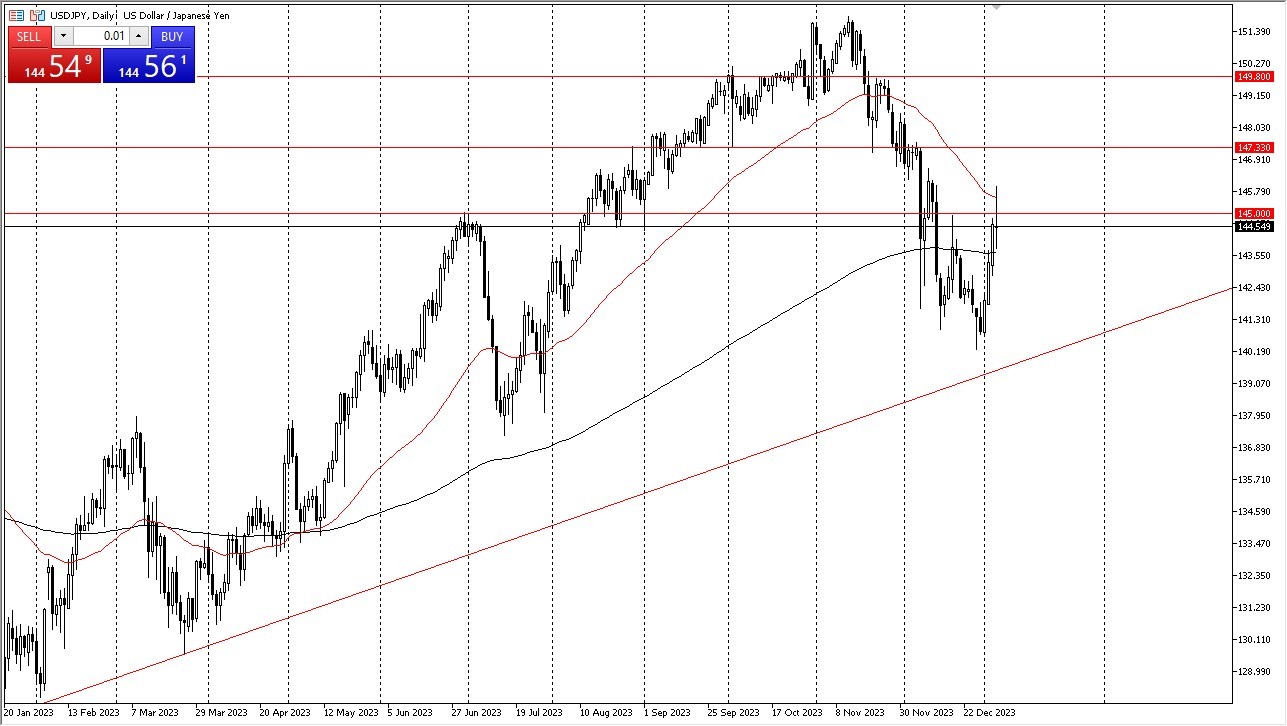

- Market dynamics have already shown resistance to remaining above the 145 yen level, and the presence of the 50-day Exponential Moving Average introduces some selling pressure.

Additionally, there are indications that the USD/JPY may be overextended, particularly in the short term. The market's current position, sandwiched between the 50-day EMA and the 200-day EMA indicators, underscores the existing uncertainty in this range. Over time, a more substantial move may materialize, but the current environment does not appear conducive to such a development. However, a breakout above the highest point of Friday's candlestick would be a notably bullish signal and could propel the US dollar toward the 147.33 yen level or potentially higher.

Conversely, a breakdown below the 200-day EMA could trigger a decline, potentially bringing the dollar back to the 142 yen level. The direction of the 10-year yield in the United States will play a significant role in determining the next course of action. Rising yields in the US tend to drive the dollar higher against the Japanese yen. It's essential to keep in mind that the Bank of Japan has been cautious about raising interest rates and is unlikely to do so shortly.

Reasonable Position capsizing is Paramount

To navigate this market effectively, it is advisable to maintain a reasonable position size. Additionally, it's crucial to be aware that full market liquidity typically returns in early January's second week, and during this transitional period, position traders may introduce substantial volatility by injecting significant amounts of capital into the market.

Top Forex Brokers

At the end of the day, the US dollar swiftly surpassed the 145 yen level on Friday, buoyed by a robust jobs report. However, a sustained upward trajectory faces challenges, with the 50-day EMA introducing resistance and indications of potential overextension. The current market position suggests a degree of uncertainty, and while a significant move may emerge in the future, the immediate environment does not favor such developments. Monitoring the direction of the 10-year yield in the US will be crucial, and prudent position management is essential, given the potential for increased volatility during the return of full market liquidity in early January.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.