The difference between success and failure in Forex / CFD trading is highly likely to depend on which assets you choose to trade each week and in which direction, and not on the methods you might use to determine trade entries and exits.

When starting the week, it is a good idea to look at the big picture of what is developing in the market as a whole and how such developments are affected by macro fundamentals, technical factors, and market sentiment.

Read on to get my weekly analysis below.

Fundamental Analysis & Market Sentiment

I wrote in my previous piece on 14th January that the best trade opportunity for the week was likely to be:

- Long of the EUR/USD currency pair following a daily close above $1.1000. This did not set up.

- Long of the NASDAQ 100 Index following a daily close above 17000. This did not set up during the week as only Friday’s close was above 17000.

- Long of Cocoa Futures. This produced a win of 5.67%.

The overall result was a gain of 5.67% which comes to a gain of 1.89% per asset.

Last week saw much stronger directional volatility in the Forex market, with most currencies fluctuating by more than 1%. There was important action in stock markets, especially in the US and Japan. The end of last week saw new all-time high prices reached by the benchmark S&P 500 Index and the Nasdaq 100 Index. The Japanese Nikkei 225 Index made a new 34-year high price.

This rise in stock markets occurred despite the CME’s FedWatch tool showing strongly lowering expectations of a March rate cut by the Federal Reserve. Markets were bearish earlier in the week but made a very strong rally on Friday, getting a tailwind from lowering US Preliminary UoM Inflation Expectations at 2.9%. However, this strongly bullish movement does not seem to be data-driven, at least in terms of major economic or central bank data releases.

The Forex market was against dominated by action in the US Dollar and the Japanese Yen, with the Dollar the strongest major currency as its treasury yields rose in tandem with lowering rate cut expectations. It seems comments from FOMC members in recent days talking down rate cuts were effective. The British Pound and the Euro were the only major currencies apart from the US Dollar that made any gains over the week, possibly due to relatively hawkish expectations continuing for the monetary policies of their central banks due to persistent inflation especially in the UK.

There were several other important economic data releases last week:

- US Retail Sales – stronger than expected, showing a monthly increase of 0.6%.

- UK (CPI) inflation – was expected to fall slightly to 3.8% but rose slightly to 4.0%.

- Canadian CPI (inflation) – as expected, showing a monthly contraction by 0.3%.

- UK Claimant Count Change (Unemployment Claims) – almost as expected.

- US Preliminary UoM Consumer Sentiment – this came in much higher than expected, suggesting consumer demand in the USA remains very buoyant.

- US Empire State Manufacturing Index – much worse than expected.

- US Unemployment Claims - almost as expected.

- UK Retail Sales – much worse than expected, showing a monthly contraction of 3.2% when only 0.5% was expected.

- Australian Unemployment Rate – unchanged, as expected.

- Chinese Industrial Production – a little higher than expected.

The Week Ahead: 22nd January – 26th January

The most important items over the coming week will probably be the central bank policy meetings, with the Bank of Japan meeting on Tuesday, the Bank of Canada on Wednesday, and the European Central Bank on Thursday. However, none are expected to make any changes to their interest rates.

Other major economic data releases this week will be:

- US Core PCE Price Index

- US Advance GDP

- UK, German, French Flash Services & Manufacturing PMI

- New Zealand CPI (inflation)

- US Unemployment Claims

Friday will be a public holiday in Australia.

Monthly Forecast January 2024

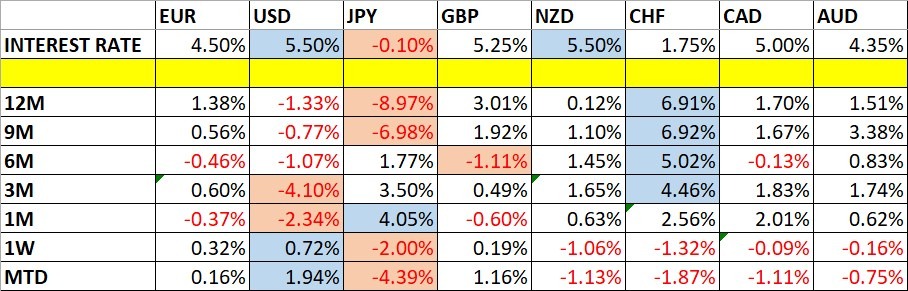

Let us look at the relevant data of currency price changes and interest rates to date, which I compiled using a trade-weighted index of the major global currencies:

For the month of January, I forecasted that the EUR/USD would rise in value, and that the USD/JPY currency pair would fall in value. The performance of this forecast so far is:

Weekly Forecast 14th January 2024

Last week, I made no weekly forecast, as there were no strong counter-trend price movements in any currency crosses, which is the basis of my weekly trading strategy.

I again made no forecast this week.

Directional volatility in the Forex market increased last week with 57% of the most important currency pairs fluctuating by more than 1%. Volatility is likely to remain at a similar level over the coming week, or maybe decrease a little if it changes.

Last week was dominated by relative strength in the US Dollar, and relative weakness in the Japanese Yen.

You can trade my forecasts in a real or demo Forex brokerage account.

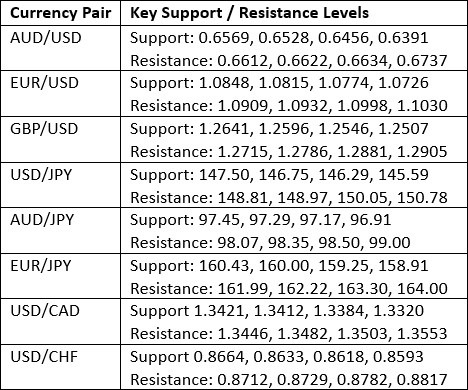

Key Support/Resistance Levels for Popular Pairs

I teach that trades should be entered and exited at or very close to key support and resistance levels. There are certain key support and resistance levels that can be monitored on the more popular currency pairs this week.

Technical Analysis

US Dollar Index

The US Dollar Index printed a bullish candlestick last week, which displays some bullish momentum despite the presence of some upper wick on the candlestick. However, the weekly close was down on the price of 3 months ago but up on the price of 6 months ago, presenting a mixed long-term trend.

It should be noted there is an additional bullish factor: the key resistance level at 102.57 was invalidated.

Due to this mixed technical picture, I cannot take a position on the US Dollar as a trend trader, so trading Forex this week it will probably be best to take a short-term, opportunistic approach based upon day-to-day sentiment, while relying on strength or weakness in other currencies beyond the greenback.

NASDAQ 100 Index

The NASDAQ 100 Index rose powerfully at the end of last week to reach and close at new all-time highs. This happened at the same time as the broader-based benchmark S&P 500 Index also broke to a new record high for the first time in two years.

The weekly candlestick is large and very bullish, closing right on its high.

This bullishness in US stock markets is a little strange as it comes at the same time as short-term US treasury yields and the US Dollar are rising in value, while expectations of a rate cut by the Federal Reserve in March are falling. These factors typically weaken US stock markets. It may be that the US economy is just looking so much more impressive than its competitors right now, that an inflow of foreign investment is coming into the US stock market.

The technical picture is wholly bullish. I wrote last week that I was looking to buy a breakout beyond 17000 which has now happened, so I see the NASDAQ 100 Index as a buy now.

S&P 500 Index

The S&P 500 Index rose powerfully at the end of last week to reach and close at new all-time highs. This was the first time this has happened in two years.

The weekly candlestick is large and very bullish, closing right on its high.

This bullishness in US stock markets is a little strange as it comes at the same time as short-term US treasury yields and the US Dollar are rising in value, while expectations of a rate cut by the Federal Reserve in March are falling. These factors typically weaken US stock markets. It may be that the US economy is just looking so much more impressive than its competitors right now, that an inflow of foreign investment is coming into the US stock market.

The technical picture is wholly bullish. A first break to a fresh all-time high has historically generated an advance of a median 13% over the next year, so traders and investors should be seriously considering going long here. I prefer the NASDAQ 100 Index as it has historically produced even higher returns since its inception in 1985.

EUR/USD

I had expected the level at $1.0848 might act as support in the EUR/USD currency pair last week, as it had acted previously as both support and resistance. Note how these “role reversal” levels can work well. The H1 price chart below shows how the price rejected this level just before the close of last Wednesday’s London session with an inside bar, marked by the up arrow in the price chart below signaling the timing of this bullish rejection. This took place during the London / New York session overlap which can be a great time of day to trade Forex. This trade was profitable, giving a maximum reward to risk ratio of almost 2 to 1 so far based upon the size of the entry candlestick structure.

AUD/USD

I had expected the level at $0.6528 might act as support in the AUD/USD currency pair last week, as it had acted previously as both support and resistance. Note how these “role reversal” levels can work well. The H1 price chart below shows how the price rejected this level just before the close of last Wednesday’s London session with an inside bar, marked by the up arrow in the price chart below signaling the timing of this bullish rejection. This took place during the London / New York session overlap which can be a great time of day to trade Forex. This trade was profitable, giving a maximum reward to risk ratio of almost 3 to 1 so far based upon the size of the entry candlestick structure.

USD/JPY

After printing an indecisive doji candlestick over the previous week, last week saw a strong advance by this currency pair, whose high volatility shows it is at the centre of the Forex market now. The US Dollar was the week’s major gainer, while the Japanese Yen was the week’s major loser.

Although the US Dollar Index gained overall last week, what we see here has a lot to do with the relative weakness of the Japanese Yen. A few weeks ago, markets were starting to expect a major shift in monetary policy would likely begin at the Bank of Japan, but its implementation was delayed due to insufficient monetary conditions. This caused the Yen to begin weakening again as a kind of rebound reaction to that.

The high volatility here could make this currency pair attractive to day traders, but with an unclear long-term trend in the greenback, traders should be ready to look for short trades as well as long ones. However, overall, long trades probably will be more attractive due to the weakness of the Yen.

Cocoa Futures

Cocoa futures have been in a strong bullish trend for over a year and last week the price again advanced very strongly last week to reach a new multi-year high price. The price chart below applies linear regression analysis to the past 69 weeks and shows graphically what a great opportunity this has been on the long side.

The weekly candlestick was a larger bullish candlestick which closed near its high at a multi-year high closing price.

Despite the recent sharp dip, this strong trend shows no true sign of stopping. There is an ever-increasing global demand for this superfood cocoa and supply has been stretched over recent months.

Trading commodities long on breakouts to new 6-month highs has been a very profitable strategy over recent years, so I see this as a buy. However, it is worth noting that the price is outside the linear regression channel, so it may be worth waiting for a dip to buy if you are a more cautious trader.

Bottom Line

I see the best trading opportunities this week as:

- Long of the NASDAQ 100 Index.

- Long of Cocoa Futures.

Ready to trade our Forex weekly forecast? Here’s a list of some of the best Forex trading platforms to check out.