- The West Texas Intermediate Crude Oil market has been volatile during the month of January, but in the end looks as if there are buyers underneath willing to pick it up.

- This makes a certain amount of sense to me because it had fallen so hard and therefore it does make a certain amount of sense that people are willing to step in.

- Furthermore, we have a lot of questions to ask about why the crude oil markets fell, and whether or not we are going to try to find some type of range for the year, something that I think is true for most financial markets.

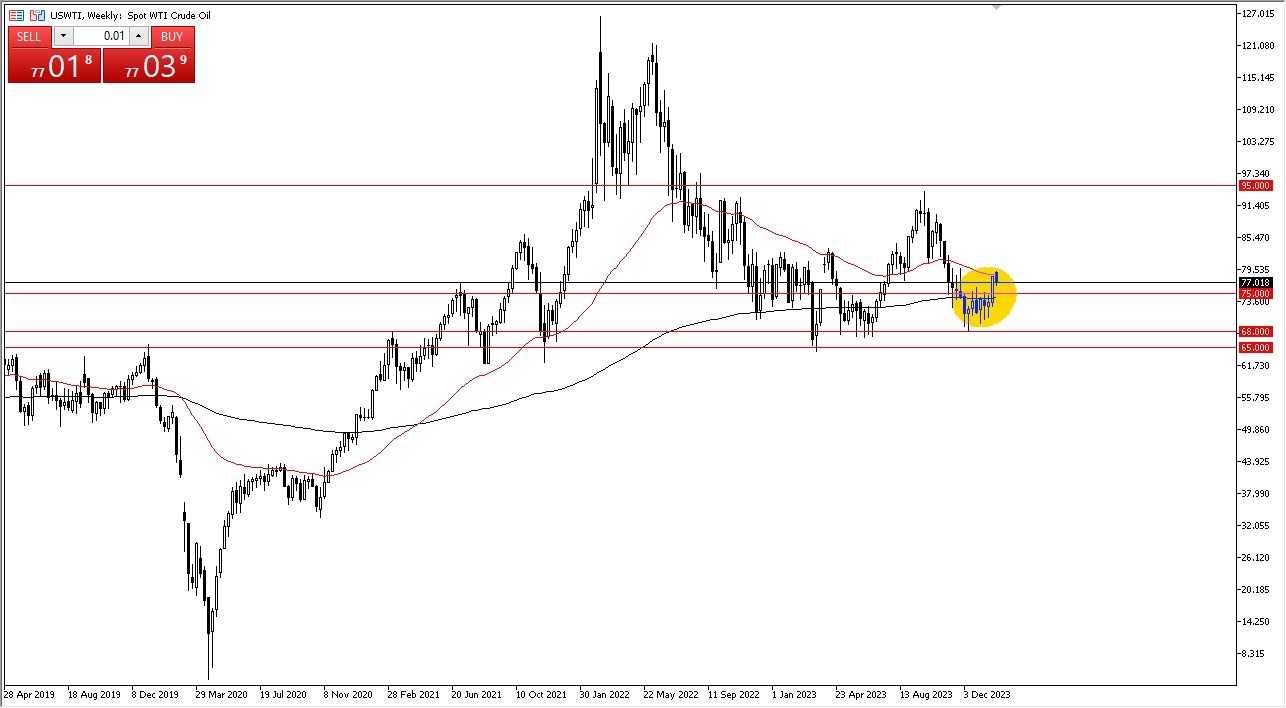

Underneath, the 200-week EMA comes into the picture as support sitting just below the $75, which of course is a large, round, psychologically significant figure. I think that there is quite a bit of support down to the $68 level, so anywhere between here and there is probably only a matter of time before buyers come in and get involved. That being said, I’d be a bit surprised to see the market drop down to the $68 level.

Supply Has Been a Concern

Top Forex Brokers

Supply has been a concern, but at the same time we have to ask questions as to whether or not the situation is going to change anytime soon, and I do think that will be the case because central banks around the world are going to be loosening monetary policy. In other words, that should drive up industrial demand for energy and industrial movement overall. Furthermore, we also have to worry about the noise coming out of the Middle East.

There have been attacks in the Red Sea, and of course various US military bases, suggesting that perhaps the conflict is going to expand in the Middle East, which obviously has its influence on the crude oil markets. If the US dollar starts to fall, that can also send oil higher, and it’s probably worth noting that the $68 level underneath is the beginning of massive support where we have seen the market bounce multiple times in the past.

On the other hand, if we can break above the $80 level on a daily close, it’s likely that we could go looking to the $85 level, perhaps even the $90 level after that. I think you are looking for short-term buying opportunities, and simply writing out the volatility.

Ready to trade our WTI Crude Oil forecast for the coming month? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.