- The Australian dollar has done very little during the trading session on Monday, rising slightly in the early hours.

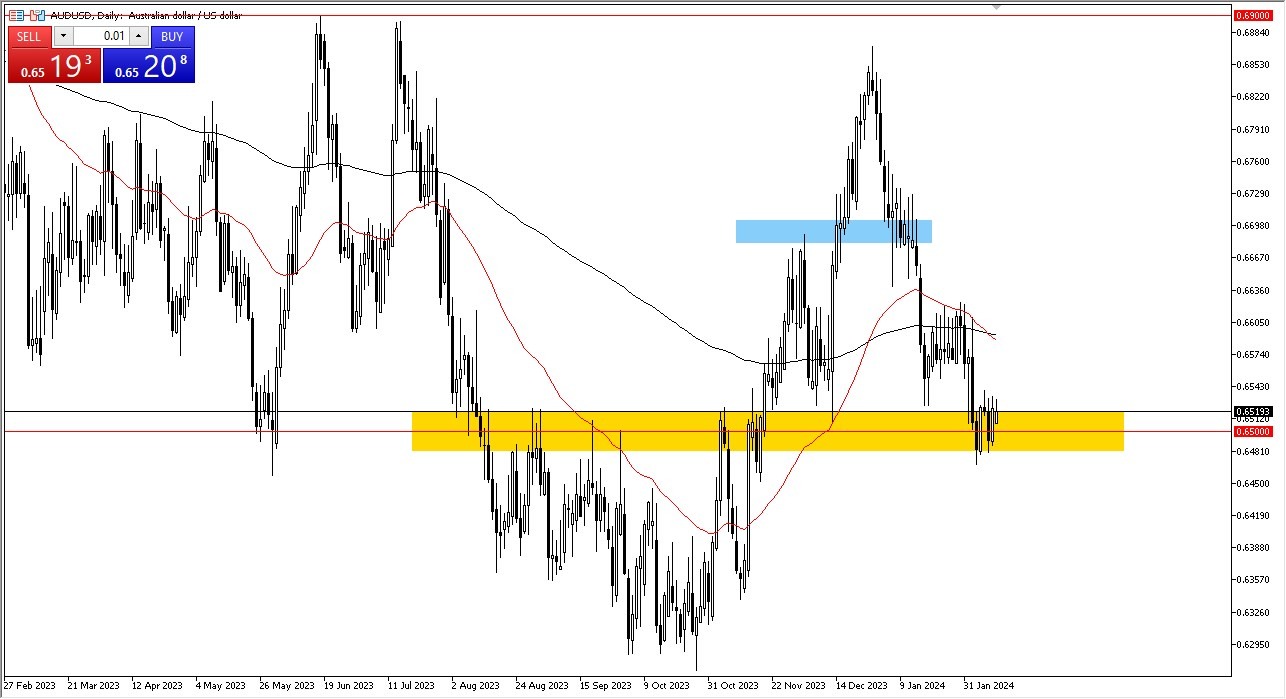

- That being said, the market is essentially stock around the 0.65 level, and it’s an area that I think has shown itself to be important more than once.

- After all, it was previous resistance, and now it looks as if it is going to be supported in what is known as “market memory.”

The 50-Day EMA has dropped below the 200-Day EMA indicator, showing signs of negativity as it is considered to be a “death cross.” This is a negative technical indicator that a lot of longer-term traders will pay attention to, but quite frankly it is a indication that comes far too late to be overly useful most of the time. That being said, the Australian dollar has a mass of noise around it that will continue to be something that you have to pay close attention to.

Top Forex Brokers

Central Banks Continue to Drive the Narrative

The central banks of course continue to drive the narrative overall, as the Reserve Bank of Australia has shown itself to be somewhat ambivalent, in the Federal Reserve has pushed back its idea of cutting rates. While it is still going to be cutting rates in 2024, the reality is that the rate cuts will come later in the year than initially suggested, therefore we have seen the US dollar show a bit of strength overall, as the idea of the Federal Reserve completely caving has been blown apart.

The Federal Reserve of course is going to pay attention to the fact that inflation in the United States continues to be an issue, and as long as that’s going to be the case, the Federal Reserve is not going to cut aggressively. That being said, traders are probably going to find 2024 to be somewhat range bound, as the central banks around the world all seem to be in the same predicament, with the exception of the Bank of Japan.

As long as that’s the case, I think you need to sort out where the range is going to be and pay close attention to it. At this point, we were to drop down below the 0.6450 level, then we will have broken the short term range to the downside and open up the possibility of the Australian dollar dropping down to 0.63 underneath. On the other hand, if we were to turn around and take out the 0.66 level, then it opens up a move to the 0.67 level.

Ready to trade our daily Forex forecast? Here’s some of the top forex online trading Australia to check out.