- The Australian dollar faced a sell-off during Friday's trading session, triggered by the unexpected surge in United States job numbers.

- Despite this, the currency remains within a clearly defined trading range. This is a feature that I see lasting for a while.

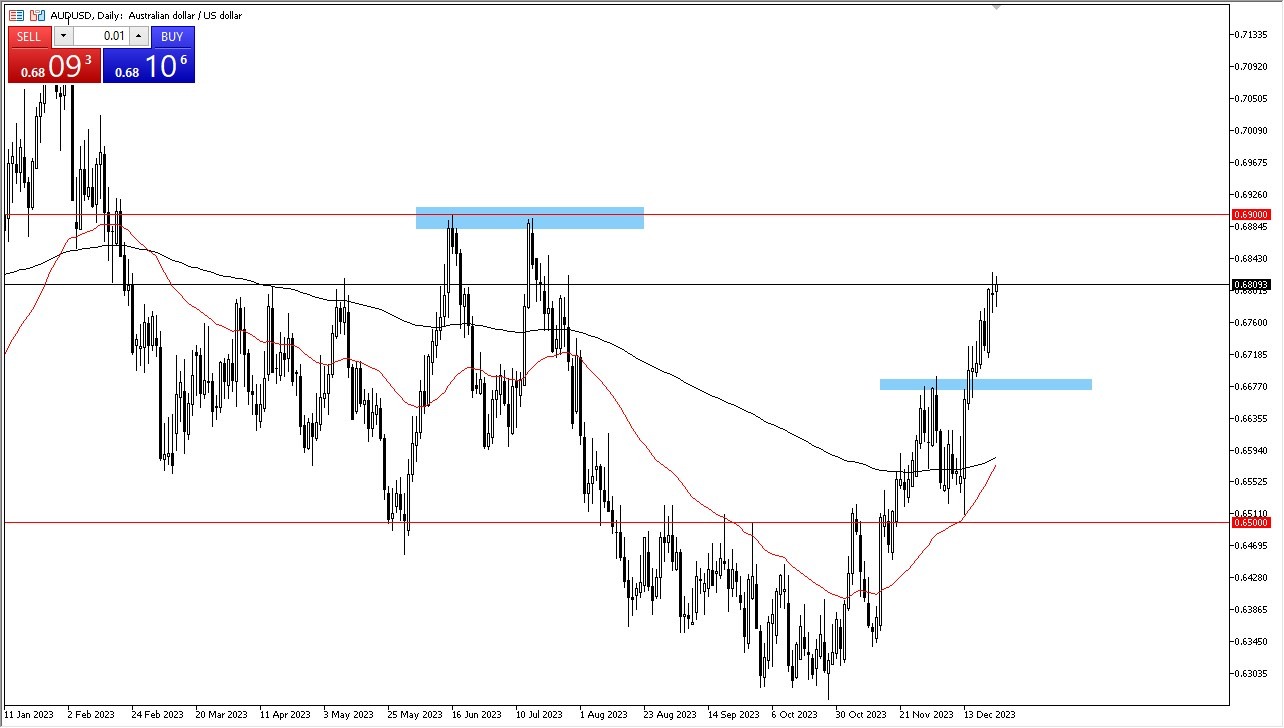

AUD/USD, the currency pair representing the Australian dollar against the US dollar, initially attempted to rally on Friday but took a severe hit when the robust job figures were released. This unexpected turn of events has raised concerns among market participants. Currently, the focus seems to be on testing the critical support level at 0.65, a level that has held significance for an extended period.

Top Forex Brokers

In the event of a breakdown below 0.65, the next level to watch is 0.6350, characterized as a swing low that has demonstrated substantial support in the past. If the pair reaches this level, it is likely to attract buyers seeking to take advantage of the lower exchange rate.

On the upside, the upper boundary of the short-term consolidation range appears to be around 0.6650. A breakout above this level could potentially propel the AUD/USD pair higher, possibly targeting the 0.67 level.

The primary factor influencing the Australian dollar's movements remains the policies of the Federal Reserve, particularly concerning interest rate adjustments. However, the unexpectedly robust US jobs data on Friday has led to a reevaluation of expectations. Surprisingly, a robust US labor market may, in the long run, benefit the Australian dollar due to its connection to commodities and global economic growth.

In the end, the AUD/USD pair is expected to remain in a sideways trading pattern for the foreseeable future, given the conflicting factors at play. The critical levels to monitor are 0.65 and 0.6650. A breach of these levels could result in notable movements, potentially opening up 150 pips to the downside or 100 pips to the upside. In the meantime, investors should anticipate a period of indecision and choppiness in the currency pair as various factors continue to exert their influence, making it a theme that is likely to persist throughout the year.

Ready to trade our free Forex signals? Here are the best forex platform Australia to choose from.