- The Bitcoin market experienced a slight retracement in the run-up to Wednesday's Federal Open Market Committee (FOMC) meeting.

- Consequently, the cryptocurrency is poised to respond significantly to Jerome Powell's statements regarding future monetary policy.

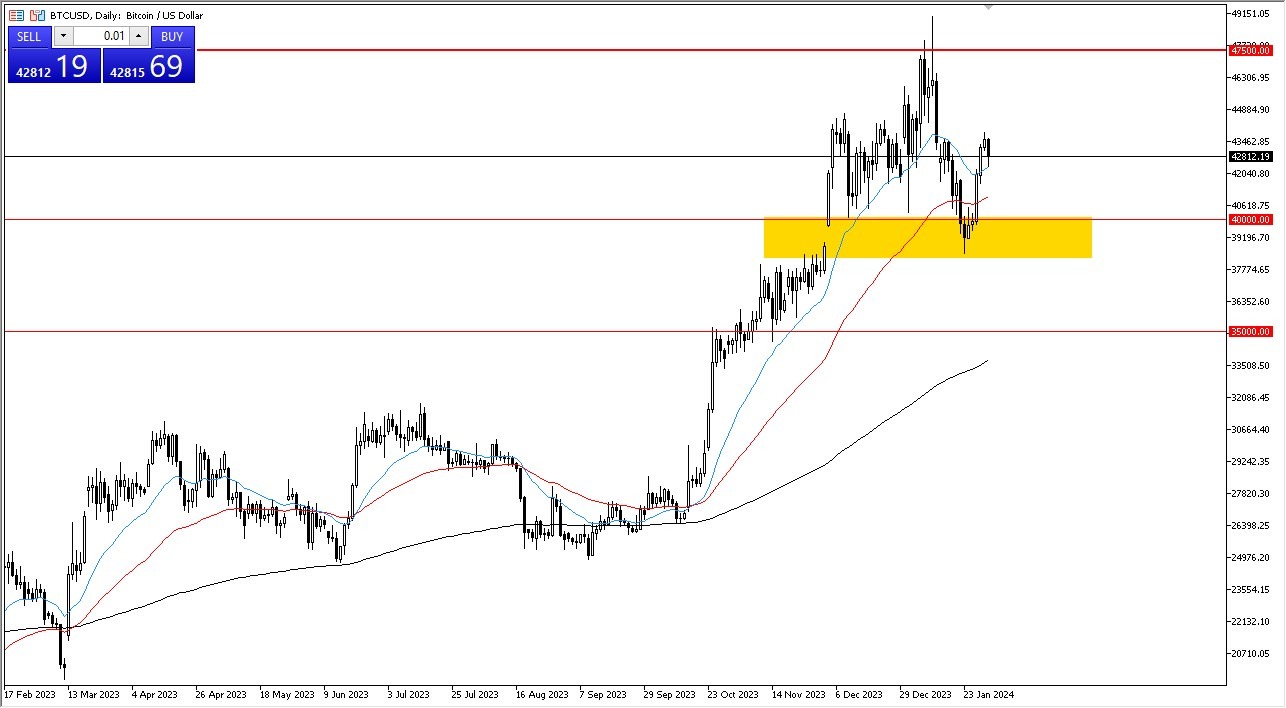

During Wednesday's trading session, Bitcoin underwent a minor decline, approaching the 20-day Exponential Moving Average. Market observers closely monitor the 20-day EMA as a pivotal indicator. Furthermore, substantial support lies just below the 50-day EMA, a crucial metric in assessing market trends. The $40,000 level, situated beneath the 50-day EMA, also holds substantial importance. Consequently, there exists a notable level of interest and scrutiny regarding the support levels in this region.

It is anticipated that questions will arise concerning the strength of support beneath these levels, and there is a reasonable expectation of buyer interest in this zone. Investors are likely to assess the situation from the perspective of identifying value in the current market conditions.

Overall, the prevailing strategy appears to be one of waiting for a downward move followed by a subsequent bounce, which would signal an opportune moment for long positions. Should Bitcoin succeed in surpassing the $45,000 level, it could pave the way for a potential ascent towards the $47,500 level.

Top Forex Brokers

FOMC is Crucial

The impending FOMC press conference carries considerable significance and is expected to exert a substantial influence on market dynamics. Bitcoin has historically been highly responsive to the Federal Reserve's loose interest rate policies, given its underlying philosophy of providing an alternative to conventional fiat currencies and monetary systems. Whether this correlation persists will be assessed in the coming weeks, as market participants navigate various asset classes, including Bitcoin.

A return to a more accommodative monetary policy stance by the Federal Reserve could theoretically benefit digital assets, not only Bitcoin but also other cryptocurrencies. Conversely, if Bitcoin were to breach the recent swing low, the $35,000 level would emerge as a prominent support threshold, representing a potential trend reversal point.

Bitcoin's recent surge of 80 to 90% was largely attributed to the anticipation surrounding the introduction of a Bitcoin Exchange-Traded Fund (ETF). With that development now realized, attention has shifted towards identifying the next catalyst that could shape Bitcoin's trajectory in the future.

In the end, the Bitcoin market remains dynamic and subject to fluctuations, with its response to the FOMC meeting and Jerome Powell's statements of utmost interest. Key support and resistance levels, along with potential catalysts, will continue to influence the market's evolution in the weeks ahead.

Ready to trade BTC/USD? Here’s a list of some of the best crypto brokers to check out.