- The Bitcoin market has exhibited limited activity during the recent trading sessions, reflecting a period of relative stagnation as participants await a resurgence of momentum.

- This subdued performance may not come as a surprise, given the prior bullish sentiment that prevailed in this market.

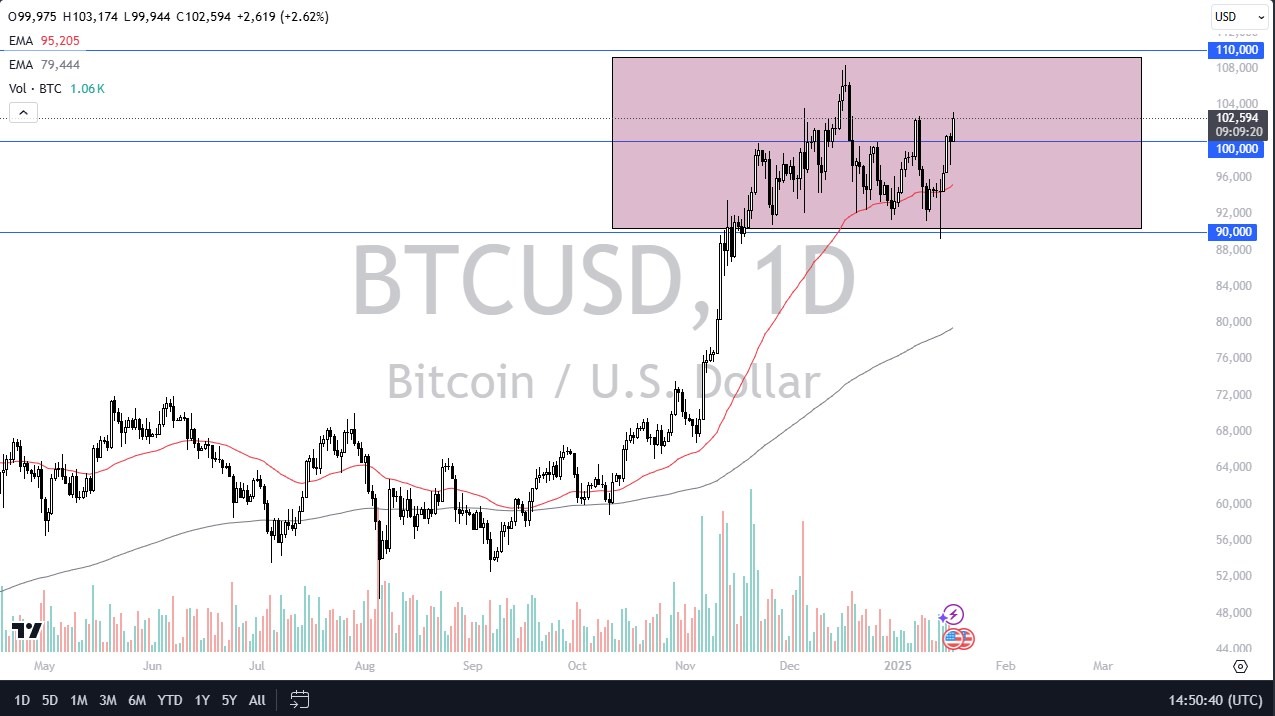

Looking at the Bitcoin market, Friday's trading activity was uneventful, mirroring the week's overall lack of significant developments. The market previously experienced substantial upward momentum, driving Bitcoin to reach approximately $43,000. The recent excitement surrounding the exchange-traded fund (ETF) contributed to an 80% surge in Bitcoin's value. However, with the subsequent absence of new buyers, the market currently finds itself in a state of stasis.

In terms of potential price movements, a break above the $44,000 mark could pave the way for a push towards $48,000, a level that previously witnessed notable selling pressure. Conversely, the $40,000 threshold represents a substantial support level, while the market's attention also remains focused on the $38,500 range.

Top Forex Brokers

Neutral State of Affairs

Presently, Bitcoin appears to be in a neutral state, devoid of any inherently positive or negative attributes. It may continue to undergo a period of relative inactivity, potentially causing some to lose interest temporarily.

Over the long term, as Bitcoin strives to consolidate its substantial gains, there is a likelihood of a breakout towards the $52,000 level. However, this outcome hinges on the trajectory of interest rates in the United States. The unexpected results of the recent jobs report had a notable impact on the bond market, potentially hindering investor enthusiasm for risk assets like Bitcoin. Nevertheless, the prevailing trend for Bitcoin remains upward, and short-term pullbacks are viewed as opportunities for investors to accumulate positions.

In the end, Bitcoin's current state of quiescence is indicative of a market in transition. While the future appears promising, the present circumstances suggest that investors may consider gradually building their positions, exercising caution due to the potential for volatility. Bitcoin's long-term outlook remains bullish, reinforcing the notion that patience and strategic accumulation may be key to realizing future gains in this dynamic market.

Ready to trade Bitcoin USD? Here are the best MT4 crypto brokers to choose from.