- Bitcoin has shown itself to be initially bullish, but then turned around to show signs of negativity.

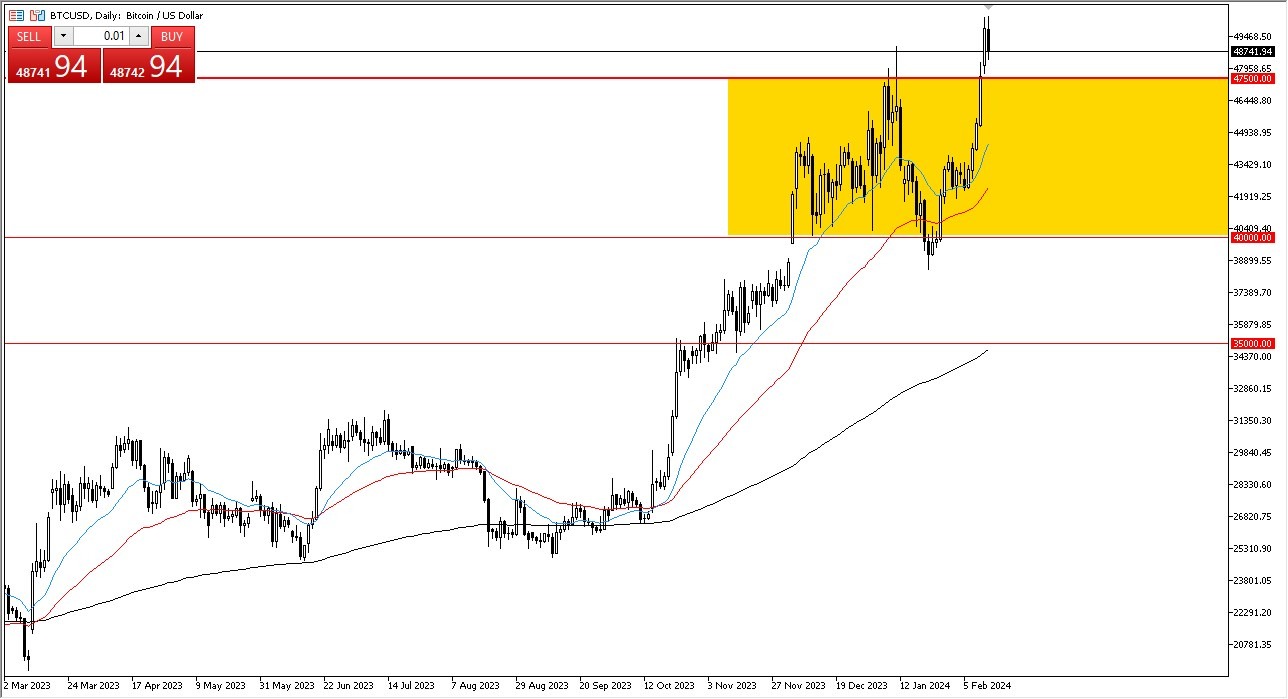

- There was a nasty reaction to the CPI number in the United States, which of course was hotter than anticipated. With this being the case, I think that we could fall to test the $47,500 level, which is the previous resistance barrier.

Given enough time, I think we could see a bit of an opportunity to pick up a little bit of value in Bitcoin. But right now, I think it is still a market that people are trying to get involved with as more inflows jump into the ETF.

Top Forex Brokers

Central Bank liquidity monetary policy is what drives Bitcoin higher over the longer term a lot. And the fact that CPI came out hotter than anticipated does have people thinking that the Fed may not cut as soon as originally anticipated. It's weird. It's almost like Jerome Powell hasn't reiterated that time and time again, but the market hears what it wants to hear. Ultimately, even if we were to break down below the $47,500 level, there's plenty of support all the way down to at least the $40,000 level that could come into the picture and lit this market.

It is because of this that I do not want to short Bitcoin. And I do think that eventually we test the crucial $52,000 level above a break above that opens up the possibility of more of a buy and hold situation. But keep in mind, Bitcoin is up about 90% since Halloween of last year. So, it is overdone, and these pullbacks are absolutely necessary. All things being equal this is a market that has been overdone for a while, and therefore it does make a certain amount of sense that we have to give back some of the gain. Gaining 80% since Halloween of course is a bit overdone and therefore I think this is just natural reaction to an explosive move to the upside and quite frankly the consumer price index was simply a reason for traders to take profit ahead of the crucial $50,000 region.

Ready to trade BTC/USD? Here’s a list of some of the best crypto brokers to check out.