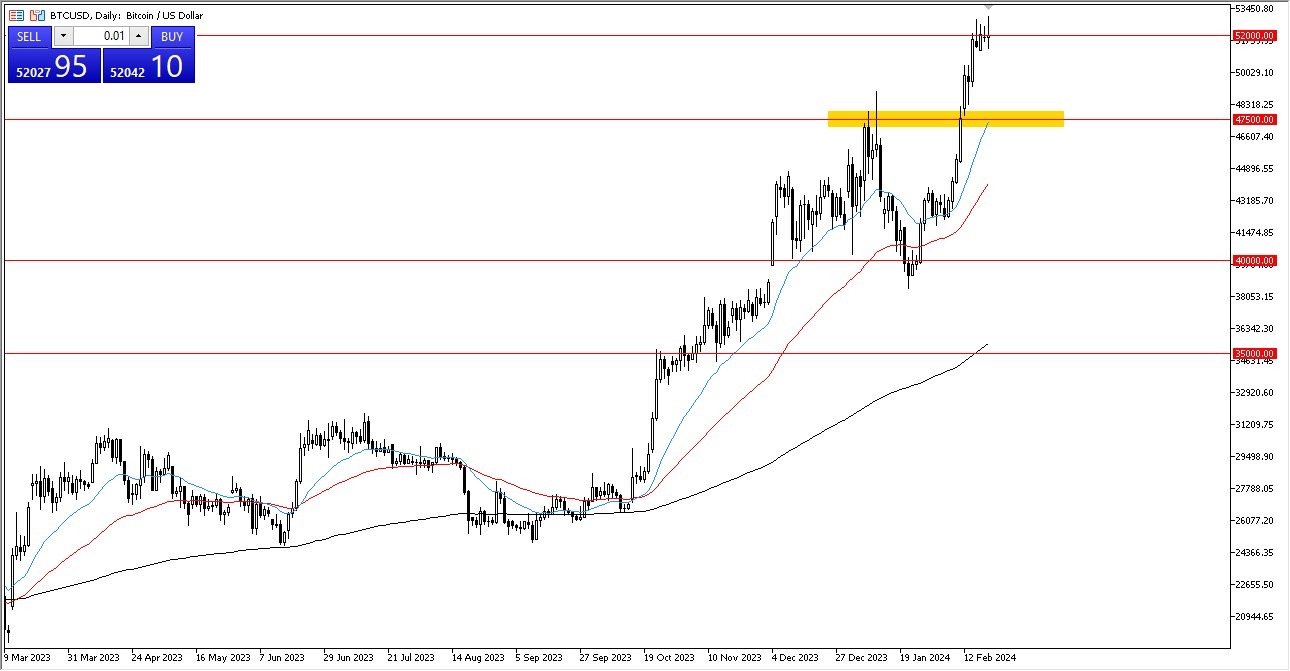

- As you can see, Bitcoin somewhat retreated early in the trading session before rising once more.

- As of right now, it appears that $52,000 is really a zone we're circling in an attempt to gather enough steam to move higher.

The $52,000 level is significant on the longer-term charts, so it's not surprising that we've only recently begun circling this area and attempting to gather steam. After all, we've rallied an absurd amount since the end of October—roughly 30 to 36 percent—and at this point, the enthusiasm surrounding the inflow into the ETF is still driving the price higher. However, this is a market that is going to change eventually.

Top Forex Brokers

Because there will be a lot of Wall Street money in the Bitcoin market, which many traders have adored over the past several years, it will resemble an index more than anything else. Wall Street, which has far more money than individual traders, will short this.

In addition, they will purchase it, dispose of it, and take various other actions. Thus, the market has evolved. There's a big hurry to get into it in the near term. However, if you consider the many prior bubbles and assets that have existed in the past, Wall Street has always driven them to absurd heights before disposing of them. Furthermore, they are not sincere “true believers”, as this is just another way to make money on Wall Street.

When it comes to trading Bitcoin, stop losses will become increasingly important. There had previously been opposition near the $47,500 mark. It has a 20-day EMA as well. And I believe that's your floor right now, at least for the near future. Your next goal should be $55,000; the psychological barrier of $60,000 would likely be tried after that.

Although I'm not interested in shorting this market, I am aware that pullbacks are more likely than not. This could be another reason to see this as a volatile but positive market in the intermediate term. Shorting is still impossible, but I think it is only a matter of time before we get come kind of substantial pullback that will shock traders.

Ready to trade our daily Forex signals? Here’s a list of some of the best crypto brokers to check out.