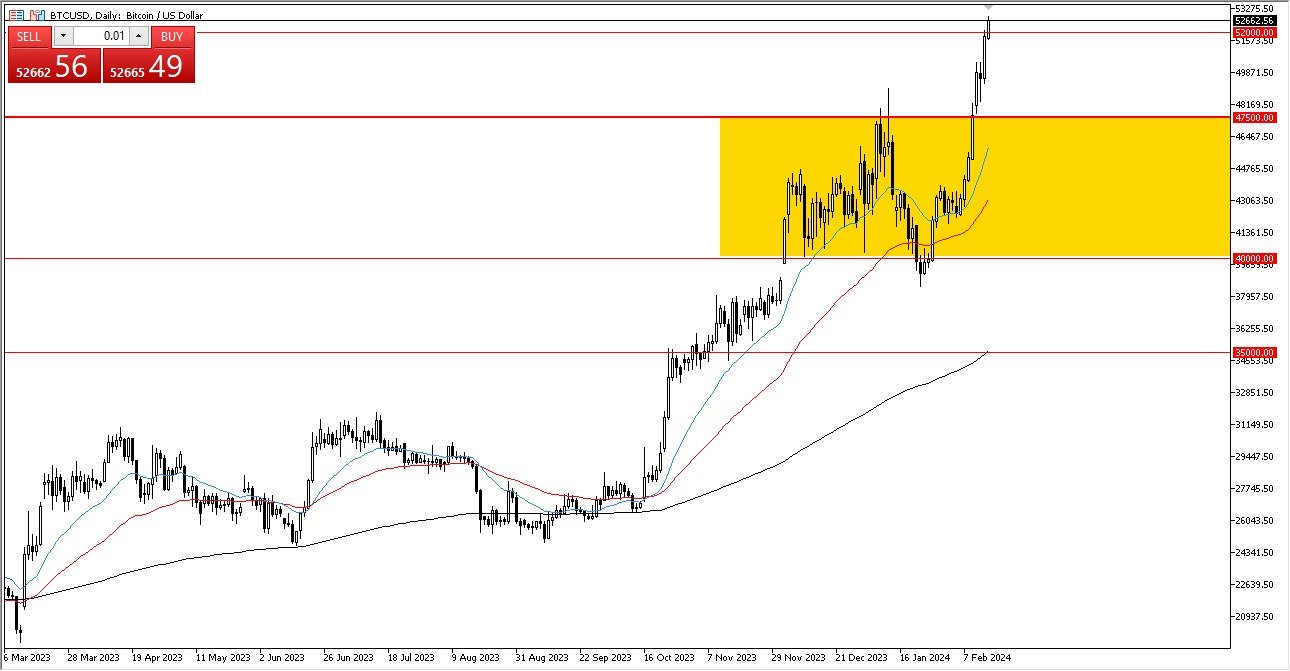

- Bitcoin has broken above the crucial $52,000 level during the trading session on Thursday as we continue to see buyers jump into this market.

- That being said, this is also a market that is far too overextended to continue this type of momentum.

- After all, from the recent pullback we have seen a gain of over 30%, and while you can justify some of that due to the ETF now being available, the reality is that sooner or later the market will need to take some type of pullback.

You certainly cannot sell bitcoin, but institutions do have the ability to move the markets quite drastically at this point. You have to be cognizant of this and understand that Bitcoin is more likely than not going to change its overall attitude going forward. In fact, it’ll be interesting to see how this market will evolve as it becomes a much more mature financial instrument and could end up behaving more or less like an index. After all, this will be the first time that it’s easy to short the bitcoin market, and don’t think for a second that institutional traders won’t try to take advantage of that sooner or later.

Buying the Dips

At this point, the only thing you can do is continue to buy the dips, because it’s obvious that this market has a mind of its own. You also need to be cautious with position sizing because the dip could be much more aggressive than you expect. Nonetheless, selling on the market is impossible, unless of course you are selling a holding that you already have in order to collect profit.

Top Forex Brokers

At this point, I think we are probably going to try to get to the $55,000 level, but sooner or later gravity has to show back up. If and when it does, that should be a nice buying opportunity and I think there are plenty of people out there that would be more willing than not to get involved. A break below the $47,500 level would of course be very negative, opening up the possibility of a move down to the 20-Day EMA, possibly the 50-Day EMA after that. Ultimately, I think the “rubber meets the road” near the $40,000 level as that will define the overall trend that we see at the moment.

Ready to trade Bitcoin in USD? We’ve shortlisted the best MT4 crypto brokers in the industry for you.