- Bitcoin experienced a minor decline during the Thursday trading session, which coincided with the anticipation of the Non-Farm Payroll announcement on Friday.

- In this volatile market, it is apparent that investors continue to view any price drop as an opportunity to put longs on.

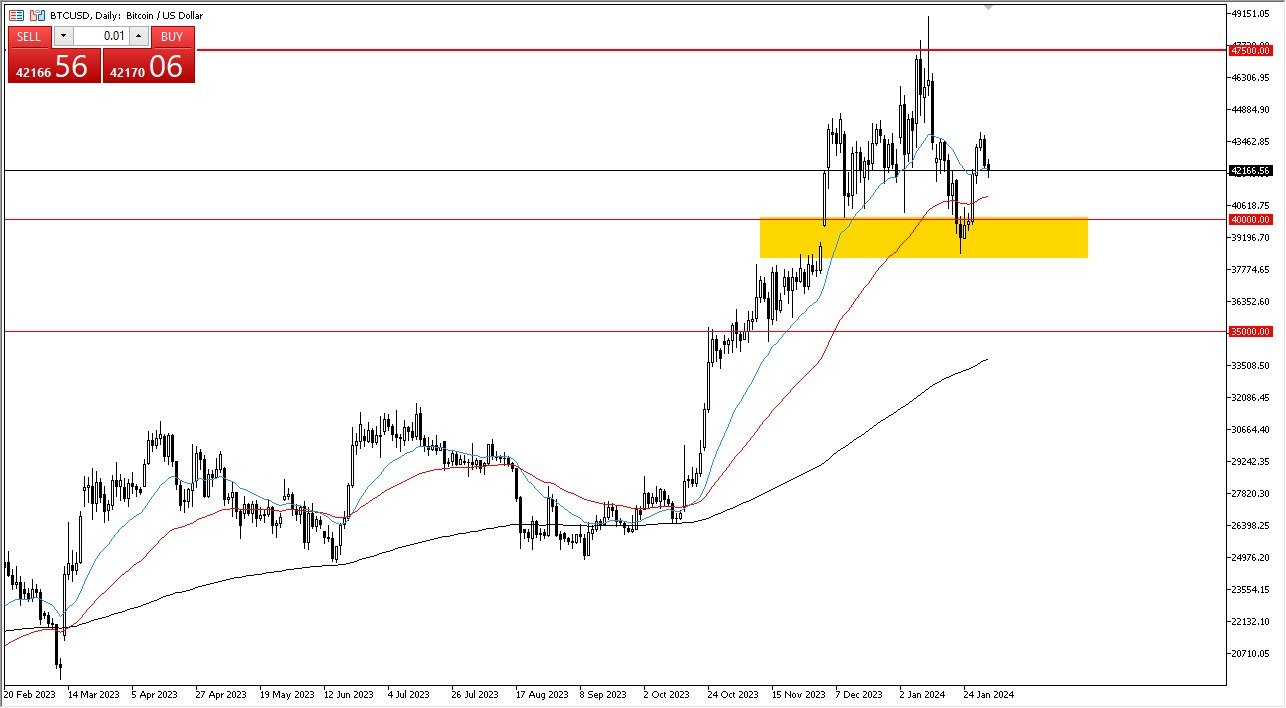

The price remained in proximity to the 20-day Exponential Moving Average. The impending release of non-farm payroll data on Friday has raised the possibility that the bond markets might exert an influence on Bitcoin and other financial markets. Consequently, it is reasonable to anticipate some degree of market fluctuation.

Despite a slightly less dovish stance taken by Jerome Powell during the FOMC press conference on Wednesday, the fundamental setup remains largely unaltered. Key support levels persist, with the 50-day EMA, the $40,000 price mark, and ultimately the $38,500 level providing a safety net. Short-term prospects suggest continued sideways movement as market participants strive to discern the cryptocurrency's future direction.

It is worth noting that the Bitcoin market had experienced a significant rally of nearly 90% in anticipation of the introduction of a Bitcoin Exchange-Traded Fund. However, now that the ETF has become a reality, investors are grappling with the question of what comes next. Uncertainty prevails, but it is not uncommon for markets to undergo consolidation phases following substantial gains.

Top Forex Brokers

Longer Term Perspective

For many traders with a longer-term perspective, the pivotal level to watch is $35,000. A drop below this threshold, currently approximately $7,000 below the present Bitcoin price, could lead to unfavorable market conditions. This concern is reinforced by the presence of the 200-day EMA, which lends further support to this assessment. Consequently, the prevailing sentiment remains one of buying Bitcoin during price declines. However, achieving a breakthrough beyond the $47,500 level, particularly in the short term, may prove to be a challenging endeavor.

In the end, Bitcoin's recent price retreat and the impending economic data release have introduced a degree of uncertainty into the market. Nevertheless, the cryptocurrency continues to exhibit resilience, with well-defined support levels and a general inclination among investors to view dips as buying opportunities. The $35,000 mark remains a crucial level to monitor, with potential consequences for the cryptocurrency's trajectory if breached. Ultimately, Bitcoin's future trajectory remains a topic of speculation as market participants navigate through this period of consolidation and adaptation.

Ready to trade Bitcoin in USD? We’ve shortlisted the best MT4 crypto brokers in the industry for you.