- The market has risen sharply early in the Tuesday session, and the bitcoin price is still shooting straight into the stratosphere.

- The mania is currently feeding off itself. This market will continue to be one of bullish pressure, but at this point – it is getting a little overdone.

Bitcoin Continues

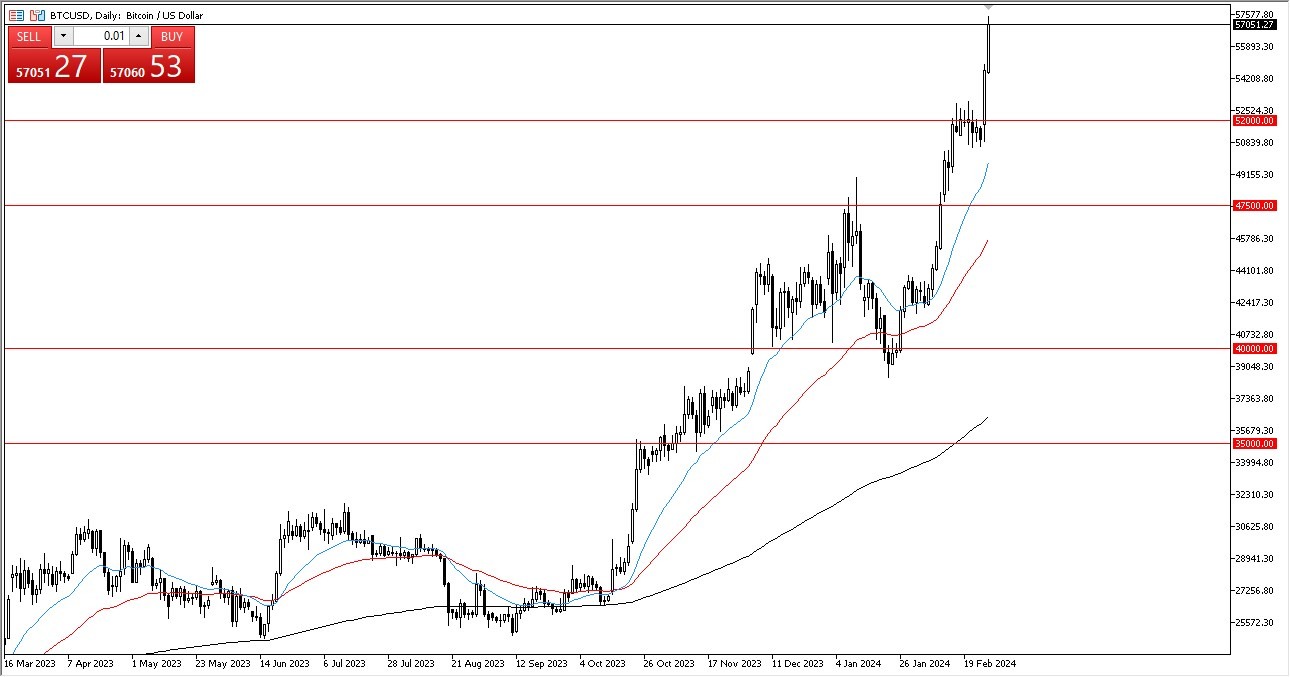

Another day and a higher surge are visible. We are currently witnessing a rather significant move that aims to break through the $57,000 mark. The longer term charts don't appear to have anything to stop it from rising much more at this time.

Top Forex Brokers

Thus, if you ever see those declines, I would expect that Bitcoin will remain a buy on the dip asset. Naturally, the ETF that was released for Bitcoin has given it a significant boost, and Wall Street will undoubtedly continue to support it. People are rushing into the spot market to purchase this ETF because there is a lot of money chasing it right now.

In the end, this is a situation that will have disastrous repercussions in the future, but for the time being, we're still in the inflated bubble stage, so your only option is to purchase the dip. The market's sentiment will eventually shift due to the ETF, but for now, everyone is still chasing it. As things stand, there appears to be plenty of momentum ahead of us in the near future. If that turns out to be the case, you will either have to follow suit with everyone else or stay away from it. This market is not shortable. That is far from being a possibility right now.

There is support available in the $47,000 range and the 20-day EMA if we were to collapse at this point, below, say, $50,000. In the short term, the sum of $60,000 that we're likely considering above carries some psychological significance. However, it appears that we will exert every effort to fuel the frenzy before Wall Street throws this on the public. However, it doesn't seem to be occurring anytime soon, so for the time being, it's still a chasing the trade situation. In the crypto markets and on Wall Street in general, fear of missing out (FOMO) is quite real. I think this continues to be the main feature out there that traders will be looking at.

Ready to trade Bitcoin in USD? We’ve shortlisted the best MT4 crypto brokers in the industry for you.