- As we've seen, Bitcoin continues to defy gravity, with the market rising to unprecedented heights.

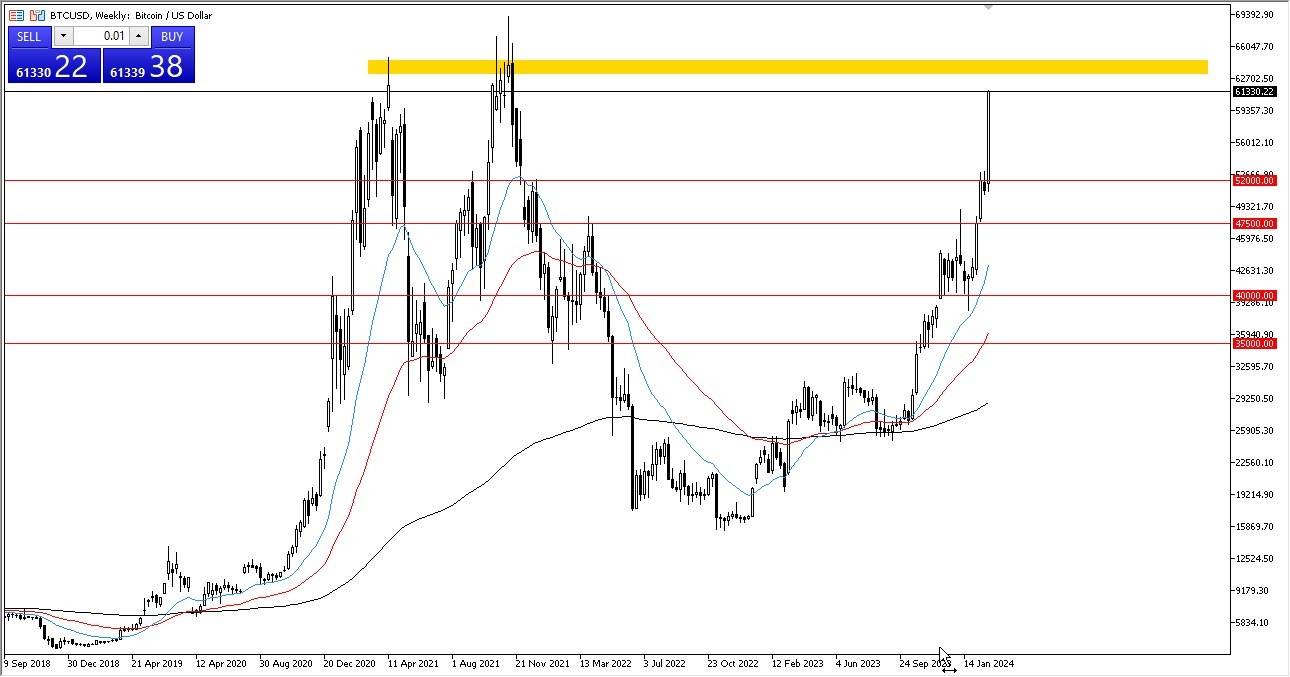

- We are quite near to testing the region of the all-time high right now. This is something that of course has been attracting a lot of attention lately, as the mania continues.

- This will be a situation that will feed upon itself as we have seen before.

Bitcoin Continues to See Rocket-Like Behavior

Upon examining Bitcoin, it is evident that we are once more in the air as we approach the New York session. We have gained almost 8%. We're just racing, so it's the same narrative as the last three days. I believe that the $63,000 mark, which was essentially the all-time high, will be our target. As we have seen numerous times in the past, I would anticipate that "FOMO" will reenter the market if we were to break above that level.

Top Forex Brokers

Between that and, say, sixty-seven thousand. There is a sizable order block of individuals who may wish to exit the market. They are spared. Though it's difficult to say for sure, at this moment Bitcoin is still seeing a lot of inflows because of the recently launched ETF market, which naturally enables traders to benefit from Bitcoin spot pricing without having to deal with the headache of holding onto Bitcoin.

Having said that, this clearly indicates a bubble, and Wall Street will eventually offer this to individuals in exchange for holding onto their bags so they can claim their profits. I'm not sure if we're there yet, though. Because of the surge of potential that is currently engulfing the market, I honestly don't think we are. Having said that, I acknowledge that if we do indeed gain some momentum, we could make a really large move beyond the $70,000 mark. However, at the moment, I like to purchase brief pullbacks. That's probably the best way to approach things, in my opinion. It's really challenging to pursue a market with this level of movement. Regretfully, there must be a final purchaser. It is up to you to ensure that you are not that person. If we even draw back that far, I think that the 52,000 level is currently a potential place of importance from a support level perspective, so I do like that.

Ready to trade Bitcoin USD? Here are the best MT4 crypto brokers to choose from.