- Bitcoin launched itself into the stratosphere during the month of February, which should not be a huge surprise considering that it finally got its ETF.

- At this point though, we have to question whether or not that will be a good thing in the longer term?

- After all, it gives Wall Street the ability to short this market as well.

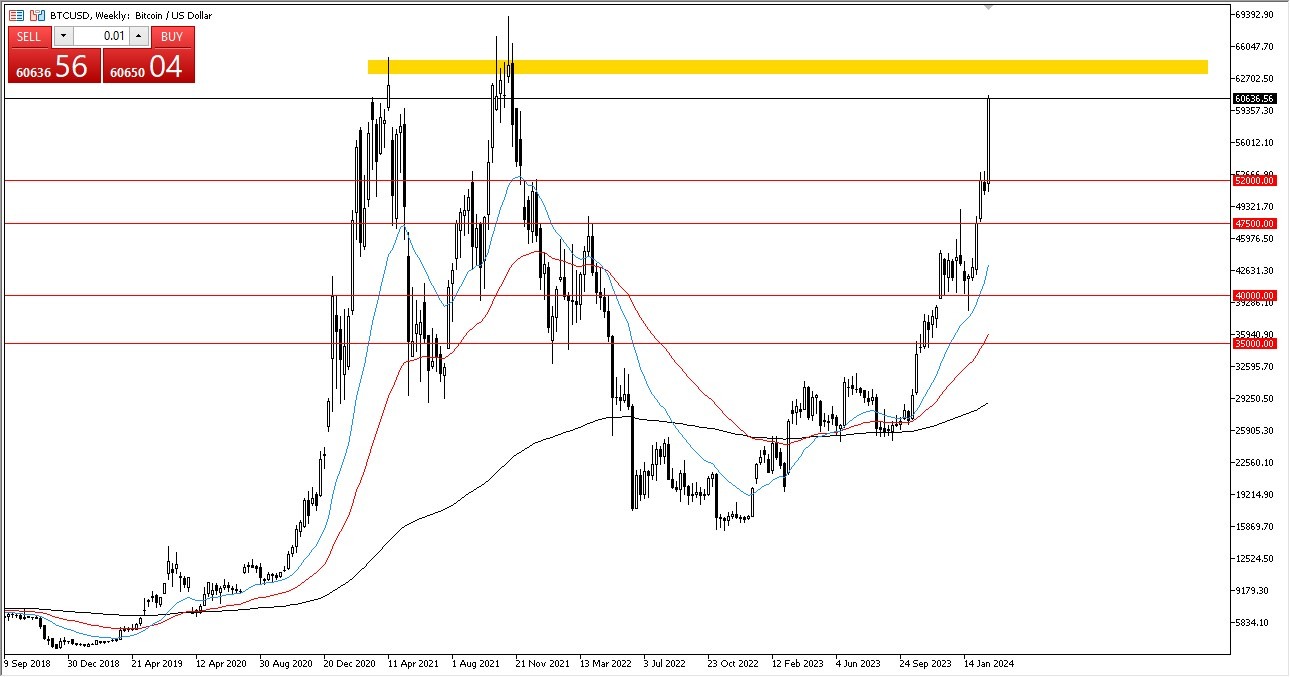

As things stand right now, the mania is in full force and Wall Street is selling Bitcoin to its institutional investors. With that being the case, it does make sense that Bitcoin will continue to rally and more likely than not will break to an all-time high. The all-time high is near the $63,000 level, but the fact that we have more than doubled the price in just a few months should give some traders a little bit of pause. This is a mania, and perhaps even a bubble. Eventually, somebody on Wall Street is going to say “Here, hold my bags.”

That being said, if we can break above the $63,000 level, I believe that this is a market that continues to go higher. There will be a lot of film of trading at that point, just like we see right now. Bitcoin is trading like it used to, but that’s only because so many people are speculating in the ETF market. That being said, sooner or later we will see a pullback and that pullback is going to be quite brutal. I think that pullback comes in the month of March, and a 10% drop would be something that could happen in the blink of an eye. Is it because of this that you cannot go “all in” into the Bitcoin market.

Top Forex Brokers

The outlook

That being said, I do see a ton of support out of the $52,000 level, so I would be very interested in scaling back into a position in that area, assuming that we even get that opportunity. The market is obviously bullish and cannot be shorted at this point. Yes, sooner or later it will pullback because we still don’t use Bitcoin for anything. Essentially, it’s just a made up asset that people are speculating with, which explains the mania that we see right now. Until it has real-world use, Bitcoin is just going to be for speculation and therefore you should not put a ton of your portfolio into it.

Ready to trade our Forex monthly forecast? Here’s a list of some of the best Forex trading platforms to check out.