Crude oil markets show potential for a breakout, favoring a strategy of buying on dips. The market is expected to remain volatile.

WTI Crude Oil

In Wednesday's trading session, crude oil experienced a minor pullback amidst ongoing market volatility. Opportunities to identify value will likely emerge on dips toward the $75 level. The 200-day Exponential Moving Average holds significance in the current market context, reflecting the market's attention and potential for dramatic price movements. Despite its inherent volatility, crude oil is anticipated to continue upward.

The crude oil market faces multiple dynamics, including supply and demand factors and geopolitical concerns in the Middle East. These variables contribute to market volatility and the need for cautious navigation in this market as it is so choppy and noisy. The market will have a lot to think about as the Middle East issues alone could cause problems, as the markets will have to worry about the possible disruption of supply as tensions rise.

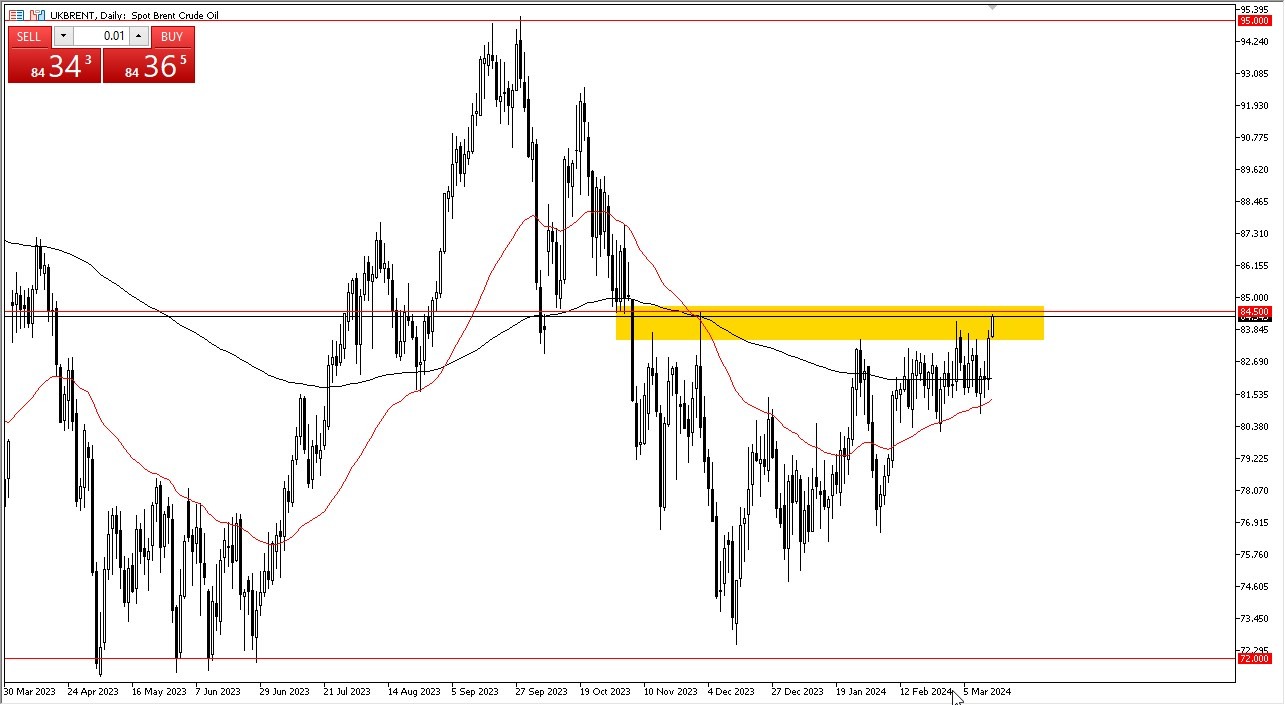

Brent

Top Forex Brokers

Similar to WTI Crude Oil, Brent is hovering around the 200-day EMA. The $80.50 level serves as a notable support threshold. Buyers are inclined to seek opportunities on dips in this market as well. The $80 level will likely attract substantial interest, with the potential for an upward move toward $90 if recent highs are surpassed. A propensity to buy on value opportunities is evident in both oil grades.

The Federal Open Market Committee (FOMC) meeting outcome later in the day could influence the market, particularly as loose monetary policy typically stimulates energy demand. However, the actual impact remains to be observed, and it is worth noting that this market will have its own mind when looking at the statement – so don’t try to “guess” what people will be thinking. Remember, price is truth in all market, including oil.

In the end, the crude oil markets exhibit potential for a breakout, with a strategy focused on purchasing during price dips. Market volatility is expected to persist, driven by various factors, including supply and demand dynamics and geopolitical considerations. WTI Crude Oil and Brent present opportunities for value-based trading, with the $80 level holding significance as a potential pivot point. The FOMC meeting's influence on energy demand remains a variable to monitor, but we also need to pay attention to the US Dollar as well.

Ready to trade WTI Crude Oil FX? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.