- There is still a lot of "buy on the dip" activity in the crude oil market.

- I believe it all boils down to my belief that we are approaching a cyclical bullish period of the year, to which many will need to pay careful attention.

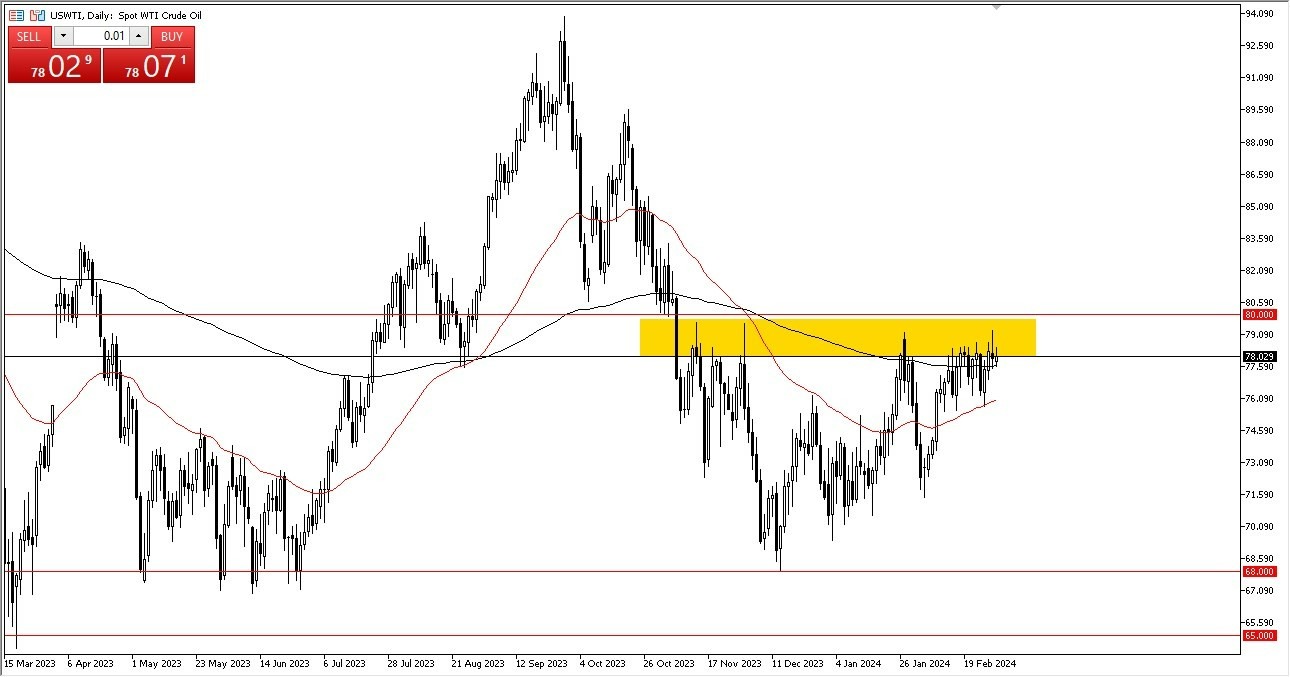

WTI Crude Oil

As you can see, each time we approach the top of this enormous range, the crude oil market has proven to be incredibly durable. Having said that, I believe that the $80 mark will continue to be seen as a crucial barrier in this market, one that must be broken in order for us to truly begin to rise. A rise to the $88 level becomes possible if the market breaks over that level. We are establishing a massive, rounded bottom; thus buyers will continue to be seen in the 200-day EMA and the 50-day EMA indications underneath any short-term pullbacks at this time.

Top Forex Brokers

Brent

While we're circling the 200 day EMA, Brent continues to look quite similar. Naturally, a larger move here could be possible near the $84.50 mark, and as of right now, you are still buying Brent declines. Given enough time, Middle Eastern tensions will keep pushing up oil prices. Of course, from a cyclical perspective, demand is expected to be increasing at this time of year. The Federal Reserve will likely be active as well. There's a chance that they could aggressively lower interest rates, which would encourage business and, therefore, increase demand for crude oil.

In any case, I have no intention of shorting this market, so I will either wait for a breakthrough or instead buy short-term declines. I'm not interested in attempting to short this market at all. As a result, I believe you are in a position where, with patience, you will eventually be compensated fairly well. Having said that, remember that you also need to have patience. In any case, I do believe that, given enough time, crude oil will likely rank among the best investments of the year. This will be especially true if the supply starts to dwindle even further as the supply remains tight.

Potential Signal: Buying US Oil on a break above $80 is how I would be getting long, or if we drop a dollar. On both of those scenarios, I would have a $2 stop loss.

Ready to trade our WTI Crude Oil Forex? We've made a list of the best Forex Oil trading platform worth trading with.