The crude oil markets have shown significant upward momentum recently, a trend that continued into Friday's trading session.

West Texas Intermediate

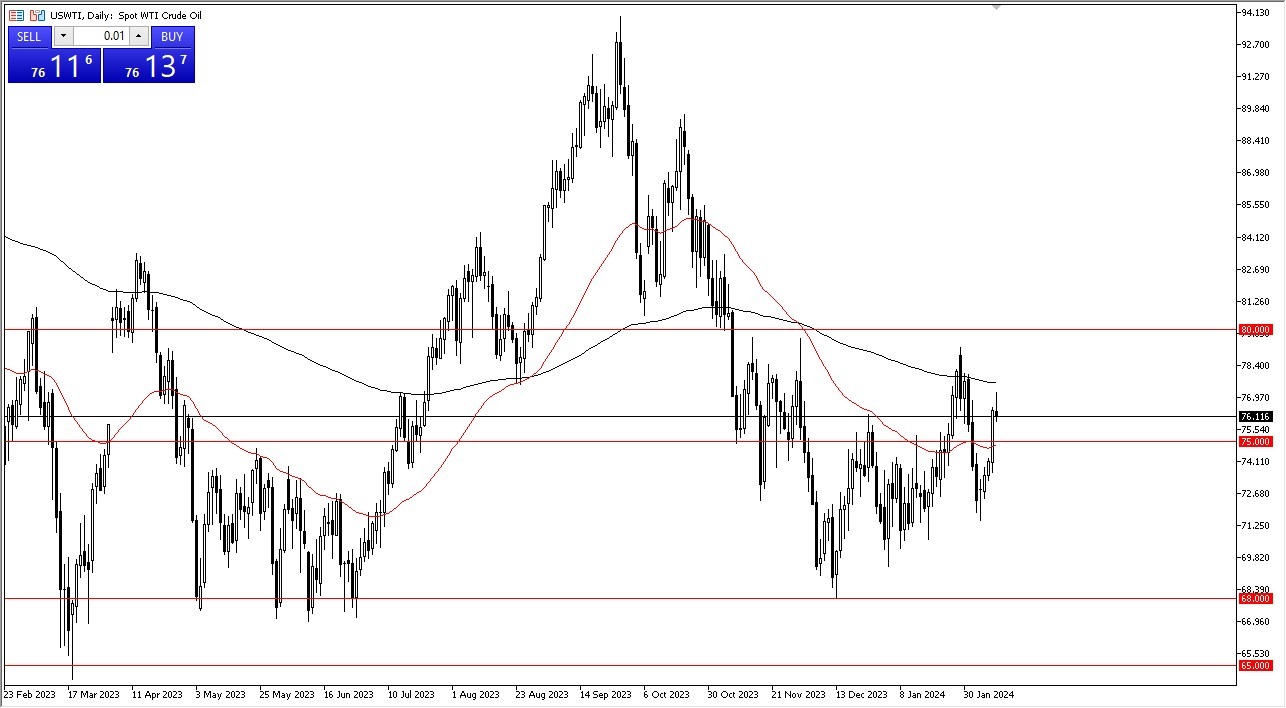

In the WTI Crude Oil market, there was a slight pullback observed on Friday, but it appears to be part of a broader pattern of sustained bullishness that began on Thursday. This consistency in positive movement suggests a favorable outlook for the market, potentially prompting investors to adopt an aggressive buying stance in the near term.

Looking ahead, the $75 level is expected to serve as a key support zone for WTI Crude Oil, bolstered by the presence of the 50-day Exponential Moving Average. Even in the event of a breakdown below this level, the $72.50 mark is poised to act as a secondary support barrier. Conversely, the 200-day EMA may pose a resistance challenge, but a breakthrough could propel prices towards the $80 threshold, potentially forming a significant inverted head and shoulders pattern.

Top Forex Brokers

Brent

Similarly, Brent crude oil displays a bullish trajectory, with upward pressure likely to persist as it approaches the 200-day EMA. A successful breach of this level would likely target the $85 mark, reflecting a pattern akin to that observed in the US oil market. Any downward movements are anticipated to attract buyers, with support expected near the $80 level, reinforced by the 50-day EMA.

A notable driver of the bullish sentiment is the decline in oil supply, which has had a positive impact on market dynamics. Additionally, the resilient economic conditions in the US and geopolitical tensions in the Middle East further contribute to the positive outlook for crude oil prices. Consequently, adopting a strategy of buying on dips remains prudent, given the potential for significant momentum if Brent crude surpasses the $85 threshold, although this may not materialize immediately.

At the end of the day, both WTI and Brent crude oil markets exhibit bullish tendencies, supported by sustained positive momentum and favorable market conditions. The presence of supply constraints and geopolitical factors underscores the potential for further price appreciation, reinforcing the attractiveness of a buy-on-dip approach for investors seeking to capitalize on upward trends in crude oil prices. As such, market participants are advised to monitor key support and resistance levels closely while remaining attuned to broader market dynamics for informed decision-making in navigating the evolving landscape of crude oil markets.

Ready to trade WTI Crude Oil FX? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.