- The actions of central banks cutting rates are expected to continue influencing oil prices, driven by the anticipation of increased economic activity.

- Additionally, developments in the Middle East are likely to impact the market.

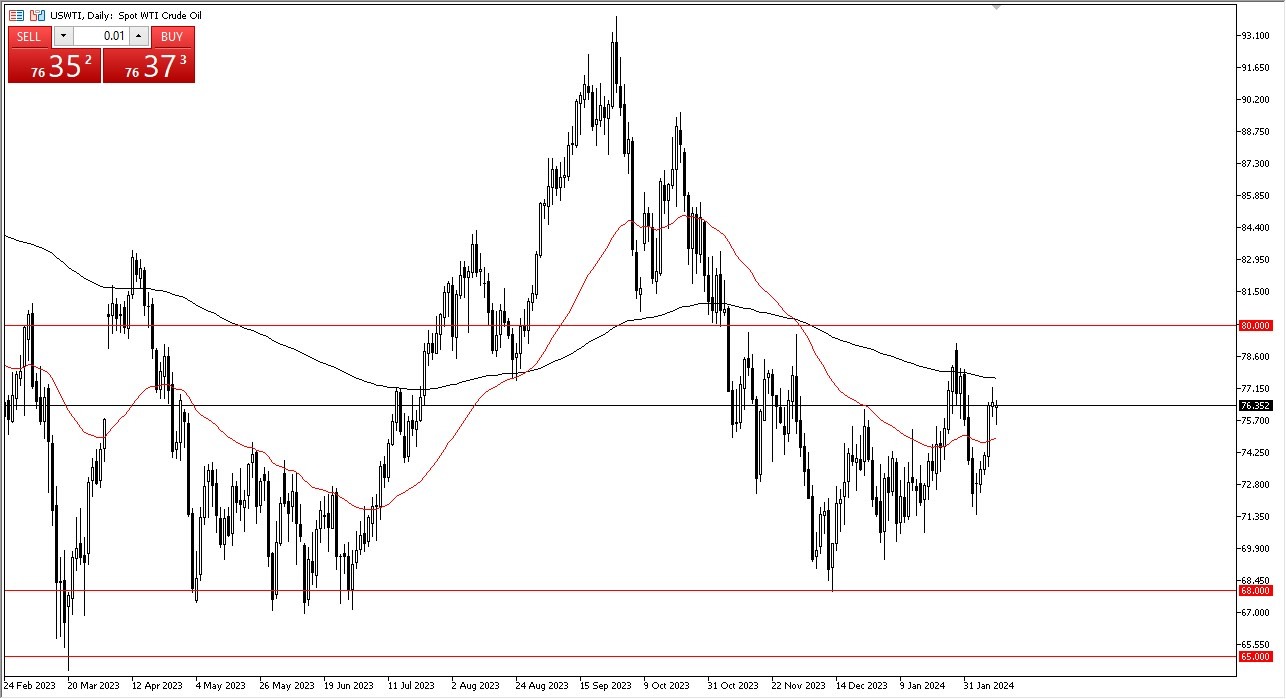

West Texas Intermediate

West Texas Intermediate crude oil experienced a slight pullback during Monday's trading session before rebounding. The market appears to be navigating between the 200-day EMA and the 50-day EMA indicators, indicative of uncertainty regarding its future direction. A breakdown below the 50-day EMA could lead to a decline towards the $71.50 level, while a breakout above the 200-day EMA could propel prices towards $80, a significant psychological level.

Top Forex Brokers

Brent

Similarly, Brent crude finds itself situated between the 50-day EMA and the 200-day EMA indicators. Clearing the $83.50 mark could signal further upside potential, possibly indicating the formation of an inverted head and shoulders pattern. It’s not a perfect pattern, but it is starting to show signs of building that, which of course is a very bullish sign once we break out to the upside, in this case be in the $83.50 level.

Potential factors driving oil prices higher include geopolitical tensions in the Middle East, which could disrupt supply. Additionally, the rate cuts implemented by central banks worldwide may impact demand for crude oil, as lower rates often stimulate economic activity, leading to increased energy consumption. Oil is a vital component of the economy, and fluctuations in its price are closely monitored as indicators of economic health.

In times of rising inflation, oil tends to exhibit heightened sensitivity, often rising in tandem. As such, buying on dips may present favorable opportunities for investors seeking to capitalize on potential price increases. After all, crude oil is one of the most sensitive assets out there when it comes to inflationary pressures, and it’s one of the first places that traders go to in order to protect purchasing power.

At the end of the day, oil prices are influenced by a combination of central bank policies, geopolitical tensions, and economic conditions. The market's current positioning between key EMA indicators suggests a period of uncertainty, with potential for both upward and downward movements. Vigilance and strategic buying on dips may offer investors a prudent approach in navigating the dynamic landscape of oil markets.

Ready to trade WTI/USD? Here are the best Oil trading brokers to choose from.