- The crude oil markets on Tuesday followed the same pattern that has been evident for a few weeks now; it appears that pressure and inertia are building up for an eventual upside breakout.

- It certainly makes a lot of sense that could be the case given the limited supply. This is the big underlying issue at this point in time.

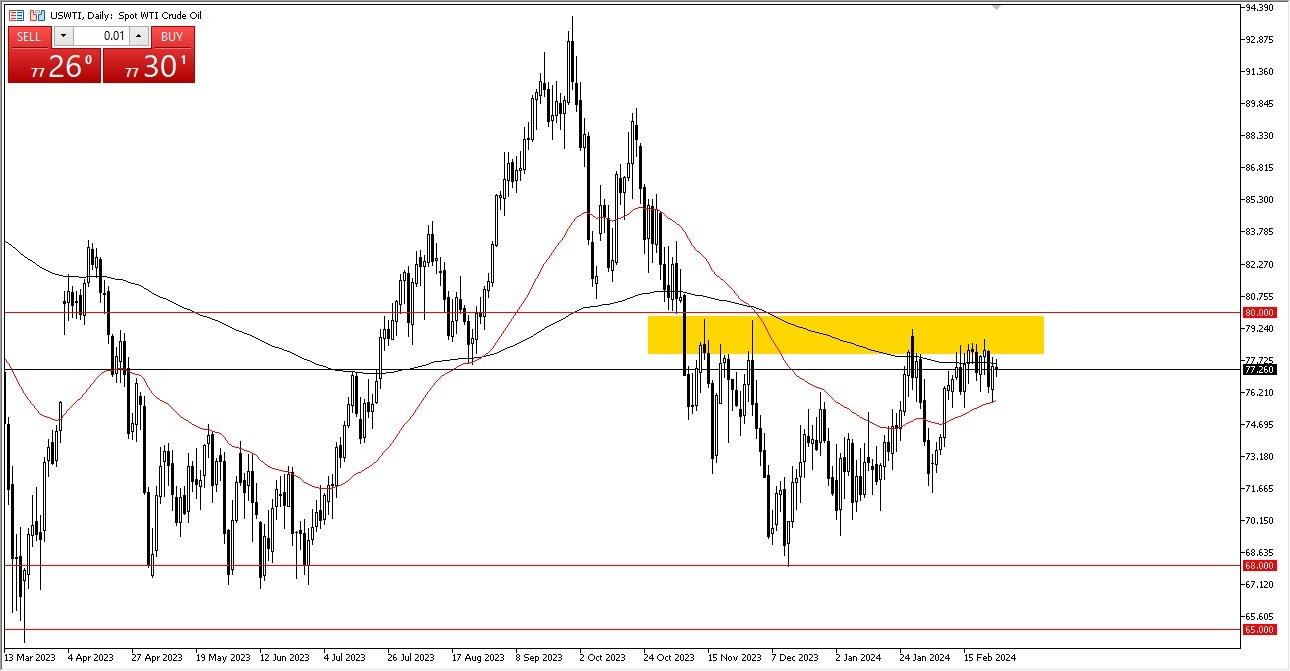

WTI Crude

As you can see, the early morning volatility in the crude oil market is a result of our ongoing efforts to determine the longer-term direction of the market. That being said, I do believe that we will continue to monitor the $80 level in this case involving the WTI grade of crude oil.

A significant amount of upward momentum will be initiated if we can break above the $80 mark. If everything else is equal, you could argue that this is a little complicated inverted head and shoulders, which is also a bullish indication. Meanwhile, I believe that buyers may enter the market in the event of a slight down to the 50-day moving average, motivated by the notion of value-hunting.

I'm not interested in shorting oil, but I am aware that there might be some work ahead of us. Brent finds himself in a similar predicament. We are threatening to rise further higher, now sitting just below the 200-day EMA.

Top Forex Brokers

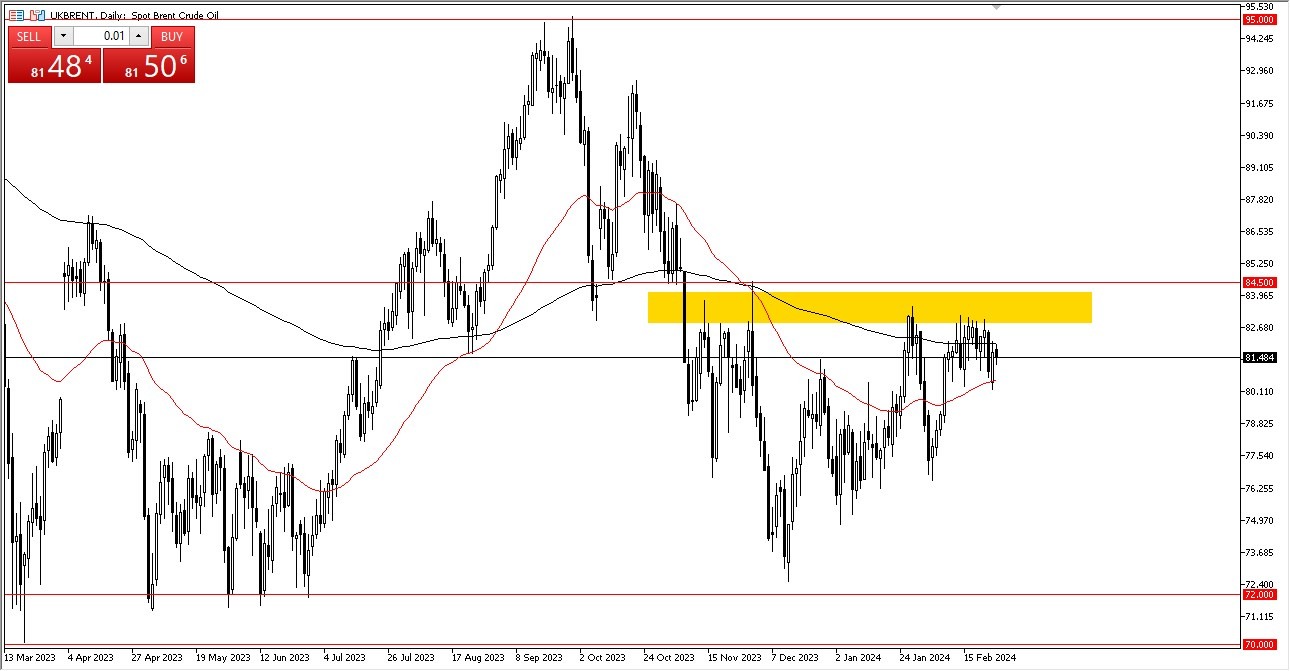

Brent

Like WTI, Brent will keep viewing the world through the lens of whether or not central bank easing occurs and, if it does, whether or not it will increase demand for crude oil. I acknowledge that there are many worries about the global economic outlook, but I also believe that a lot of people are relying on it at this point. Due to the fact that supplies is beginning to become more scarce in the physical market, there are worries in the Middle East.

All of that being said, I do believe that there is a significant amount of upward momentum just waiting to happen, but you need to exercise some caution because we are now building up a small amount of inertia before making our next move. Nonetheless, it is difficult to sell – so I think we have a bullish market that is plotting its next move.

Ready to trade our WTI Crude Oil Forex? We’ve made a list of the best Forex Oil trading platforms worth trading with.