- The crude oil market is currently showing signs of bullishness all around, and it appears that a big breakout is imminent.

- I'm still pretty positive right now, but I'm being cautious with the size of my positions. This is a market that I think will pay attention to, but ultimately, I think this is a situation that is almost self-fulfilling.

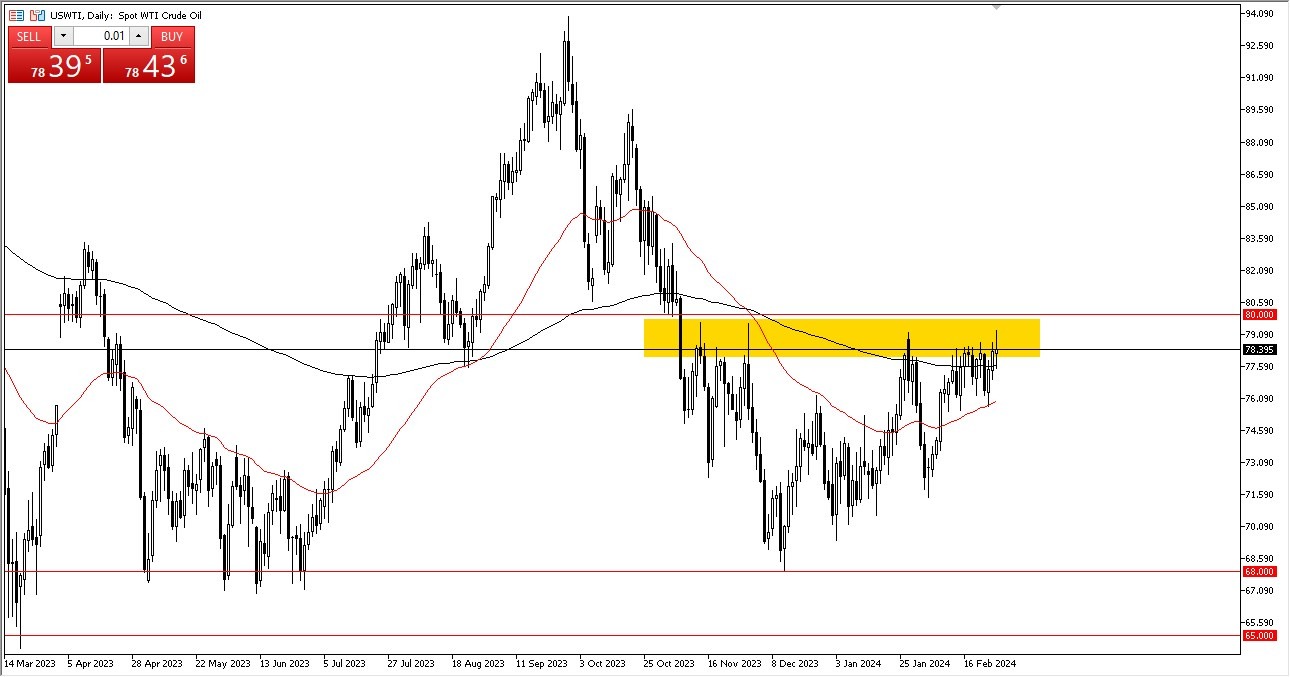

WTI Crude Oil

As you can see, we started off weakly throughout Wednesday's trading session before starting to strengthen once more. I believe it is now very evident that we will eventually break out to the upside, with the $80 level in WTI serving as a significant area of resistance. This area has been important many times in the past, and therefore I think it is worth paying attention to.

Top Forex Brokers

For that reason, all I'm doing is waiting for a daily close above that level so that I can try my hand at a longer-term buy and hold. Naturally, a move up to the $85 mark, or perhaps higher with adequate time, could be possible from the buy and hold position. I believe that right now you have to keep viewing this as a situation where you should purchase on the drop. Because of this, I think it's a good idea to profit from each downturn as it occurs. We are also above the 200-day EMA, which is helpful.

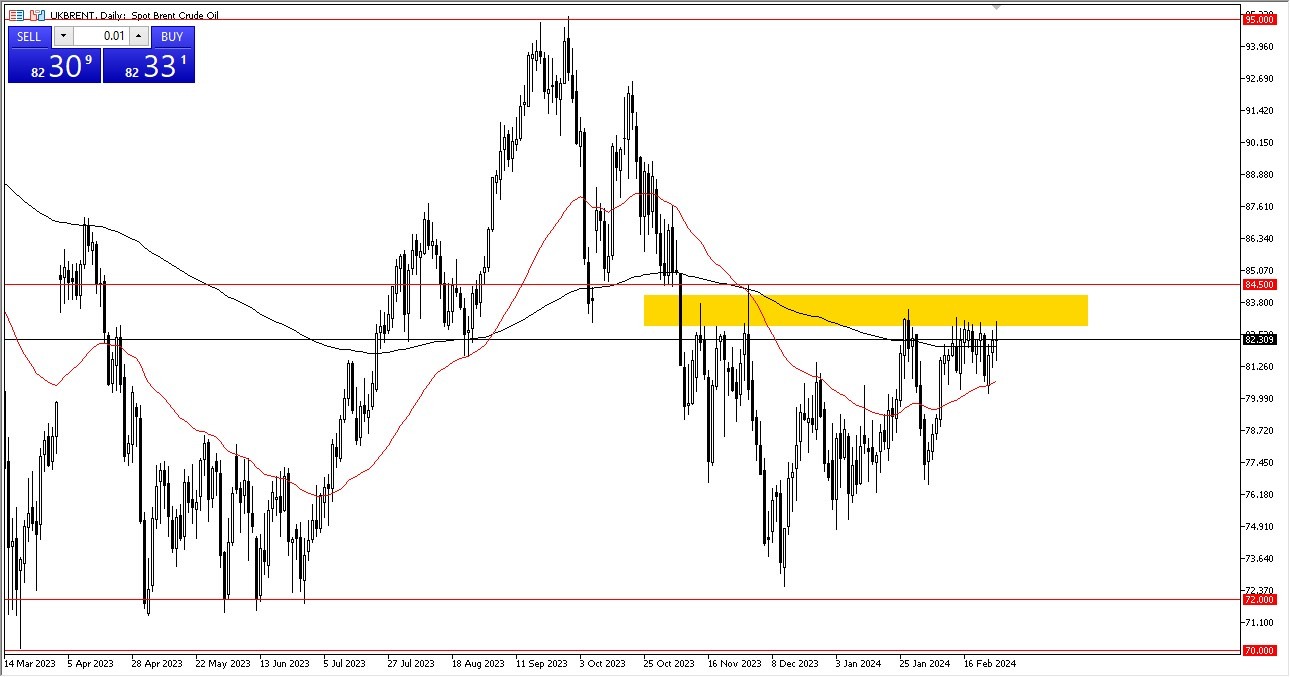

Brent

The Brent market is in essentially the same situation; even while there is still some movement ahead of us, I believe we have broken through the resistance and are currently near the top of the range. As such, I believe this is a market you should continue to keep an eye on. As we approach the summer driving season and demand naturally increases, I believe that short-term pullbacks will once again provide value. I have no interest in shorting crude oil at all. And I believe that will stay the case. Buying on the cheap is the best strategy, and you should continue to seize value whenever it presents itself. In the end, I believe that one of the major markets this summer will be crude oil, but as of now, we are only beginning to gather the required momentum to have it truly take off as I anticipate it will.

Ready to trade our WTI Crude Oil Forex? We’ve made a list of the best Forex Oil trading platforms worth trading with.