- Crude oil markets commenced the Thursday session with a positive trajectory, as they continue to find support near the 50-Day Exponential Moving Average in both varieties of crude oil under observation.

- Amidst these developments, there arises a significant focus on central banks across the globe, with questions surrounding potential shifts in monetary policies.

- Such shifts, if enacted, could potentially lead to increased energy demand.

WTI Crude Oil

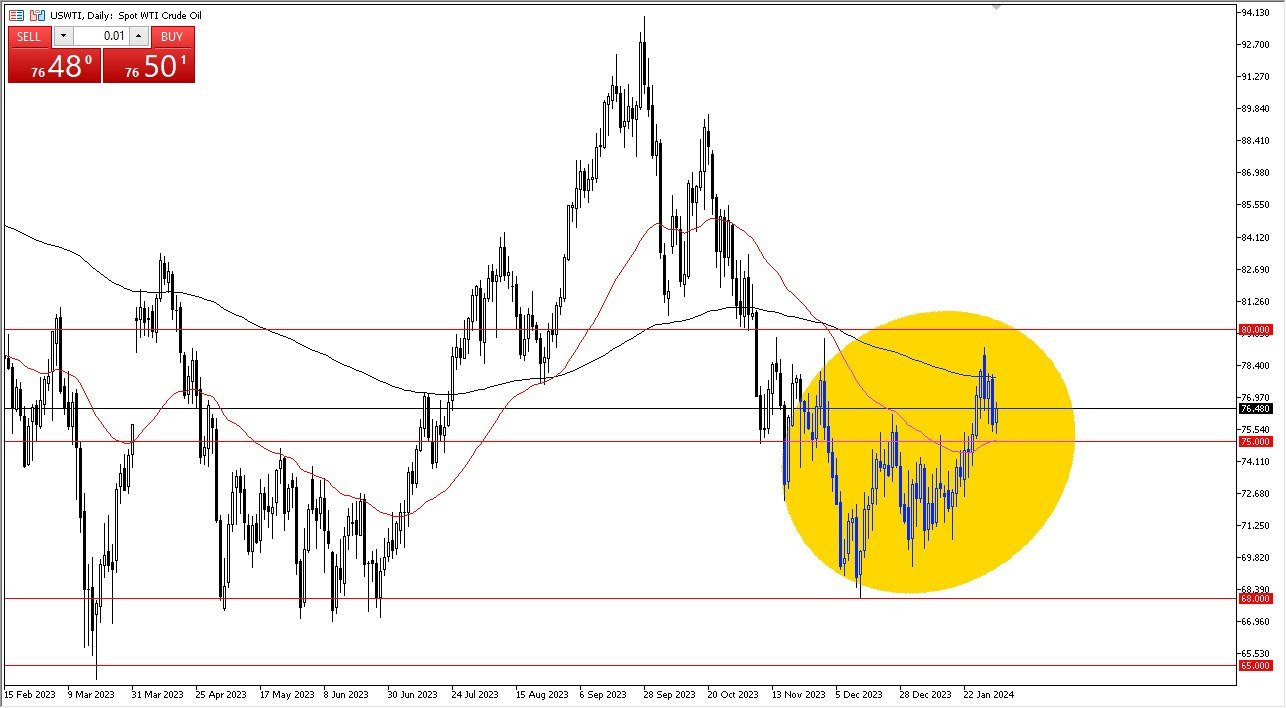

The WTI crude oil market initially retraced slightly during Thursday's trading session, approaching the 50-day EMA before rebounding from the $75 level. The significance of the $75 level extends beyond its role as a prominent psychological marker, as it has previously witnessed market activity. In the event of a rally from the current levels, the market could set its sights on the $80 level. To emphasize this potential target, a horizontal line has been placed at the $80 mark. Conversely, a breakdown below the $75 level may expose the $72.50 level. The prevailing approach of buying on price declines remains consistent, reflecting a strategy that has persisted for several months. This pattern appears to be forming a gradual "rounded bottom." This is something that I have been following for some time. The markets are becoming more and more obvious as well when it comes to deciphering this.

Top Forex Brokers

Brent

The Brent crude oil market presents a similar scenario, with notable support in the vicinity of $80, or even $80.50. The support line has been adjusted to $80, although $80.50 remains a precise reference point. This range has previously transitioned from resistance to support. In the event of a rally from current levels, the 200-day EMA becomes a plausible target, with potential further upside to the $85 level. It is important to underline that there is a distinct reluctance to engage in shorting these markets. Instead, a prevailing sentiment suggests that both WTI and Brent crude oil are in the process of establishing a bottom. While this journey may not be devoid of challenges, the prevailing conviction is that buyers will ultimately prevail. Consequently, there is a belief that these markets will progress towards the $90 level over the ensuing months, possibly marked by a gradual and steady ascent. In other words, I am not looking for a huge or massive move in a short-term time frame.

Ready to trade WTI/USD? Here are the best Oil trading brokers to choose from.